MercadoLibre Q1 2025 Earnings Surpass Expectations with Strong Growth

MercadoLibre (MELI) reported first-quarter 2025 earnings of $9.74 per share, exceeding the Zacks Consensus Estimate by 26.99% and showing a year-over-year increase of 43.7%. Revenues climbed 37% compared to the previous year, reaching $5.9 billion, surpassing the Zacks Consensus Estimate by 7.39%.

Total revenues were driven by significant growth in commerce and fintech, rising 32.3% and 43.3% respectively, to $3.3 billion and $2.6 billion. Strong performance in Brazil (up 30%) and Mexico (up 23%) played a key role. Notably, items sold in Argentina grew 52% year over year.

In fintech, Monthly Active Users increased by 31% to 64.3 million, with high-frequency user growth even more pronounced. Additionally, Assets Under Management surged 103% to $11.2 billion.

Moreover, revenues from MELI’s advertising services grew 50% year over year on an FX-neutral basis, reflecting the increasing total payment volume (TPV) driven by the robust Mercado Pago. The rising gross merchandise volume (GMV) also contributed positively to the performance.

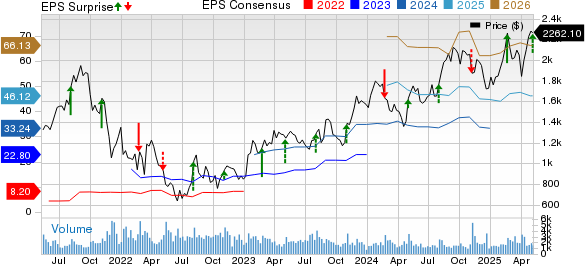

MercadoLibre, Inc. Price, Consensus and EPS Surprise

MercadoLibre, Inc. price-consensus-eps-surprise-chart | MercadoLibre, Inc. Quote

Quarterly Breakdown of MELI

Brazil: In Q1, net revenues reached $3.08 billion, comprising 51.9% of total revenues, reflecting a 19.9% year-over-year growth.

Argentina: This market generated revenues of $1.38 billion, which is 23.3% of the total, soaring 124.7% year-over-year.

Mexico: Net revenues amounted to $1.22 billion (20.6% of total revenues), marking a year-over-year increase of 25.8%.

Other countries: Revenues totaled $249 million, representing 4.2% of total revenues, a 41.5% increase from the previous year.

Key Metrics for MELI

The GMV was reported at $13.3 billion, up 17% year over year, and 40% on an FX-neutral basis, beating the consensus estimate by 2.95%.

The successful items sold totaled 492 million, a rise of 27.8% year-over-year.

TPV surged 43.2% compared to last year, reaching $58.3 billion and outpacing the Zacks Consensus Estimate by 11.26%.

In addition, total payment transactions increased by 38.3% to 3.34 billion.

MercadoLibre’s Operating Summary

For the first quarter, the gross margin remained steady at 46.7% year over year.

Operating expenses rose to around $2 billion, marking a year-over-year increase of 34.2%. However, as a percentage of revenues, it declined by 70 basis points to 33.8% in this quarter.

This led to an operating margin expansion of 70 basis points to 12.9% compared to the same period last year.

MELI’s Balance Sheet Overview

As of March 31, 2025, cash and cash equivalents amounted to $2.98 billion, an increase from $2.63 billion at the end of 2024.

Short-term investments stood at $741 million, with net debt totaling $2.77 billion at the close of the quarter.

Market Position and Comparisons

Currently, MercadoLibre holds a Zacks Rank #3 (Hold).

In the broader Zacks Retail-Wholesale sector, stocks like Alibaba (BABA), Costco Wholesale (COST), and Canada Goose (GOOS) are rated Zacks Rank #2 (Buy) at present.

Year-to-date, shares of Alibaba have increased by 45.3% and are expected to report fourth-quarter fiscal 2025 results on May 15.

Meanwhile, Costco shares have seen a 9.9% gain in the year, with third-quarter fiscal 2025 results due on May 29.

Canada Goose stocks have decreased by 17.3% year-to-date, with fourth-quarter fiscal 2025 results pending on May 21.

Conclusion

In summary, MercadoLibre has shown solid performance in Q1 2025, with robust growth across key metrics, suggesting a positive outlook for the company moving forward.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.