Meta Platforms Shares Surge After Strong Earnings and Trade News

Shares of Meta Platforms (NASDAQ: META) rose last month after the company reported better-than-expected earnings. Additionally, the stock gained momentum in the second week of May due to improved trade relations between the U.S. and China.

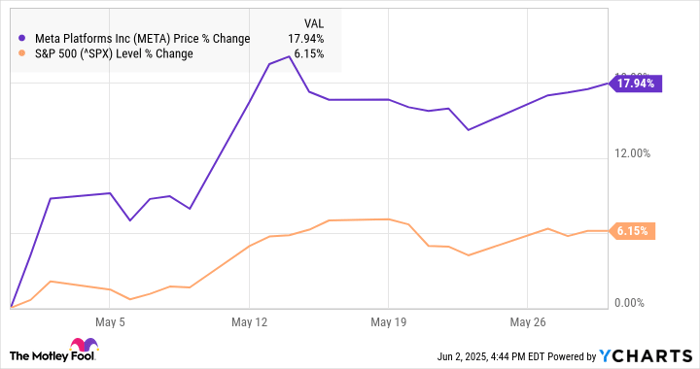

According to S&P Global Market Intelligence, the stock ended the month with an 18% gain. Early price increases followed the earnings report, which sparked further growth throughout the month.

Meta’s Earnings and Market Response

After a decline in April concerns about the trade war, Meta rebounded with solid first-quarter results. On May 1, the stock jumped 4.2%, followed by another 4.4% increase the next day after reporting Q1 earnings that exceeded expectations. Revenue for Q1 grew 16% to $42.3 billion, surpassing estimates of $41.4 billion. User growth, increased ad impressions, and higher average ad prices all contributed to this revenue spike. Earnings per share (EPS) rose 37% to $6.43, well above the consensus estimate of $5.22.

Moreover, Meta provided encouraging guidance, predicting Q2 revenue between $42.5 billion and $45.5 billion, while lowering full-year expenses by $1 billion.

Another key factor for the stock’s rise was a broader market surge on May 12, following the U.S. and China’s temporary tariff reductions. Meta, being sensitive to macroeconomic conditions due to its reliance on digital advertising, gained 8% on that day and closed the month 1% higher.

Market Dynamics and Future Outlook

Last month’s pressure on rival Alphabet also affected Meta’s stock. Alphabet faces accusations of monopoly practices in several sectors. Additionally, news that Apple might offer AI search engines as alternatives to Google contributed to Alphabet’s struggles.

Meta may gain from any Alphabet weaknesses as both compete for digital advertising and AI markets. Although economic downturns could pose challenges, Meta’s guidance and AI developments suggest strong potential for continued growth.

Investment Considerations for Meta Platforms

Before considering investing in Meta Platforms, note the following:

The Motley Fool Stock Advisor team has highlighted ten stocks they currently believe are the best investments, but Meta Platforms is not included. These ten stocks have the potential for significant returns in the years ahead.

For context, when Netflix was recommended on December 17, 2004, a $1,000 investment would now be worth $651,049. Similarly, a $1,000 investment in Nvidia recommended on April 15, 2005, would be valued at $828,224.

It’s important to recognize that Stock Advisor has an average return of 979%, significantly outpacing the S&P 500’s 171% return.

Disclaimer: The views expressed here are the author’s and do not necessarily reflect those of Nasdaq, Inc.