Investors Seek Income Boost from Tecnoglass Inc. With Covered Calls

Shareholders of Tecnoglass Inc. (Symbol: TGLS) can enhance their income beyond the stock‘s annualized dividend yield of 0.8%. One strategy is to sell the October covered call at a $75 strike price. This move could yield a premium of $8.20, which translates to an annualized return of 23.1% based on the current stock price. If the stock is not called away, this could lead to a total annualized return of 23.9%. However, if the shares rise above $75, any potential upside would be forfeited. TGLS shares would need to increase by 7% from current levels for this to occur. In such a case, shareholders would achieve an 18.7% return from the current price, along with any dividends received prior to the stock being called.

Dividend amounts can fluctuate and are influenced by each company’s profitability. Therefore, examining the dividend history chart for Tecnoglass Inc. may assist investors in determining the likelihood of maintaining the current 0.8% annualized yield.

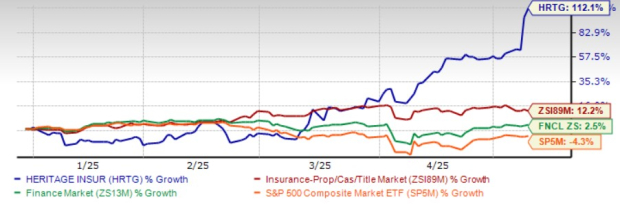

The following chart depicts TGLS’s trailing twelve-month trading history, highlighting the $75 strike in red:

Evaluating the aforementioned chart and the stock‘s historical volatility can assist investors in assessing whether selling the October covered call at the $75 strike presents a favorable risk/reward scenario. Current data indicates that most options tend to expire worthless, making this analysis critical. Tecnoglass Inc.’s trailing twelve-month volatility is 47%, calculated based on the last 251 trading days and the current price of $70.20. For additional call options contract insights at various expirations, please visit the TGLS Stock Options page on StockOptionsChannel.com.

In mid-afternoon trading on Tuesday, the S&P 500 components recorded put volume of 713,693 contracts and call volume of 1.19 million, resulting in a put/call ratio of 0.60 for the day. This figure, when compared to the long-term median put/call ratio of 0.65, indicates a higher preference for call options among buyers in today’s trading environment.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Also See:

- TEGP YTD Return

- NXTI Videos

- KO Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.