It’s been a whirlwind week for investors, but none made as much of a splash as Meta Platforms (META). The company announced its inaugural dividend after breezing past Q4 financial predictions on Thursday. This news comes on the heels of the Federal Reserve dismissing the possibility of rate cuts in March. Despite this, Meta’s stock soared during today’s trading session.

Q4 Triumph and Price Performance

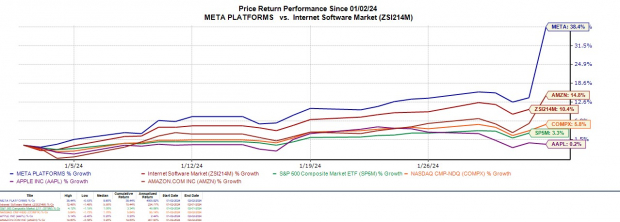

Meta’s Q4 report concluded a week marked by significant tech giants, including Apple (AAPL) and Amazon (AMZN), also releasing their quarterly results. While all exceeded expectations, Meta stole the spotlight. Alongside its robust performance, Meta declared its first cash dividend of $0.50 per share and its stock surged over 20% in Friday’s trading session. Notably, Meta’s stock has demonstrated a strong upwards trajectory and holds an “A” Zacks Style Scores grade for Momentum.

Image Source: Zacks Investment Research

Over the past year, Meta’s stock has rallied over 150%. Furthermore, the company has consistently seen stock surges following positive earnings reports, which extends back five consecutive quarters as evidenced by the EPS surprise chart below.

Image Source: Zacks Investment Research

Financial Results

Delving into Meta’s Q4 financials, earnings of $5.33 per share surpassed the Zacks Consensus by 10% and surged 77% from the prior-year quarter. Quarterly sales of $40.11 billion also climbed 25% year over year and exceeded expectations by 3%. Notably, Meta has posted an average earnings surprise of 19.71% in its last four quarterly reports.

Image Source: Zacks Investment Research

CEO’s Projections and Conclusion

Meta’s CEO, Mark Zuckerberg, emphasized the company’s advancements in artificial intelligence and the metaverse. With an optimistic outlook, Meta anticipates growth driven by investments in servers, including both AI and non-AI hardware in FY24, along with its new data center architecture.

Bottom Line

Currently holding a Zacks Rank #2 (Buy), Meta Platforms appears to be gaining traction, with positive annual earnings estimate revisions for FY24 over the last 30 days. With the company beating Q4 earnings and introducing a quarterly dividend, there is a compelling case for investors to consider Meta’s stock at this juncture.