McDonald’s Insiders Sell Shares, But Buyback Strategy Still Strong

Insiders at McDonald’s (NYSE: MCD) have been selling shares in 2025. However, investors may want to consider the opposite approach. Despite the volume of insider sales, which stems largely from share-based compensation, it holds little significance. Executives, including several EVPs, the CEO, and directors, have consistently sold small amounts over the past two to three years, capitalizing on their earnings.

MarketBeat reports that insider sales in 2025 total approximately $9.2 million. In context, this is minimal when compared to the $2.8 billion McDonald’s allocated for share repurchases in 2024 and its projected buyback plans for 2025.

Robust Share Buyback Program

The company’s share buybacks are noteworthy. McDonald’s reduced its share count by an average of 1.4% in 2024 and aims to achieve similar results in 2025. The Q1 statement reveals a 1% year-over-year decline in shares, but the company still has robust sales and earnings seasons ahead. Furthermore, dividends represent an additional aspect of capital return for investors.

McDonald’s offers a dependable dividend yield of 2.2%, expected to grow at a mid-single-digit rate for the foreseeable future.

Q1 Challenges Highlight Resilience

McDonald’s Q1 results were affected by various challenges, including tough year-over-year comparisons due to last year’s Leap Year. Revenue dipped significantly, falling to $5.96 billion, a decline of 3.0%, and falling short of consensus estimates by 270 basis points. However, the company managed to maintain its margins amidst this decrease.

Despite the drop, adjusted revenues were only down 2%, with global comparable sales declining by 2%, and a 1% decline after adjustments. The U.S. market faced the largest hurdle, posting a 3.6% decrease in comparable sales. Conversely, the international developing markets segment performed well, growing by 3.5%.

Net income consolidated fell in line with revenue, dropping 3%, but the company continues to generate sufficient cash flow and free cash flow to support its financial health and capital returns. Earnings per share (EPS) also missed the reported consensus, although it was only down by 2%, reflecting the impact of buybacks compared to larger revenue and operating income declines.

No revenue guidance was issued, but investors should anticipate continued softness into Q2, with a forecast for margins. The company expects the full-year operating margin to be in the mid-to-high 40% range, hinting at stable or improving margins for the remainder of the year.

Analysts’ Sentiment and Future Outlook

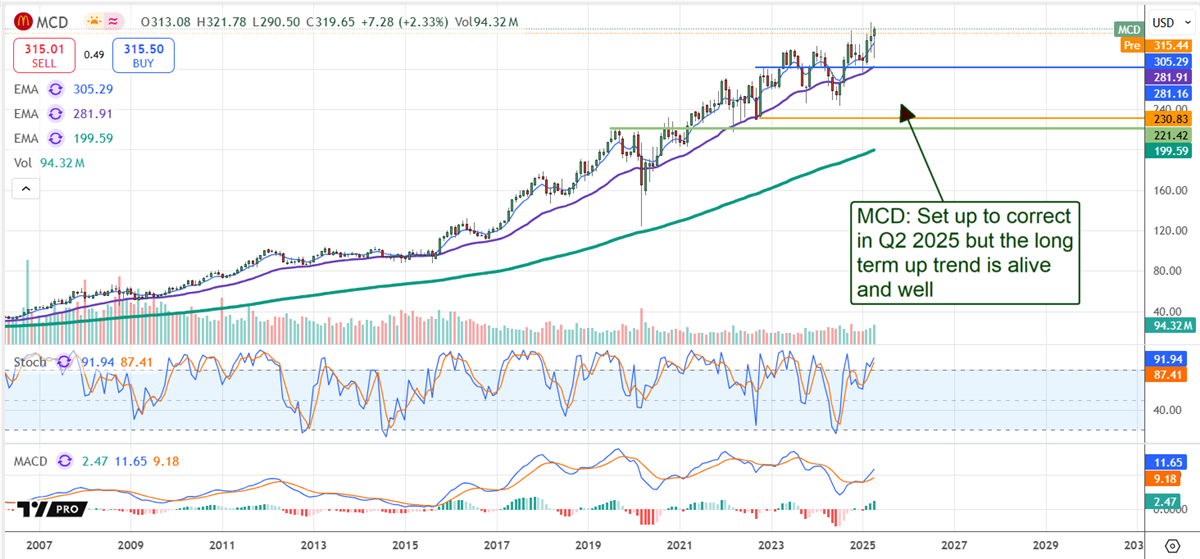

Generally, analysts maintain a bullish outlook on McDonald’s stock, rating it as a Moderate Buy. However, price target reductions in Q2 may follow the Q1 results. Analysts are likely to reaffirm their ratings and targets, which indicate that the stock is fairly valued near its all-time weekly closing high of $323.

Concerns remain about the potential for analysts to lower targets or ratings in Q2. Such actions could create additional market headwinds and possibly lead to a correction in the stock. Unlike many S&P 500 and restaurant stocks, McDonald’s has not corrected in Q1 and early Q2, but the possibility of a downturn exists as Q2 concludes. A potential correction could present a buying opportunity for later in 2026.

Following the latest report, McDonald’s stock shows bearish trends. Pre-market trading reveals a decline of over 1%, displaying resistance at the all-time high. If this trend continues, MCD shares may see a drop of 5% to 10%, revisiting support levels around $300 and $280.