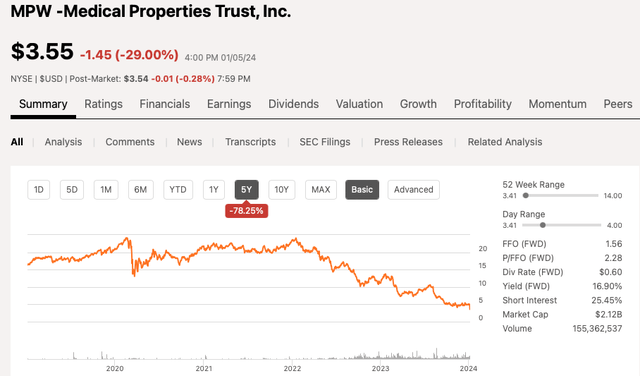

January 5, 2024, marked another 29% plummet in the shares of Medical Properties Trust (NYSE:MPW), closing at $3.55. This dive compounded an already bleak performance over the past five years. Including $5.18 in cumulative dividends, if you held MPW shares from January 1, 2019, to January 5, 2024, your total return is a staggering -45.6%. And on a three-year basis (January 1, 2021 – January 5, 2024), the return is a whopping -61.1%. The five-year return is nothing short of disastrous at -69.7% (January 1, 2019 – January 5, 2024).

In 2022, there were a startling 82 articles on MPW. Among them, 70 were “strong buy” or “buy” articles, 10 were “hold” articles, and two were “sell” articles.

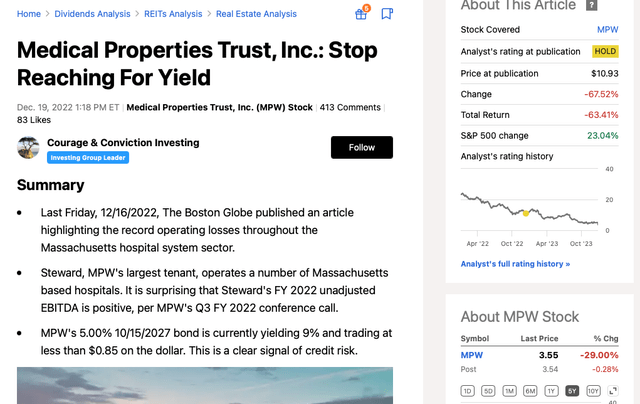

I was one of the authors who contributed to the MPW discussions, penning just a single article. In December 2022, I published my take titled “Medical Properties Trust, Inc.: Stop Reaching For Yield.” My article, to be candid, was bearish and cautionary. However, I must clarify that I rarely take a “sell” stance. It’s tricky to make thoughtful points when dealing with these ‘battleground stocks’—emotions run high, opinions are entrenched, and groupthink abounds. Unfortunately, cautionary voices often get lost amid the boldly touted attractiveness of dividend yields, with insufficient emphasis on the risks involved.

In the first half of 2023, there were 62 “buy” ratings, 12 “hold” ratings, and five “sell” ratings for MPW. This trend continued during the latter half of 2023 when, despite the clear downward trajectory of the stock, there were still 24 “buy” ratings, 25 “hold” ratings, and 10 “sell” ratings.

The burning question is: why were there over 200 articles written on MPW in 2022 and 2023? Is MPW developing a cure for cancer or pioneering the next AI breakthrough? Quite the contrary, so what’s the allure?

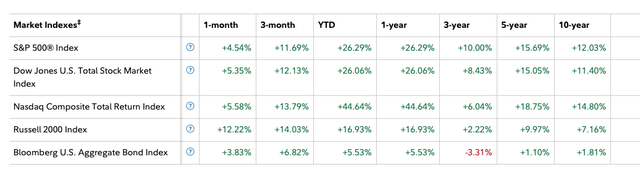

Comparing this to the S&P 500, which returned a solid 26.3% last year, and boasted a three-year annual yield of 10%, and a five-year annual yield of 15.7%—the attraction of MPW seems even more confounding.

In the upcoming weeks, we may witness a deluge of new MPW articles—some advising to ‘buy the dips’, while others attempt to rationalize the stock’s plummet, possibly resulting in permanent capital impairment for unsuspecting retirees, given MPW’s heavily leveraged balance sheet. The bearish case, as predicted by informed short sellers, has played out almost exactly as anticipated, starting from the $12 to $15 per share range.

Why the Craze for High-Yield Stocks?

Beyond MPW, the real question that retirees must ponder is: why are these high-yield dividend stock investing strategies so hyped? And crucially, do these strategies genuinely outperform the S&P 500 over one, three, or five years?

Possibly fueled by demographics, prolonged artificially low-interest rates by the Federal Reserve from 2009 to 2022, or shrewd marketing, a burgeoning industry emerged around 2020, advocating the creation of the perfect high-yield equities portfolio. The narrative, on the surface at least, was compelling, glorifying the seemingly untapped potential of the stock market. It was cherry-picking 7% to 10% yielding dividend stocks, supposedly offering consistent returns, while downplaying the inherent risks in these strategies.

