Benchmark Boosts Meta Platforms Outlook to ‘Buy’

Analysts Predict Minor Price Drop for META Shares

On January 30, 2025, Benchmark upgraded its outlook for Meta Platforms (NasdaqGS:META) from Hold to Buy.

As of January 28, 2025, the average one-year price target for Meta Platforms stands at $677.65 per share. Predictions range from a low of $262.60 to a high of $851.55. This average target indicates a decrease of 1.36% from its latest reported closing price of $686.99 per share.

For a closer look, check our leaderboard showcasing companies with the largest price target upside.

The projection for annual revenue at Meta Platforms is $142,851 million, showing a decrease of 13.16%. Analysts expect an annual non-GAAP EPS of 11.16.

Fund Sentiment: Growing Interest in META

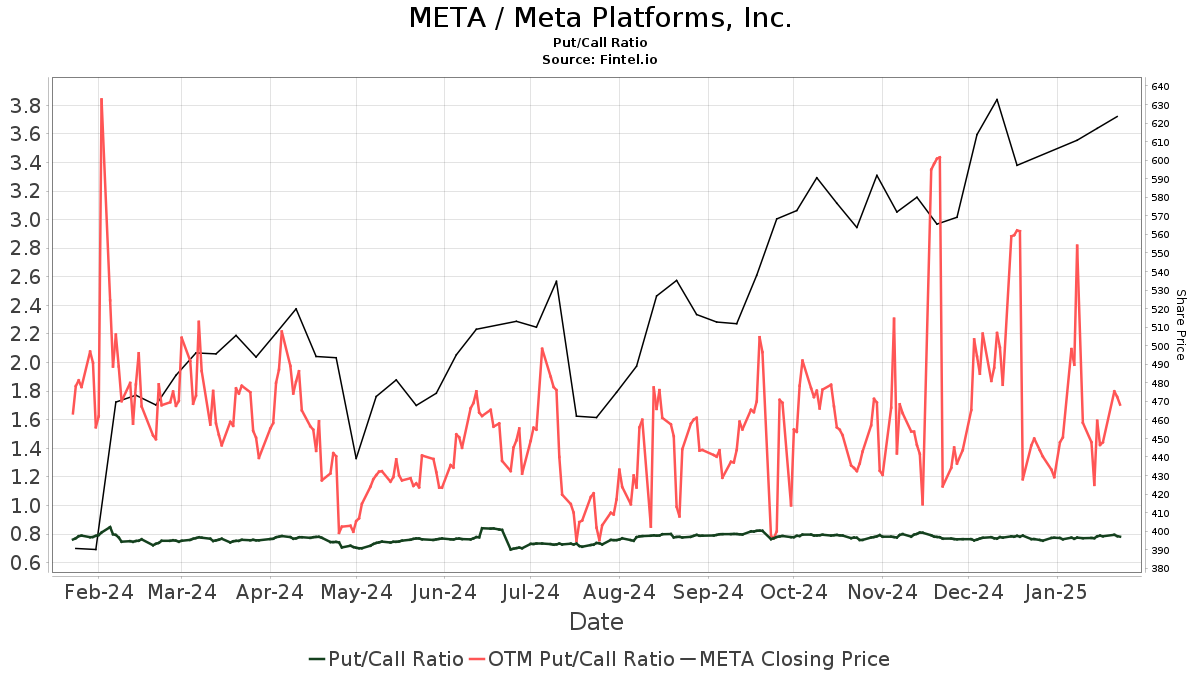

Currently, there are 6,195 funds and institutions reporting positions in Meta Platforms, up by 172 or 2.86% from the previous quarter. The average portfolio weight for all funds dedicated to META is -20.22%, representing a significant increase of 1,256.23%. Institutionally owned shares rose by 0.39% over the last three months, totaling 1,949,698K shares.  The put/call ratio for META is currently at 0.69, indicating a bullish sentiment.

The put/call ratio for META is currently at 0.69, indicating a bullish sentiment.

Institutional Investors’ Moves

The Vanguard Total Stock Market Index Fund (VTSMX) holds 69,251K shares, accounting for 3.18% ownership of Meta. This is a slight increase from the previously reported 69,230K shares, reflecting a rise of 0.03%. Over the last quarter, Vanguard increased its META allocation by 6.67%.

The Vanguard 500 Index Fund (VFINX) owns 57,219K shares, equating to 2.62% ownership. Its previous filing noted 56,245K shares, showing a 1.70% increase. The firm also raised its META portfolio allocation by 6.29% last quarter.

JPMorgan Chase owns 52,256K shares (2.40% ownership), a modest decline from the previous 52,277K shares, which is a decrease of 0.04%. However, the firm boosted its portfolio allocation by 5.17% in the last quarter.

Geode Capital Management possesses 48,161K shares (2.21% ownership), an increase from 47,462K shares previously, marking a rise of 1.45%. Their portfolio allocation in META also went up by 6.22% in the last quarter.

Price T Rowe Associates currently holds 41,268K shares, representing 1.89% ownership. Previously owning 41,709K shares, this is a decrease of 1.07%. Yet, the firm has increased its META allocation by 8.08% over the last quarter.

Overview of Meta Platforms

(Provided by the company.)

Founded in 2004 by Mark Zuckerberg and based in Menlo Park, CA, Meta’s mission is to empower people to build communities and connect with each other globally. The company offers a range of engaging products for users to connect via mobile devices, computers, and virtual reality. Its services facilitate social interaction, enabling users to share diverse content and engage in discussions through multiple platforms like Facebook and Instagram. Meta primarily generates revenue through advertising targeted to users based on demographics, interests, and behaviors. The company has a strong focus on innovative technologies like augmented and virtual reality as well.

Fintel serves as a comprehensive investment research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our data is extensive and global, covering fundamentals, analyst insights, ownership data, and fund sentiment. We also provide strategic stock picks through advanced quantitative models.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.