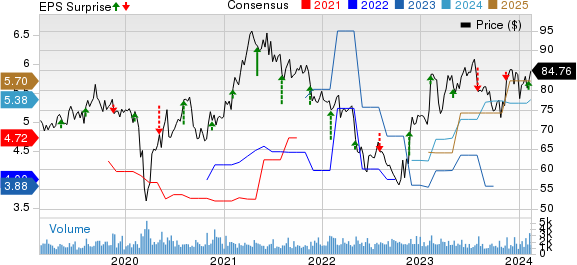

Maximus, Inc. (MMS) has made waves with its impressive first-quarter fiscal 2024 performance, surpassing both earnings and revenue projections set by the Zacks Consensus Estimate. Since the earnings release on Feb 7, the stock has surged by an impressive 8.7% in response to the better-than-expected results. Moreover, the company has revised its bottom-line guidance for fiscal 2024, projecting higher adjusted earnings and operating income compared to the previous forecast.

Earnings and Revenue Performance

The latest earnings of $1.34 per share exceeded the Zacks Consensus Estimate by 4.7% and soared 42.6% year over year. Similarly, revenues of $1.33 billion outperformed the consensus mark by 3.5% and marked a substantial 6.2% annual increase.

Segments Driving Growth

The robust growth was driven by the U.S. Services segment, recording revenues of $489.8 million, marking an 11.5% surge year over year. Additionally, the U.S. Federal Services segment reported revenues of $677.1 million, reflecting a commendable 9.5% increase from the previous year.

Solid Sales and Pipeline Progress

Maximus has also demonstrated a strong sales pipeline, with year-to-date signed contract awards totaling $422 million, and a substantial sales pipeline of $37.7 billion. The company boasts a book-to-bill ratio of 1.2x as of Dec 31, 2023, reflecting its robust sales performance.

Financial Standings and Future Trajectory

The company ended the quarter with a significant cash and cash equivalents balance of $104.2 million, marking an impressive increase from the previous quarter. In terms of future outlook, Maximus projects fiscal 2024 revenues to be in the range of $5.05-$5.2 billion and anticipates a free cash flow between $300 million and $350 million.

Notably, Maximus carries a Zacks Rank #3 (Hold) at present, reflecting stability in the face of market dynamics.

Comparative Earnings Performances

The positive streak in earnings has not been an isolated case in the industry. Fellow service providers like Robert Half (RHI), Aptiv (APTV), and S&P Global (SPGI) have also delivered commendable results, showcasing the overall strength of the sector.

It’s fascinating to witness the remarkable leap in Maximus’ stock price, underscoring the company’s robust standing in the market. The impressive results hint at a promising trajectory, potentially fueling further investor enthusiasm for the stock.

Source: Zacks Investment Research