Meta Platforms Inc. (NASDAQ: META) is leveraging artificial intelligence (AI) to enhance content recommendations and ad rankings, achieving an annual run rate of over $60 billion for its AI-powered advertising tools. In Q3 2025, the average price per ad rose by 10% year over year, reflecting increased advertiser demand driven by better ad performance. The company expects total revenues for Q4 2025 to be between $56 billion and $59 billion, with a consensus estimate of $58.4 billion, marking a growth of 20.7% from the previous year.

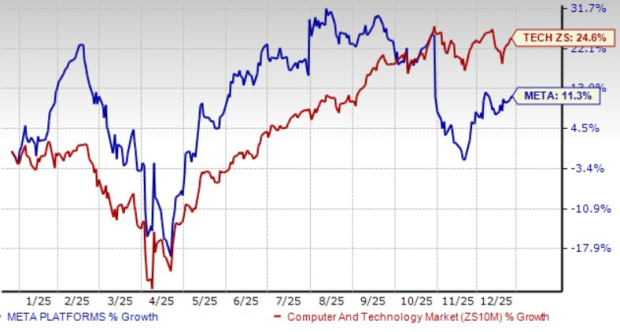

In terms of ad spending, Meta, along with Alphabet (GOOGL) and Amazon (AMZN), is projected to account for more than 50% of global ad expenditures this year, climbing to 56.2% by 2026. Meta is increasing its capital spending, estimating a range of $70 billion to $72 billion for 2025. Additionally, the company’s stock price has risen by 11.3% over the past year, despite the broader tech sector’s return of 24.6%.