The market can get truly absurd from time to time. Instead of being this efficient machine that many believe it to be, it can create scenarios that logically do not make sense. A great example of this can be seen by looking at what occurred on January 5th. Shares of Medical Properties Trust (NYSE:MPW), a REIT that owns and leases out medical properties, plunged, closing down 29%. This massive move lower came after management announced that they were taking some actions aimed at recapturing some value from their largest tenant, Steward Health Care, and simultaneously working to further reduce exposure to that tenant moving forward.

Those who follow my work closely know that I have owned shares in Medical Properties Trust for some time. After carefully evaluating all that transpired and all that the press release issued by the company implies moving forward, I more than doubled the size of my position in the business in response to this plunge. To be clear, unless some really good news comes out, I am unlikely to hold all or even most of this increase in holdings. I believe that the market severely overreacted, so I view this as a short-term strategy to capture some quick upside upon a partial recovery of the loss experienced on January 5th. This is because, while I am bullish on the business in the long term, the increase in stake that I initiated makes me more exposed than I would like to be. And at the end of the day, some degree of diversification is imperative for investors to adopt.

An Unwarranted Selloff

There has been a tremendous amount of speculation over the past year or so regarding the future of Steward. Concerns about the operator’s ability to survive have been based on legitimate developments that some investors have observed quite closely. More recently, for instance, in the third quarter earnings release issued by Medical Properties Trust, the company revealed that Steward delayed paying some of the rent that it was supposed to for both September and October of the 2023 fiscal year. To shore up its own financial condition, the business has even resorted to some planned hospital shutdowns. As an example, in early December of last year, the company announced that it would be shutting down its New England Sinai Acute Long-Term Care and Rehabilitation Hospital Early April of this year. Citing low reimbursement rates from Medicare and Medicaid, the company stated that it lost around $22 million from that facility alone, though they did not specify over what time frame that loss occurred.

In the press release issued by Medical Properties Trust on January 4th, management revealed that it would be stepping up its plans to recover uncollected rents and outstanding loan obligations from Steward. Management even admitted to hiring both a financial advisory firm and a law firm so that it can explore its options as thoroughly as possible. This comes after Steward has continued to make only partial monthly rent payments, resulting in total unpaid rent under its master lease with Medical Properties Trust growing to roughly $50 million as of the end of 2023. That is on top of another $50 million that was previously deferred associated with the reconstruction of Medical Properties Trust’s Norwood Hospital.

Obviously, details of this plan are still being worked out. But we do have some data at this time. For starters, Steward does appear to be pursuing potential strategic transactions that could include the sale or re-tenanting of some of its hospital operations, as well as the sale of assets that are considered non-core to its business. Steward is also looking at a potential third party capital partner related to the managed care business that it has, with the idea that any proceeds coming from an arrangement would be paid directly to Medical Properties Trust with the hope of covering all outstanding obligations that Steward has to Medical Properties Trust.

As part of this initiative, Medical Properties Trust has gone so far as to fund a new $60 million bridge loan that is secured by its existing collateral, as well as by new second liens on the managed care business owned by Steward. To make things easier on Steward, Medical Properties Trust has also agreed to the deferral of unpaid rent up to this point, as well as to the additional deferral of an estimated $55 million of rents for 2024 until either some sort of asset sale occurs or June 30th of this year, whichever comes first. This does not mean that the company won’t receive any rental payments during this time. In February, management is expecting rents to recommence, with a total of $9 million to be paid in the first quarter in its entirety. This should be followed up by $44 million in payments in the second quarter.

Clearly, this is not a pleasant situation for any party involved. The management team at Medical Properties Trust even went so far as to say that they cannot be assured that Steward will make all of its scheduled lease payments for the remainder of its 22-year master lease agreement. This has convinced the firm to record a non-cash impairment for the final quarter of the 2023 fiscal year associated with the $788.76 million of straight-line rent receivables on its books. The charge in question will be somewhere around $225 million. This would be in addition to another $25 million of straight-line rent receivables related to an unconsolidated partnership in Massachusetts, as well as the aforementioned $100 million in deferrals the company has now made available to Steward.

These kinds of developments are certainly painful and they do impair the value, likely permanently, for a company like Medical Properties Trust. In early 2022, approximately two years ago, shares of Medical Properties Trust were trading at just above $20 apiece. While investors have received some nice distributions over that window of time, those distributions have not come even close to covering the gap between where shares were and the $3.55 that units closed at on January 5th. I would also argue that the chance of units ever getting back to that $20 range is very small. That is why those who are bullish on the business would be wise to dollar cost average lower. Even though the very first units that I purchased of the enterprise were at a price of $18.55, a price that we may never see again even under good circumstances, the timing and size of my purchases over the past two years have brought my weighted average cost down to $5.83. As you will see shortly, getting from where we are today to somewhere north of that is unlikely to be a big stretch.

