Nvidia captivated the market’s attention throughout 2023 and into 2024. However, Meta Platforms (NASDAQ: META) has emerged as a hidden gem, potentially overshadowing even Nvidia’s success. In a swift and remarkable ascent, Meta’s stock soared by an astounding 458.8% between Nov. 2, 2022, and March 8, 2024, transforming from an eight-year low to an all-time high within a brief timeframe. While part of this surge can be attributed to overselling in 2022, Meta’s underlying strength lies in its unparalleled business model.

In the realm of the stock market’s elite “Magnificent Seven,” Meta Platforms shines brightly as a beacon of innovation and resilience. Amidst sky-high stock prices, Meta’s narrative stands out as a compelling tale of success and growth, poised to captivate investors with its unique offerings.

Image source: Getty Images.

The Power of Product Enhancements

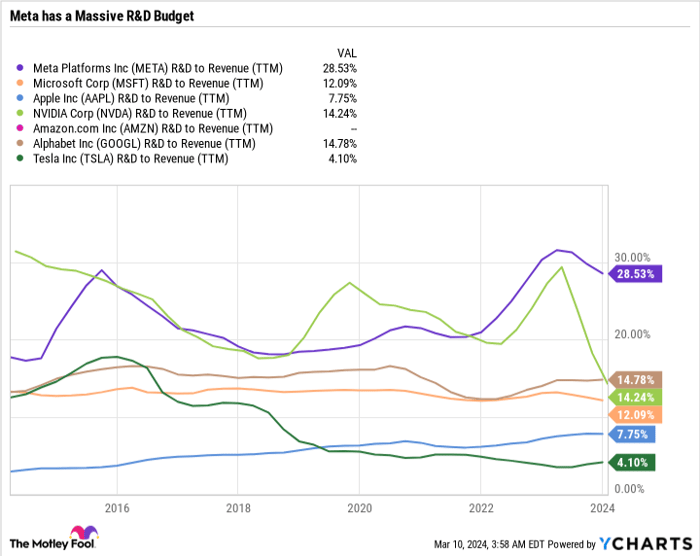

At the heart of Meta Platforms’ success lies a steadfast commitment to innovation. While trailing only Alphabet in absolute research and development (R&D) spending, Meta dwarfs its competitors with an R&D-to-revenue ratio of 28.5%, setting a new benchmark in the industry.

META R&D to Revenue (TTM) data by YCharts.

Unlike its counterparts, Meta’s enterprise hinges on platforms like Facebook, Instagram, and WhatsApp, necessitating continual refinement to maintain their competitive edge. The strategic overhaul of Instagram, in response to the TikTok threat, exemplifies Meta’s agility and forward-thinking approach, enabling it to swiftly adapt to evolving market dynamics.

Fortifying its Position

During Meta’s Q4 2023 earnings call, the company underscored its sustained investment in AI and the metaverse, emphasizing a lean operational model that optimizes resource allocation. Unlike peers like Apple, Tesla, and Nvidia, Meta’s asset-light business framework empowers it to spearhead aggressive growth initiatives while maintaining financial prudence.

- Apple manufactures and sells physical products.

- Tesla relies on car sales.

- Nvidia’s revenue streams revolve around GPUs.

- Amazon engages in product subscriptions, e-commerce, and cloud services.

- Microsoft operates through software subscriptions and physical product sales.

Meta’s expansive digital portfolio has positioned it as a pivotal player in the advertising landscape, offering unparalleled avenues for brands to engage with consumers. With initiatives like the Meta Quest VR headset complementing its core business, Meta’s product diversification adds a layer of resilience to its investment narrative.

Meta’s ability to swiftly counter TikTok’s threat embodies its strength in leveraging resources effectively. The competitive landscape has spurred Meta to refine its offerings, enabling it to unlock unprecedented value for long-term investors.

Delivering Value to Stakeholders

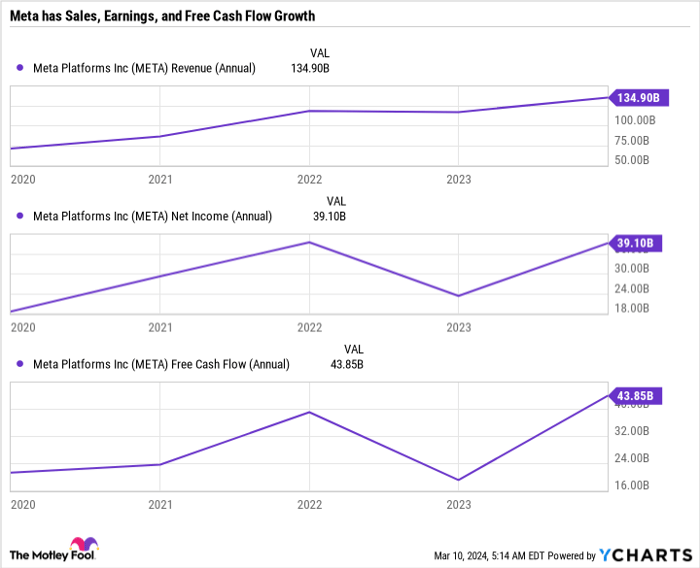

Amidst its transformative journey, Meta has not only fortified its operational capabilities but also remained committed to rewarding shareholders. With its maiden dividend announcement and robust share buyback program, Meta heralds a new era of shareholder-centric growth, powered by its enviable free cash flow of $43.9 billion in 2023.

META Revenue (Annual) data by YCharts.

Despite Meta’s soaring valuations, reflected in its price-to-earnings ratio of 34 and price-to-FCF ratio of 30.3, the stock’s current price level belies its historic undervaluation in late 2022, underscoring the potential for continued growth and value creation.

A Holistic Investment Proposition

Meta’s balanced approach to growth, innovation, and shareholder returns positions it as a beacon of stability and progress in the tech landscape. While the stock may not be a bargain at current levels, Meta’s unwavering commitment to excellence reaffirms its status as a formidable player in the market.

As investors navigate the dynamic market environment, the evolving narrative of Meta Platforms warrants attention for its resilience, innovation, and shareholder-centric ethos.

Should you invest $1,000 in Meta Platforms right now?

Before diving into Meta Platforms, it’s crucial to consider the broader investment landscape. While Meta shines bright, alternative investment avenues identified by the Motley Fool Stock Advisor could offer compelling returns, showcasing the diversity and dynamism of the modern market.

Stock Advisor provides a roadmap for investors, offering actionable insights, regular updates, and curated stock picks, ensuring a holistic approach to wealth creation and long-term success. The Stock Advisor service embodies a legacy of outperformance, surpassing the S&P 500 returns since 2002*

Discover the 10 stocks shaping the future

*Stock Advisor returns as of March 11, 2024

Disclaimer: The views expressed herein are the author’s own and do not reflect the opinions of Nasdaq, Inc.