McKesson Inc. Sees 14-Point Gain Following Power Inflow Signal

McKesson Inc. (MCK) witnessed a notable increase, gaining over 14 points after a recent Power Inflow signal, an important indicator for traders monitoring institutional investment flows and order dynamics.

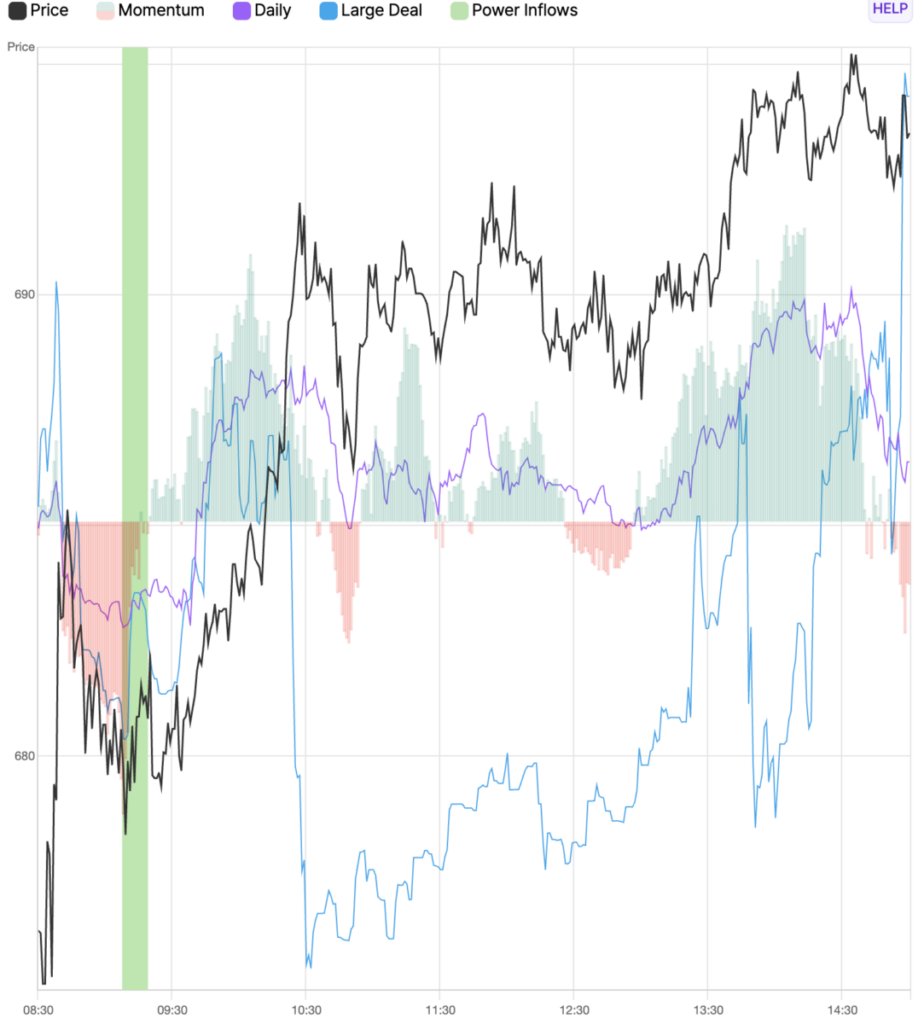

On April 2nd at 10:17 AM, a significant trading signal emerged for McKesson, Inc. (MCK), showing a Power Inflow at a price of $681.16. This signal is crucial for traders looking to decipher the movements of institutional money, often referred to as “smart money,” within the market. Traders emphasize the importance of using order flow analytics to inform their decisions, and this Power Inflow suggests a potential uptrend for McKesson’s stock. As such, this could present a viable entry point for traders aiming to take advantage of anticipated upward price movement.

Understanding Power Inflow Signals

Power Inflow, a key concept in order flow analytics, refers to the analysis of buying and selling orders, examining their volume rates, timing, and other relevant characteristics. Traders utilize this analysis to make informed decisions. This indicator is often viewed as a bullish signal for active traders.

Typically, Power Inflow manifests within the first two hours of market activity, offering insight into the stock’s overall direction influenced by institutional trading for the day. Incorporating order flow analytics allows market participants to better assess market conditions, identify trading opportunities, and potentially enhance their overall performance.

Moreover, while tracking smart money flow yields useful insights, effective risk management is vital to safeguard capital and limit potential losses. Implementing a structured risk management strategy supports traders in navigating market uncertainties more effectively, increasing the odds of sustained success.

For the latest updates on options trades regarding MCK, Benzinga Pro offers real-time alerts.

Market news and data are provided by Benzinga APIs, in collaboration with firms like TradePulse, which contribute to parts of the data included in this report.

Post-Market Update: At the time of the Power Inflow, the stock price was $681.16. The returns reached a high of $695.23 and closed at $693.51, resulting in respective gains of 2.1% and 1.8%. This underscores the necessity of a trading plan incorporating Profit Targets and Stop Losses that align with each trader’s risk appetite.

Past performance is not indicative of future results.