Warren Buffett, the legendary investor known for his traditional approach, has surprisingly embraced the tech titan Apple as a cornerstone of his investment portfolio. Despite his historical focus on simple businesses, Apple now comprises about 30% of Berkshire Hathaway‘s holdings, making it their largest position. Though Buffett has typically avoided technology stocks, his affinity for Apple has proven to be a lucrative move.

Unleashing the Potential

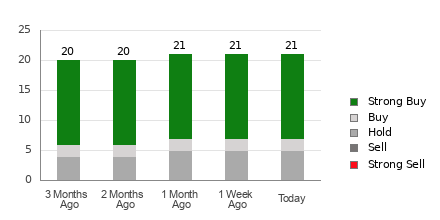

As of late, Apple’s stock has been garnering attention from Wall Street analysts, with Dan Ives of Wedbush Securities setting a $300 price target for the tech giant, suggesting a sizable 32% upside from the current market value. The question now arises: what factors could propel Apple’s stock further and is it a compelling investment opportunity at present?

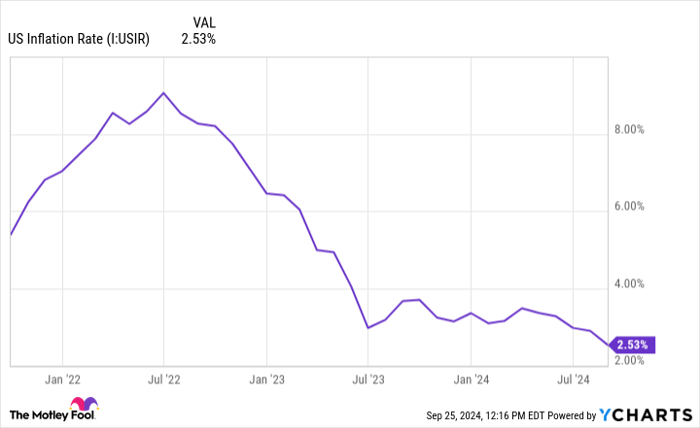

The Winds of Change

In light of recent macroeconomic shifts, including rising inflation and interest rates, consumer behavior has undergone changes, affecting companies like Apple. However, with signs of inflation stabilizing and Federal Reserve actions to taper interest rates, consumer purchasing power is anticipated to rebound.This could bode well for Apple’s future growth prospects.

AI: The Next Frontier

While Apple has not historically been at the forefront of artificial intelligence (AI) development, Dan Ives foresees a new chapter for the tech giant. The release of the latest iPhone 16, coupled with a partnership with OpenAI, signals Apple’s foray into an AI-driven era.As Apple integrates AI capabilities into its products and explores potential collaborations, a “supercycle” of growth awaits the company on the horizon.

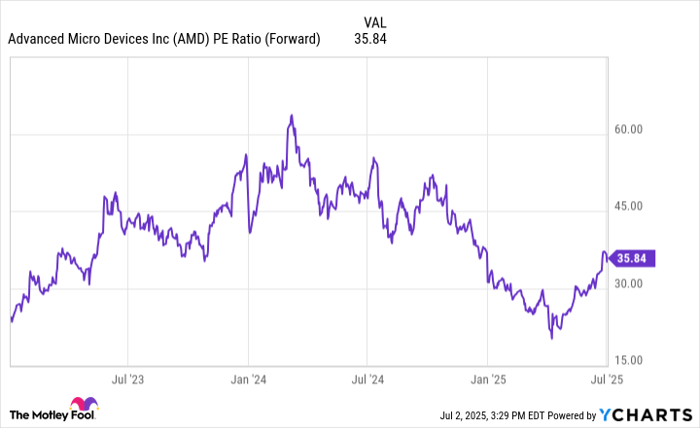

Valuation Considerations

Despite the promising prospects, Apple’s stock currently trades at a premium with a forward price-to-earnings (P/E) ratio of 33.7, well above the S&P 500’s average. While some argue that the AI potential is already factored into the share price, the allure of Apple’s growth trajectory remains intriguing.Investors must weigh the lofty valuation against the potential for sustained growth driven by AI innovation.

Final Thoughts on Apple

Amidst the evolving landscape, one thing remains certain: Apple’s entry into the AI realm presents a captivating narrative for investors. While uncertainties loom regarding valuation and market saturation, the allure of Apple’s technological evolution and consumer demand cannot be overlooked.As history has shown, underestimating Apple’s ability to innovate and captivate the market has often been a costly mistake.

Investing Wisdom

When it comes to identifying investment opportunities, listening to expert advice could be the key. With Stock Advisor‘s impressive track record, uncovering the next top stocks becomes a compelling journey.Be it Apple or other potential hidden gems, exploring the realm of investment possibilities could unveil lucrative opportunities in the ever-changing market landscape.

Adam Spatacco holds positions in Apple. The Motley Fool has positions in and recommends Apple, Baidu, and Berkshire Hathaway. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not reflect Nasdaq, Inc.’s viewpoints.