Northrop Grumman Corp (Ticker: NOC) shareholders can enhance their income by selling a January 2028 covered call at the $720 strike, currently yielding a premium of $40.00, which translates to an additional 3.3% annualized return. This would bring the total potential return to approximately 5%, assuming the stock is not called away. Given the current stock price of $569.39, it would require a 25.9% increase for the call to be exercised, providing shareholders with a total return of 33% if the stock is called, along with any collected dividends.

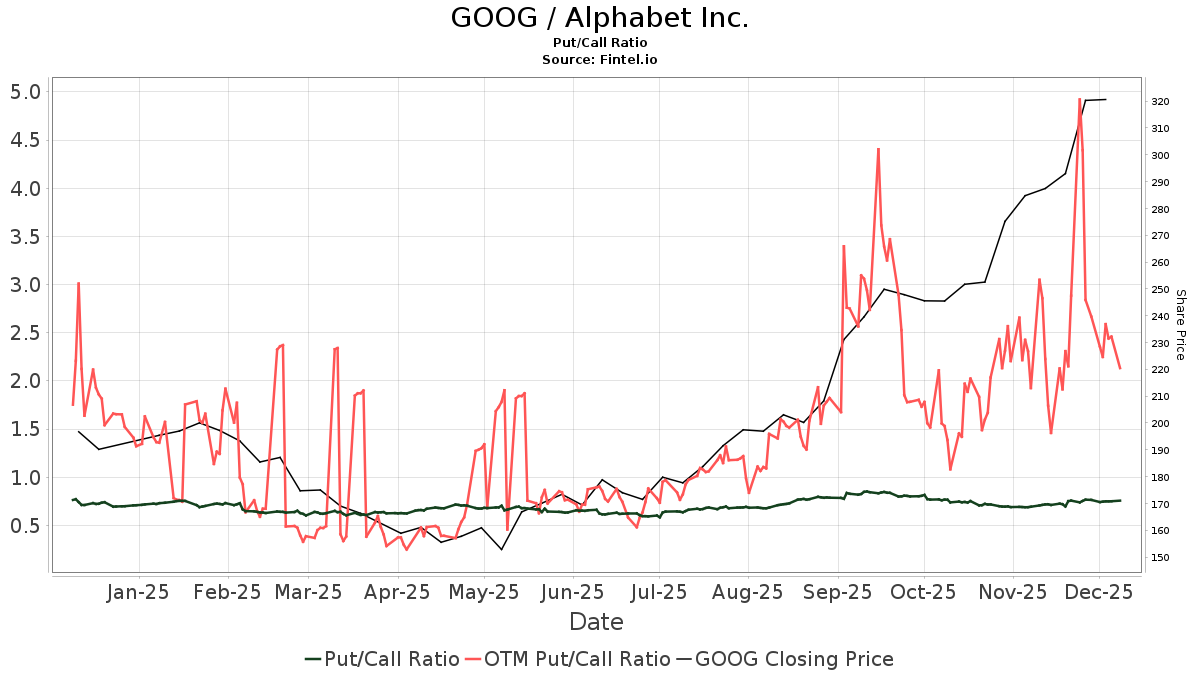

In mid-afternoon trading on Tuesday, S&P 500 put volume reached 697,243 contracts while call volume reached 1.29 million, resulting in a put-to-call ratio of 0.54. This indicates a higher preference for call options compared to puts, compared to the long-term median ratio of 0.65.