Meta Platforms (META) stock has surged post-earnings release, yet out-of-the-money (OTM) put options retain elevated premium levels. This scenario presents a lucrative opportunity for short-sellers aiming for income generation, particularly advantageous for current shareholders.

Heeding my counsel from the Feb. 23 Barchart article, “Shorting META Puts for Income Makes Sense for Shareholders Given The High Premiums,” sellers took the plunge by vending the $465 strike put option slated for March 15 expiration, strategically positioned three weeks ahead. As fate would have it, with META closing at $484.10, the put option faced obsolescence.

Offering a breath of relief, the $4.55 premium pocketed by sellers translated to a pristine 1.0% yield ($4.55/$465 = 0.978%). At the stock’s valuation of $486.35 back then, the play stood comfortably OTM by 4.39% (i.e., $465/$486.35-1). Consequently, a cushion existed for potential stock downturns, ensuring the investor’s yield remained safeguarded.

Albeit META eventually faced a minor descent, the short put speculation materialized without entailing the obligation to procure stock at $465.00. Revisiting this strategy on March 18 typified a sound initiative, given the persisting lofty premiums on OTM META put options.

Strategic Maneuver: Selling OTM Puts with META Stock

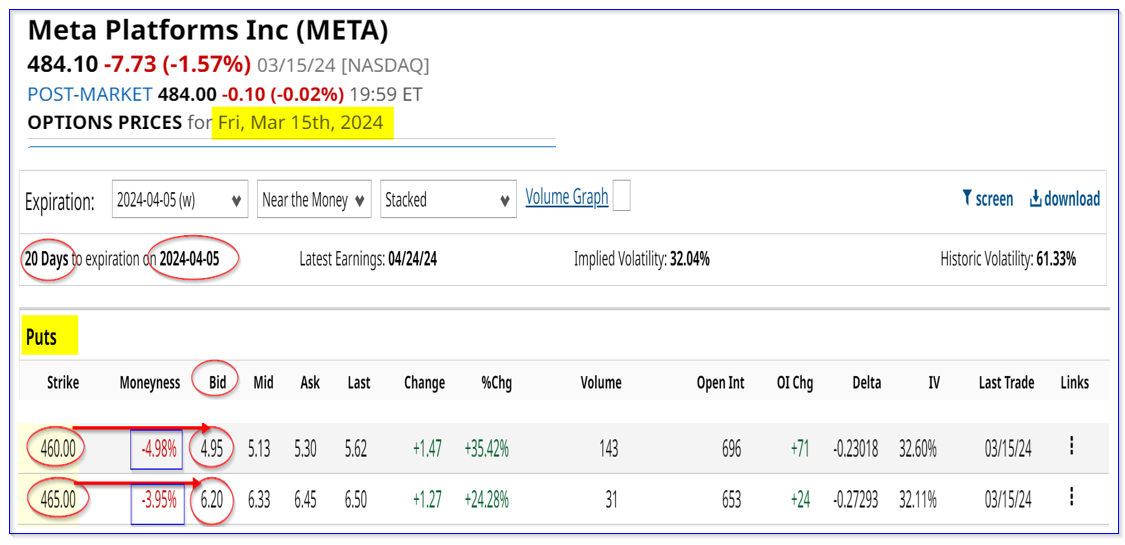

As elucidated within the April 5, 2024, expiration period, positioned three weeks away, discern the $465 puts, 4% OTM, trading at $6.20 per put. Meanwhile, the $460 strike puts, 5% OTM, are valued at $4.95.

This disposition enables a short seller to enjoy a 1.333% yield with the $465 puts (i.e., $6.20/$465.00). The alternative—$460 strike put play—yields 1.076% (i.e., $4.95/$460.00).

Operational mechanics? Potential participants need to earmark $46,500 in cash and/or margin with their brokerage entity. Subsequent to securing approval for such option trades, one can venture forth by “Selling to Open” a put contract at $465.00, set to mature on April 5. Post such a maneuver, the account garners an immediate $620, barring any market fluctuations by March 18. This calculates to 1.333% of the $46,500 invested.

Further reassurance prevails—if META stock persists above $465 within the forthcoming three weeks, the $46,500 shall evade automatic utilization to secure 100 shares at $465.00 per share.

Apart from the immediate gains, replicating this trade quarterly could amass $2,480 ($620 x 4)—transcending into an expected return (ER) of 5.333% affiliated with the $46,500 investment.

Per options disclosure, the $460 strike put hypothesizes a diminished yield and ER, granted the lesser investment. Notwithstanding, the $495 gain from pledging $46,000 to procure 100 shares (if consigned at maturity) yields 1.076%. Over 12 weeks, the potential return tallies at $1,980 or a 4.30% ER.

A word of caution—if META stock treads a flat trajectory, the put option premiums may exhibit tempered volatility and reduced premiums.

Embrace this lucrative avenue to amass returns with META stock, an enticing narrative, especially beckoning to current shareholders. A caveat—should the stock stumble, their sole onus would be augmenting their share allotment.

More captivating Stock Market insights await you on Barchart.

On the date of publication, Mark R. Hake, CFA held no direct or indirect positions in any securities referenced. The content serves purely informational purposes. For a comprehensive overview, refer to the Barchart Disclosure Policy available here.

The author’s perspectives articulated herein do not definitively align with those of Nasdaq, Inc.