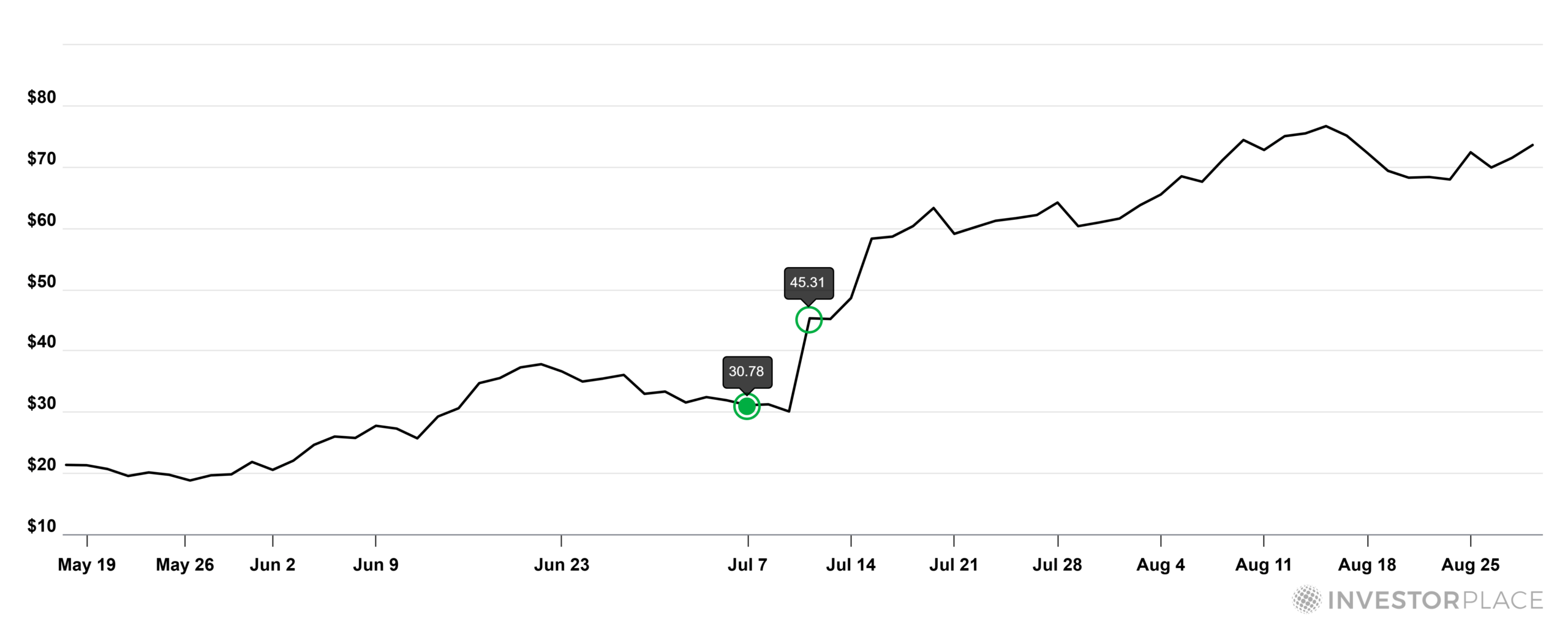

Meta Platforms (META) has seen its shares increase by 7.6% in the last month and recently reached a 52-week high of $784.75. Year-to-date, the stock has risen by 32.1%, outperforming the Zacks Computer and Technology sector, which is up by 11.4%, and the Zacks Internet – Software industry, which has gained 21.1%.

In its latest earnings report on July 30, 2025, Meta reported earnings per share (EPS) of $7.14, surpassing the consensus estimate of $5.83, alongside a 5.96% revenue beat. For the current fiscal year, the company is projected to earn $25.84 per share on revenues of $192.45 billion, representing an 8.3% increase in EPS and a 16.99% increase in revenues. The following fiscal year forecasts a further increase to $28.36 in EPS on $212.06 billion in revenues.

Meta holds a Zacks Rank of #1 (Strong Buy) and displays a mixed valuation profile with a Growth Score of A and a Value Score of F, trading at 29.9X current fiscal year EPS estimates compared to an industry average of 28.7X. Overall, analysts suggest potential for further gains driven by ongoing strong earnings estimates.