“`html

MDU Resources has announced its plans for long-term capital investments totaling approximately $3.1 billion during the 2025-2029 period, focusing on its regulated energy delivery business following the recent spinoff of Knife River and Everus Construction. The company anticipates a long-term earnings per share growth of 6-8% and a 1-2% annual customer growth rate in the electric and natural gas segments through 2026.

Recently, MDU secured electric service agreements for 580 megawatts (MW) for data center demand, of which 180 MW is already online and an additional 100 MW is expected to come online later this year. In the second quarter of 2025, the Electric Utility segment reported a 12% increase in retail sales volumes driven by data center operations.

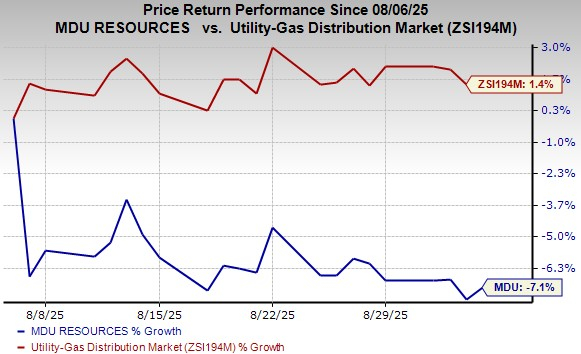

Despite these advancements, MDU faces challenges including aging infrastructure that could lead to operational failures and regulatory risks. The company’s stock performance has declined by 7.1% over the past month, contrasting with the industry’s growth of 1.4% during the same period.

“`