Maximizing Income for Xylem Inc Shareholders Through Options

Shareholders of Xylem Inc (Symbol: XYL) seeking to increase their income beyond the stock’s current 1.3% annualized dividend yield have a strategic option. They can sell an October covered call at the $130 strike price and receive a bid premium of $5.80. This creates an annualized return of 11.4% based on the stock price. If the stock price remains unchanged, the total return could reach 12.7% annually. However, if the stock rises above $130, shareholders will miss out on any gains past that threshold. Currently, Xylem shares would need to increase by 3.7% to reach that strike price, allowing a total return of 8.3% if called away, along with any dividends received before the call was executed.

Understanding Dividend Stability

Dividend payments can fluctuate, directly tied to a company’s profitability. Examining Xylem’s dividend history is crucial in assessing the sustainability of this 1.3% yield. The chart below provides insight into the company’s dividend trajectory.

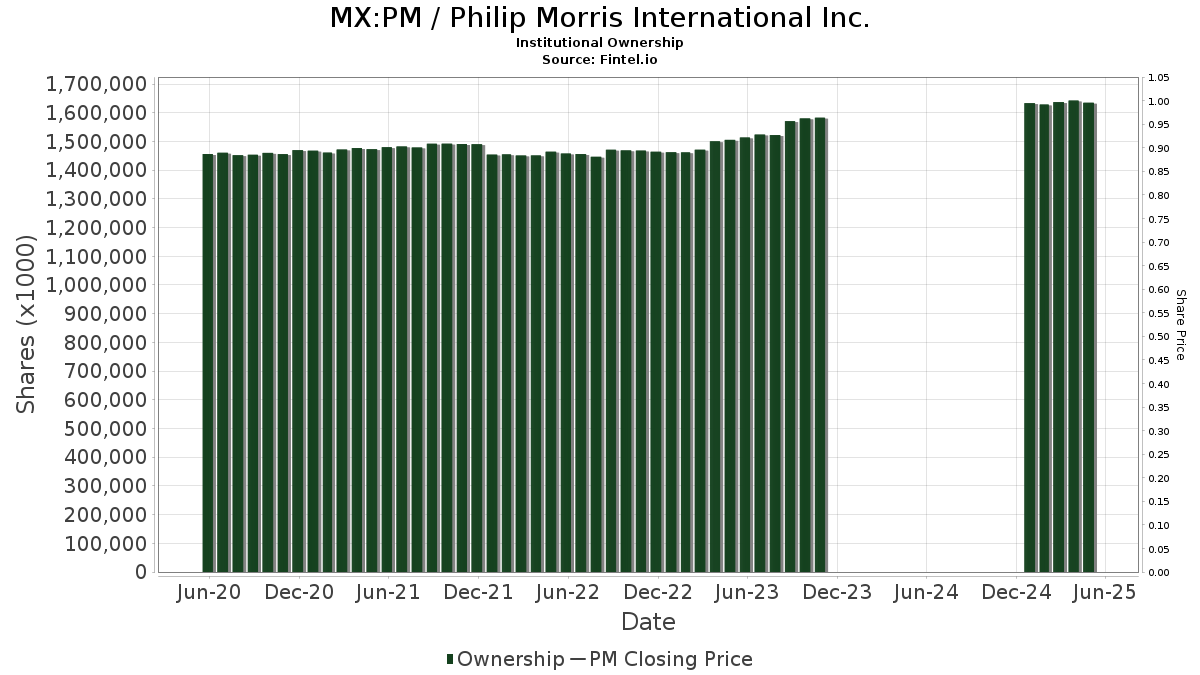

Trading History and Volatility

The following chart illustrates Xylem’s trailing twelve months of trading, highlighting the $130 strike point in red:

Evaluating the above chart alongside the stock’s historical volatility provides context for considering a covered call strategy. Selling the October call at the $130 strike involves weighing potential rewards against the risk of capped upside. Xylem’s trailing twelve-month volatility stands at 26%, calculated from the most recent 250 trading days, alongside today’s price of $125.80.

Current Options Market Insights

In Thursday afternoon trading, put volume among S&P 500 components reached 765,270 contracts, while call volume reached 1.62 million, giving a put-to-call ratio of 0.47. This figure is significantly lower than the long-term median ratio of 0.65, indicating heightened interest in calls among investors today.

For further information on other call options and strategies, visit the XYL options page.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.