Imagine this scenario: you’re in your late 50s or early 60s, with around $500K to $700K in investable capital, and you’re bombarded with these enticing marketing pitches. You may be contemplating early retirement, weathering the aftermath of a Covid-induced job purge, or simply eager to retire. Perhaps you’re already retired and occasionally fret about finances. Free of mortgage and car payments, your cost of living is moderate, but you might reside in a high-tax state or might be aiding your family. Amidst this, enters the allure of high-yield dividends, a supposed remedy for the unimpressive bond yields of 2019-2021.

The imagery painted is that of a Willy Wonka-esque Chocolate Factory, providing a bountiful basket of juicy 7% to 10% yielding dividend stocks, ripe for the picking—a mesmerizing prospect underwritten by seemingly sound security selection.

High-Yield Dividend Stock Strategies: A House Built on Shaky Ground?

Many investors are drawn to the promise of building a portfolio with ample downside protections, a comforting cushion for their hard-earned principal. The lure of sitting back while dividend checks roll in, seemingly shielded from market volatility, is undeniably appealing, especially to retirees. After all, who wouldn’t prefer an 8% return over a paltry 4%?

However, as the saying goes, not all that glitters is gold, and the real question is, are these strategies truly a safe harbor for retirees’ nest eggs? How can they gauge the success and thoroughness of the portfolio selection process without a benchmark or barometer such as a high-yield stock index? Blind faith in high-yield dividend stock strategies may prove to be an unwise gamble.

Comparing Performance

Without a clear benchmark, evaluating the success of high-yield dividend stock strategies becomes a game of guesswork. The oft-touted Vanguard Real Estate Index Fund (VNQ) may be a popular choice, but its performance pales in comparison to the S&P 500. Over the past five years, the S&P 500 has delivered impressive compound annual returns, far outstripping the compounded growth of a $500,000 investment at a 7% return.

While some may argue that the S&P 500 is overvalued and that high-yield stocks may rebound if the Fed cuts rates, the devil is in the details. Anecdotally, many high-yield stocks are burdened with high leverage, and the promise of high returns often comes with significant risk.

The Alternative

It’s crucial to consider an alternative approach. Rather than blindly following high-yield dividend stock strategies, investors should take a step back and assess the stability and sustainability of these lucrative offers. As the old adage goes, there’s no free lunch on Wall Street, and the allure of high returns often comes with unseen risks. As retirees entrust their financial future to these strategies, a more cautious and discerning approach is warranted.

Retirees Beware: The Cautionary Tale of MPW’s Blow Up

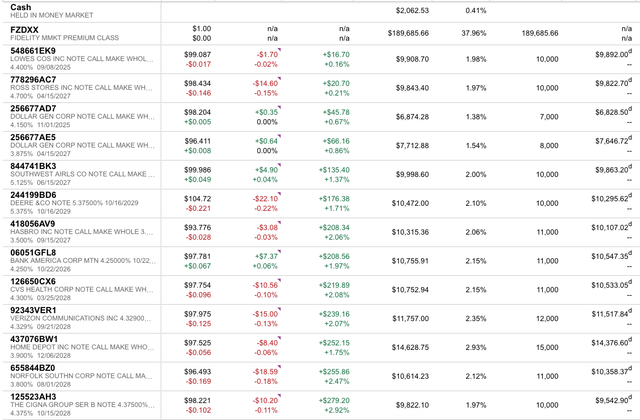

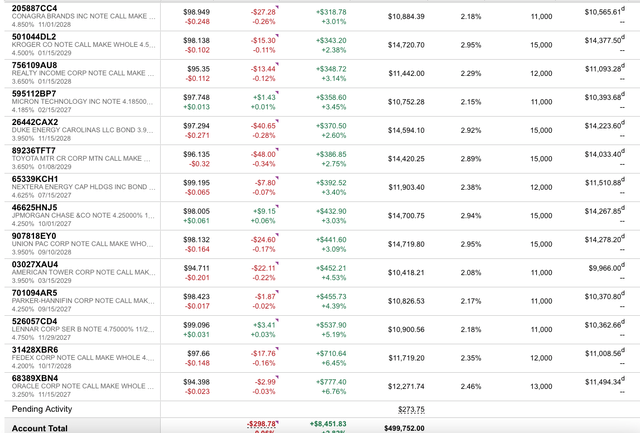

Back on October 28, 2022, the article “My Gift To Retirees: Sharing My Recently Constructed $300K Investment Grade SWAN Portfolio” aimed to provide a solid investment option for retirees. With the interest rate cycle not at its peak, the portfolio has performed well with all original bonds in tow, showing unrealized long-term capital gains, no major drawdowns, and consistent semi-annual coupon payments.

Nevertheless, it’s crucial to note that similar investment grade bond opportunities are available, albeit at slightly lower yields to maturity.

Analyzing MPW’s Downfall

The blow up of MPW serves as a cautionary tale and a wakeup call for retirees, akin to a small-scale Enron-type shock. It signifies the need for a product recall when investments falter, just like when planes are grounded or consumer goods are recalled. This is a stark reminder that chasing high yields is much more complex than it appears, and supposedly “money good” equities may not be suitable for retirees.

In investing, there are no shortcuts to outsmart the market. It’s beyond compiling a list of stocks with 8% to 10%-plus yields and buying them for current income. Retirees require a total return mindset, including protecting the principal. Historically, over the past five years, the S&P 500 has likely outperformed high-yield stock strategies. Without concrete evidence or an objective way to prove otherwise, it’s probably best for retirees to avoid such controversial high-yield stocks.