Investing in the stock market is akin to riding a rollercoaster. Over the past decade, the major stock indexes have oscillated between bear and bull markets with dizzying speed. While many investors yearn for stability in 2024, the reality remains that stock market behavior is often capricious in the short run.

The Power of Stock Splits in Today’s Market

During times of high volatility and uncertainty, investors gravitate towards companies that have demonstrated consistent outperformance across different economic landscapes. The reign of the FAANG stocks over the past decade illustrates this trend vividly. However, in recent years, it is the companies implementing stock splits that have emerged as the stars of the show.

Image source: Getty Images.

A stock split, a mere facelift for a publicly traded company, adjusts its share price and outstanding share count without altering market capitalization or operational performance. While a forward split can make shares more affordable for retail investors, a reverse split aims to boost share prices for continued exchange listing. Yet, the limelight has been on high-growth firms opting for forward splits.

A Surge in Forward Stock Splits Among Top Companies

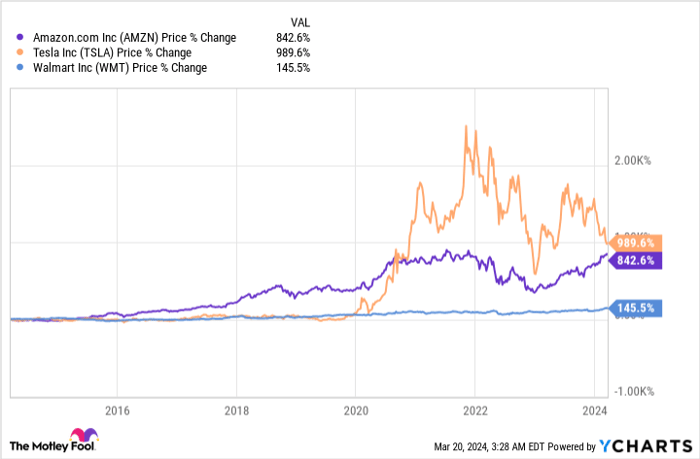

Companies implementing forward splits are often leaders in profitability and innovation within their industries. Since mid-2021, nearly a dozen prominent companies, such as Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), and Walmart (NYSE: WMT), have executed forward stock splits. Amazon and Tesla undertook splits of 20-for-1 and 3-for-1, respectively, in 2022, while Walmart’s 3-for-1 split came into effect last month.

AMZN data by YCharts.

These firms have thrived due to their competitive edges:

- Amazon reigns supreme in e-commerce, commanding almost 38% of U.S. online retail sales, six times more than its closest competitor. Its subsidiary AWS leads the cloud infrastructure services market.

- Tesla dominates North America’s electric vehicle market, boasting profitability amidst producing significant EV volumes annually.

- Walmart’s economies of scale provide a pricing advantage, while its extensive network fosters customer loyalty.

On a recent Tuesday, another standout company announced its induction into the league of stock-split icons.

Image source: Chipotle Mexican Grill.

Exploring the Latest Addition to the Stock-Split Phenomenon

After market close on March 19, the board of Chipotle Mexican Grill (NYSE: CMG) unveiled a monumental 50-for-1 stock split, one of NYSE’s largest. Pending shareholder nod in June, trading post-split commences on June 26, 2024.

Having gone public in 2006 at $22 per share without ever splitting, Chipotle’s shares neared $3,000 pre-split. The proposed 50-for-1 split would lower the share price to approximately $60, maintaining current valuation.

Chipotle’s CFO, Jack Hartung, remarked,

This inaugural split in Chipotle’s history aims to democratize stock ownership and comes amidst record-breaking financial performance and growth.

Interestingly, Chipotle’s initiative mirrors Walmart’s intent when it announced its 3-for-1 split in January.

The key to Chipotle’s exceptional run and monumental split lies in its commitment to quality, menu innovation, and operational excellence.

By sourcing responsibly and optimizing menus, Chipotle wields exceptional pricing power and operational agility, key drivers of its success.

Moreover, Chipotle’s strategic innovations, like “Chipotlanes” for mobile orders, showcase operational prowess and customer-centricity.

The Next Potential AI Stock to Embrace the Split Trend

With Walmart’s split completed and Chipotle set for theirs, attention pivots to Broadcom (NASDAQ: AVGO), a semiconductor giant poised for a potential split amid the AI buzz. Don’t bet on Nvidia just yet.

A Metamorphosis on Wall Street: The Rise of Broadcom

Broadcom’s Stellar Stock Performance

March 19 witnessed a trading session where Broadcom’s shares reached a staggering $1,238 each, marking an extraordinary surge of over 1,800% in the last decade. Despite multiple stock splits carried out pre-Avago acquisition, the rise of the Avago-acquired Broadcom has been formidable.

A Glance at Broadcom’s AI Realm

The AI revolution, akin to the internet’s epoch-making advent, is a megatrend of colossal proportions. Projections, such as PwC’s forecast of a potential $15.7 trillion boost to global GDP by 2030, bode well for Broadcom’s future.

Broadcom’s Technological Prowess

Broadcom’s operational prowess finds its fuel in revolutionary innovations like the Jericho3-AI chip, unveiled last year. This cutting-edge chip can seamlessly link up to 32,000 GPUs in AI-optimized data centers. In essence, Broadcom stands as the backbone enabling the forthcoming surge of generative AI solutions and large-scale language model training.

Wireless Chips: Broadcom’s Profitable Backbone

Beyond its AI forte, Broadcom’s wireless chip segment is a veritable goldmine. A dominant force in 5G wireless chip production for cutting-edge smartphones, the company rides high on a wave of consumers upgrading devices to leverage faster connectivity. The resultant deluge of orders signifies a bright future for Broadcom.

The Untapped Potential of a Stock Split

Despite a history devoid of stock splits under Avago’s reign, Broadcom’s share price surpassing $1,200 may well be the stimulus needed to render the stock more accessible to the everyday investor.

Seeking Stock Advice?

Wondering if shelling out $1,000 for Chipotle Mexican Grill stocks is prudent? Perhaps a look at expert insights could help before diving in headfirst.

The esteemed analyst team at Motley Fool Stock Advisor has pinpointed the 10 top stocks they believe investors should keep an eye on for potential mammoth returns in the days to come. While Chipotle Mexican Grill may not have made the cut, these selected stocks present a tantalizing investment opportunity.

Stock Advisor equips investors with a user-friendly roadmap to investment success, offering counsel on portfolio construction, regular analyst updates, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has outperformed the S&P 500 by a staggering margin*, underlining its credibility and expertise.

Curious about these 10 exciting stocks? Explore further to uncover your next potential investment gems.

*Stock Advisor returns accurate as of March 20, 2024

John Mackey, erstwhile CEO of Whole Foods Market, now an Amazon subsidiary, is a noteworthy member of The Motley Fool’s board of directors. Sean Williams holds positions in Amazon. Both Amazon, Chipotle Mexican Grill, Nvidia, Tesla, and Walmart feature in The Motley Fool’s assets. The Motley Fool advocates for Broadcom, underlining its investment potential. The Motley Fool also stands by a transparency protocol, ensuring responsible reporting.

Opinions shared in this article are those belonging to the author, not necessarily reflective of Nasdaq, Inc.’s views.