Melius Research Upgrades 3M: Analysts Predict Positive Growth Ahead

Fintel reports that on October 22, 2024, Melius Research upgraded their outlook for 3M (XTRA:MMM) from Hold to Buy.

Analyst Price Forecast Predicts Gains

As of October 21, 2024, the average one-year price target for 3M is 132.25 €/share. Projections range from a low of 91.87 € to a high of 156.28 €. This average target implies a potential increase of 6.36% from the latest reported closing price of 124.34 € / share.

Company Revenue Trends

The projected annual revenue for 3M is €33,236 million, marking a 1.83% increase. Analysts estimate the annual non-GAAP EPS to be 9.61.

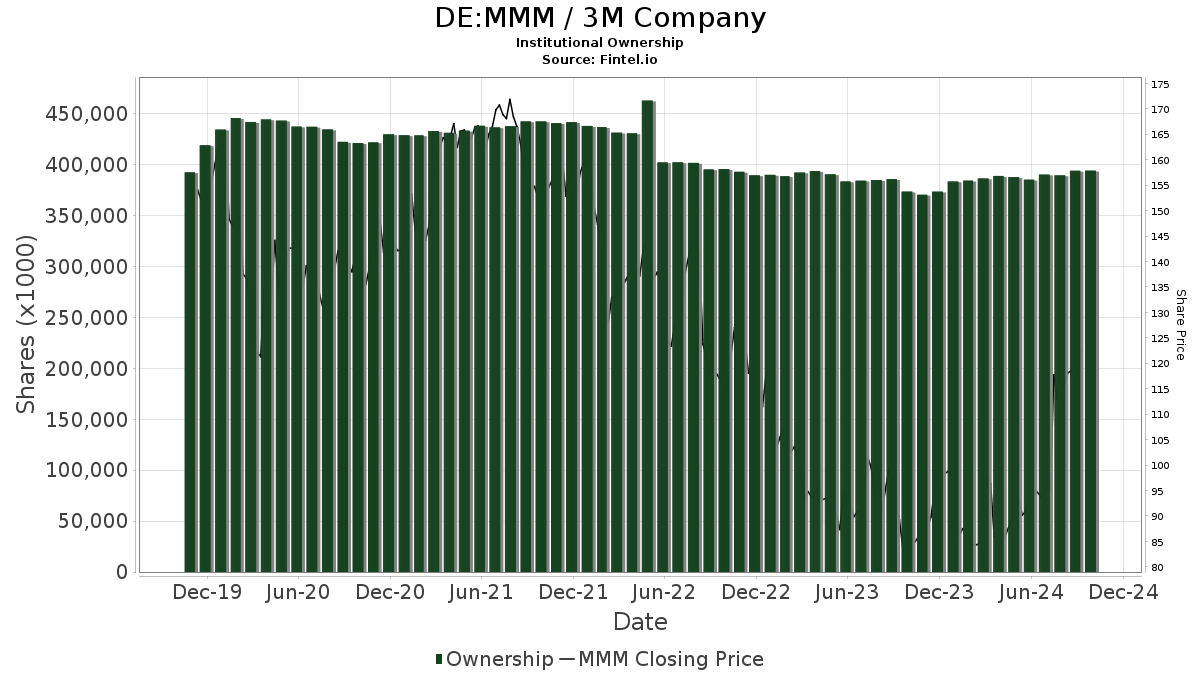

Institutional Interest in 3M

There are 2,807 funds or institutions reporting positions in 3M, an increase of 102 owners, or 3.77%, in the last quarter. The average portfolio weight of all funds dedicated to MMM stands at 0.30%, reflecting a 9.73% rise. Total shares owned by institutions have grown by 4.05% over the last three months, reaching 394,579K shares.

Actions by Major Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 17,506K shares, representing 3.19% ownership. The firm increased its holdings from 17,383K shares, an uptick of 0.70%. However, it decreased its portfolio allocation in MMM by 5.65% last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares currently holds 14,203K shares, or 2.59% ownership. The firm increased its position from 13,928K shares, a rise of 1.94%, but reduced its allocation in MMM by 7.00% last quarter.

Geode Capital Management owns 11,288K shares, which is 2.05% of the company. Previously, they held 11,100K shares, showing an increase of 1.66%. Yet, their total allocation in MMM declined by 41.95% in the last quarter.

State Farm Mutual Automobile Insurance maintains 8,277K shares, accounting for 1.51% ownership with no changes reported last quarter.

Newport Trust reports holding 7,592K shares, or 1.38% ownership, down from 7,802K shares, indicating a decrease of 2.77%. Their portfolio allocation in MMM dropped by 13.34% last quarter.

Fintel is a leading research platform providing extensive investing insights for individual investors, traders, financial advisors, and small hedge funds.

Covering a wide range of data, it includes fundamentals, analyst reports, ownership statistics, and fund sentiment, among many other resources. Exclusive stock picks are driven by advanced, backtested quantitative models for improved profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.