Merck Teams Up with LaNova in Major Cancer Therapy Licensing Deal

Merck (MRK) has announced an exclusive licensing agreement with LaNova Medicines, a private biotech company from China, for the development of the bispecific antibody candidate LM-299, which targets PD-1 and VEGF.

Under the terms of this deal, Merck will obtain the global rights to develop and market LM-299. In exchange, LaNova will receive an initial cash payment of $588 million, along with potential milestone payments that could reach up to $2.7 billion.

The transaction is anticipated to close by the end of this year, contingent on meeting standard closing conditions, which include regulatory approvals. Currently, LaNova is conducting an early-stage study of LM-299 in China, with participant enrollment ongoing. Merck aims to accelerate the drug’s development “with speed and rigor for patients in need.”

Merck’s Stock Performance Overview

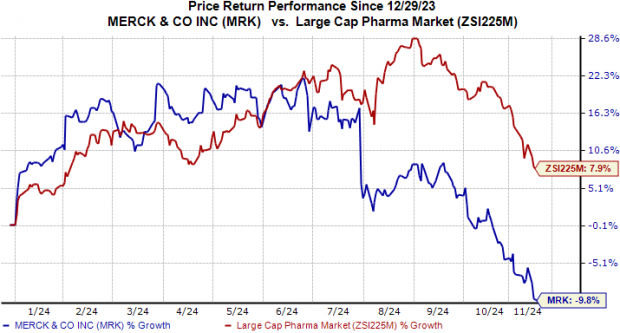

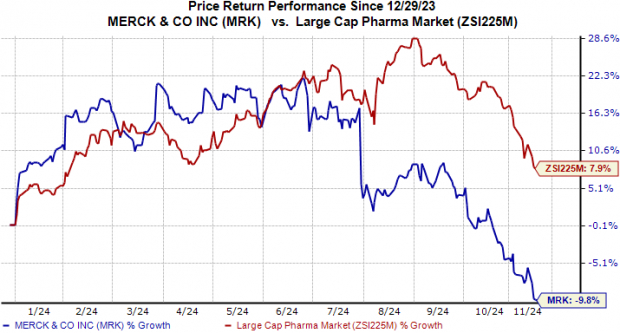

So far this year, Merck’s shares have decreased by 9.8%, a decline that is greater than the 7.9% drop experienced by the industry overall.

Image Source: Zacks Investment Research

Competition in Bispecific Antibodies

The field of bispecific antibodies targeting both PD-1 and VEGF has gained substantial interest in cancer treatment recently. Other biotech companies, such as Summit Therapeutics (SMMT), Instil Bio (TIL), and BioNTech (BNTX), are also developing their own PD-1/VEGF-targeting therapies, including ivonescimab, SYN-2510, and BNT327 respectively.

Summit Therapeutics is currently leading in clinical trials, having recently published positive data from a phase III study that indicated ivonescimab outperformed Merck’s Keytruda in certain cases of non-small cell lung cancer (NSCLC). The results showed a nearly 50% reduction in disease progression or mortality risk compared to Keytruda’s outcomes.

These findings mark ivonescimab as the first drug to demonstrate a meaningful statistically significant advantage against Keytruda in a late-stage NSCLC study, where Keytruda is viewed as the treatment standard.

In comparison, the candidates from BNTX and TIL are still in early or mid-stage trials across various cancers. Instil Bio’s SYN-2510 may have an advantage, as it can block both VEGF-A and VEGF-B, unlike ivonescimab which only targets VEGF-A.

Notably, numerous companies have in-licensed their PD-1/VEGF candidates from Chinese biotechs. Summit Therapeutics secured a license for ivonescimab from Akeso in 2022, Instil Bio partnered with ImmuneOnco Biopharmaceuticals for SYN-2510, and BioNTech entered into a deal for BNT327 with Biotheus last year, recently announcing an $800 million acquisition of its partner.

Analysis of Merck’s Strategy

While the licensing agreement appears promising, Merck faces significant challenges ahead. This alliance aims to diversify Merck’s revenue, which has heavily relied on Keytruda. In the first nine months of 2024, approximately 45% of Merck’s total revenues stemmed from Keytruda sales. With potential exclusivity concerns looming post-2028, the introduction and successful marketing of LM-299 could reduce reliance on this single product for future growth.

The dual-action mechanism of LM-299 sets it apart from existing solid tumor therapies (including Keytruda), as tumor tissues may exhibit higher expressions of both PD-1 and VEGF compared to normal tissues.

Merck & Co., Inc. Price Insights

Current prices for Merck & Co., Inc.

Merck’s Current Zacks Rank

Currently, Merck holds a Zacks Rank of #3 (Hold).

Emerging Solar Investment Opportunities

The solar sector is poised for growth as technology companies pivot away from fossil fuels, aligning with the rise of AI. Over the coming years, clean energy investments are expected to surge, with analysts suggesting solar could represent 80% of this renewable energy growth. Such trends may present significant profit opportunities, provided investors choose the right stocks.

Discover Zacks’ top solar stock recommendations, offered free of charge.

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Summit Therapeutics PLC (SMMT) : Free Stock Analysis Report

Instil Bio, Inc. (TIL) : Free Stock Analysis Report

BioNTech SE Sponsored ADR (BNTX) : Free Stock Analysis Report

Access the full article on Zacks.com here.

The views expressed here are the author’s own and do not necessarily reflect those of Nasdaq, Inc.