Valentine’s Day Offers Boost for Travel and Streaming Stocks

As Valentine’s Day approaches, many consumers are on the lookout for gifts and experiences. Although this holiday doesn’t have a significant impact on the stock market, some companies may experience a short-term increase in sales.

This article highlights a couple of companies that are likely to benefit from the holiday. Royal Caribbean Cruises (RCL) and Netflix (NFLX) are prime examples of firms that could see their revenues rise as couples and singles celebrate the day.

Royal Caribbean’s Record Bookings

Royal Caribbean Cruises runs three global brands: Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises. Recent results show robust consumer demand, marking a positive trend that has continued for several years.

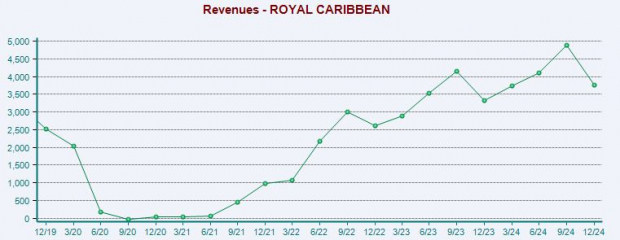

In its latest report, Royal Caribbean announced an adjusted earnings per share (EPS) of $1.63, surpassing prior forecasts. Additionally, sales reached $3.8 billion, which reflects an 11% increase year-over-year. The company’s impressive sales growth since the pandemic, illustrated in the annual chart below, highlights its strong performance.

Image Source: Zacks Investment Research

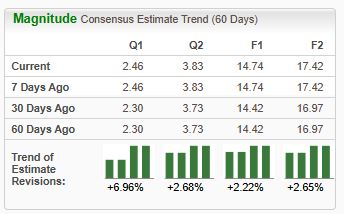

Looking ahead, Royal Caribbean expressed optimism for FY25 as WAVE season bookings start strong, prompting analysts to raise their earnings estimates. The stock currently holds a bullish Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Netflix’s Subscriber Growth

Similar to RCL, Netflix has seen its shares rise sharply over the past year, gaining nearly 80%, compared to the S&P 500’s gain of 23%. The latest quarterly results indicate strong user growth alongside positive momentum from its ad-supported membership offerings.

The company displayed remarkable top line strength as shown in the following chart.

Image Source: Zacks Investment Research

During the recent period, Netflix added 18.9 million paid subscribers, significantly exceeding the consensus estimate of 9.1 million. This achievement marks the seventh consecutive quarter of surpassing subscriber estimates, contributing to the stock’s robust performance.

Image Source: Zacks Investment Research

Netflix’s stock is currently rated as Zacks Rank #2 (Buy), indicating favorable market sentiment and upward revisions for its current fiscal year estimates following recent results.

Image Source: Zacks Investment Research

Conclusion

With a strong consumer sentiment evident, companies like Netflix (NFLX) and Royal Caribbean Cruises (RCL) are well-positioned to see a boost in their revenues this Valentine’s Day.

Just Released: Zacks Top 10 Stocks for 2025

Be among the first to discover our ten top stocks for 2025, carefully selected by Zacks Director of Research Sheraz Mian. Since inception in 2012 until November 2024, the Zacks Top 10 Stocks portfolio has gained over +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Check these top picks known for their potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today for free!

Netflix, Inc. (NFLX): Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.