This does not mean that I am forecasting rosy times for Medical Properties Trust right around the corner. There are some risks that the company faces. But we need to

Reassessing Medical Properties Trust amidst market volatility

The market paints a bleak portrait, but a closer examination of the data tells a different story. Focused investors are right to be cautious about relying solely on funds from operations (FFO) when evaluating this REIT, as it collects significant straight-line rents. Emphasizing the importance of adjusted FFO figures, the firm disclosed a high 70% adjusted FFO payout ratio, suggesting a stable and secure distribution. The potential to further reduce distribution for debt reduction is worth considering, but the current distribution appears well-founded.

Complex Dynamics Unveiled

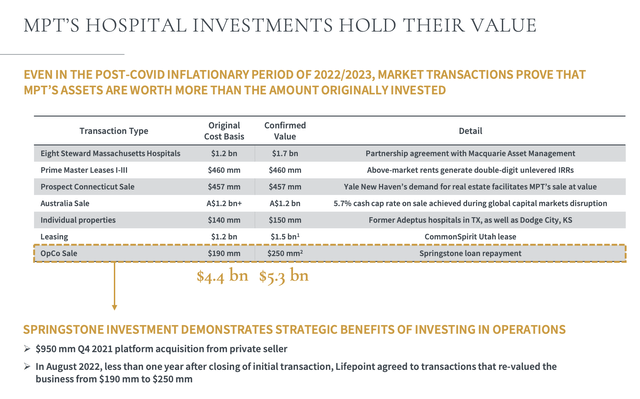

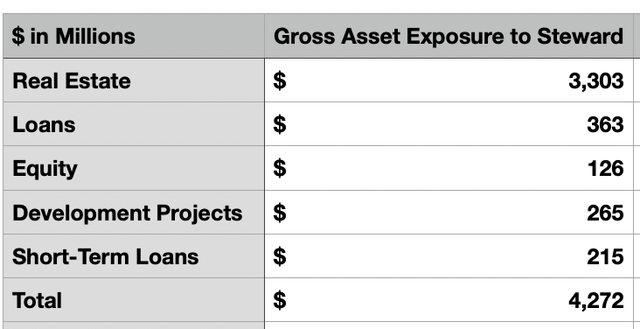

The situation becomes more intricate beyond the FFO analysis, largely due to management’s actions. A prior presentation addressed the company’s relationship with Steward, but there was a missed opportunity to present current net asset values. With $3.30 billion of real estate investments involving the operator, this overlooked data is crucial.

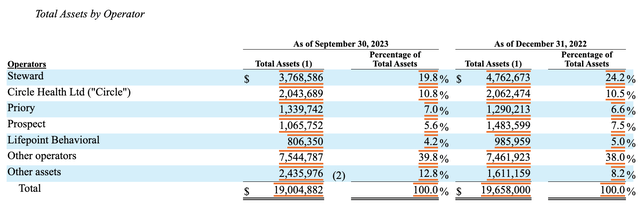

While the company may not be in the dark, with total net assets of $3.77 billion exposed to Steward, representing about 19.8% of Medical Properties Trust’s total assets, the impact is significant but not enough to threaten bankruptcy. Nonetheless, a prospective Steward bankruptcy could render a substantial portion of these assets, including the $60 million loan just announced, virtually worthless. The nightmare scenario entails a complete rejection of leases with Medical Properties Trust by Steward, potentially leaving properties vacant.

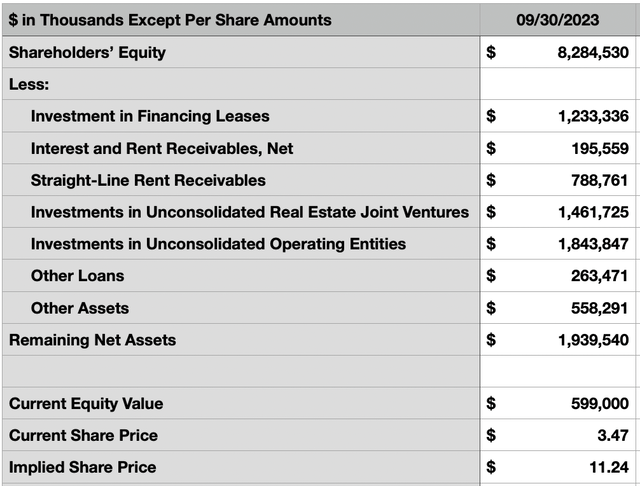

Even in this worst-case scenario, the steep share price plunge on January 5th seems unjustified. The company’s $8.28 billion of shareholders’ equity as of the end of the third quarter of last year, when significantly reduced, still values Medical Properties Trust at over three times its current trading pricing at $11.24 a share.

An Optimistic Outlook

While uncertainties drive market volatility, rash selling due to the Steward situation may be unwarranted. Despite looming bankruptcy, there appears to be considerable upside potential for Medical Properties Trust shareholders. The business has been unduly battered, leading bearish sentiments to become irrational. Despite the temporary nature of my increased stake in the company, I intend to retain my stock, considering the substantial discount at which shares are currently trading.