Meta Platforms Sees Strong Recovery Amid AI Boom

Shares of Meta Platforms (NASDAQ: META) soared last year as the “Magnificent Seven” stocks reached a trillion-dollar valuation again. This surge mirrored a broader rally among technology companies.

Meta’s Turnaround Story

After a challenging 2022, when falling advertising revenues and heavy investments in its metaverse project weighed down the stock, Meta Platforms is experiencing a significant resurgence in 2024. According to S&P Global Market Intelligence, the stock jumped 65% last month, following a strong earnings report that improved investor confidence.

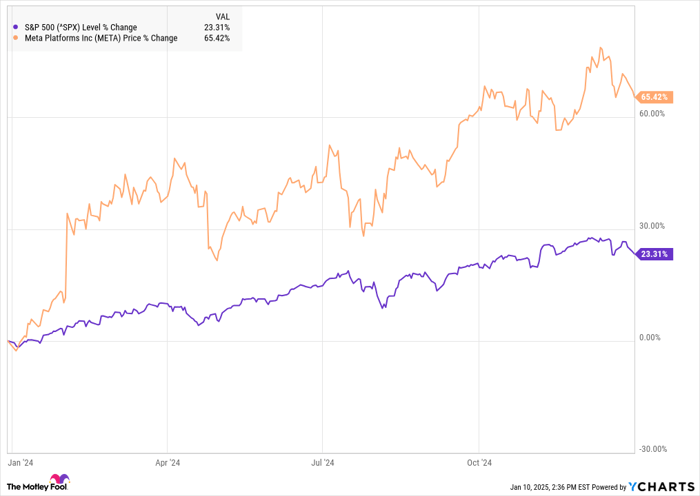

The chart below illustrates how Meta’s stock began to recover early in the year and maintained an upward trend that coincided with gains in the S&P 500.

^SPX data by YCharts.

Strong Financial Performance

In February, Meta’s stock experienced its best performance of the year after announcing fourth-quarter earnings for 2023. The stock spiked 20% on February 2, following a report revealing a 25% increase in revenue, reaching $40.1 billion. Operating margin more than doubled to 41% due to previous cost reductions and layoffs, with net income tripling to $14 billion, translating to $5.33 per share. This demonstrated the company’s strong profit potential.

In the first three quarters of 2024, Meta continued this positive trend, benefiting from robust demand for advertising and a growing user base. Its popular products include Facebook, Instagram, Messenger, and WhatsApp. For the period, the company noted a 22.5% rise in revenue, alongside a 66% increase in earnings per share.

Image source: Getty Images.

Looking Ahead: Will Meta Continue to Grow in 2025?

As the new year approaches, Meta appears poised for continued growth, bolstered by a strong digital advertising environment and advancements in AI. Investors are eagerly awaiting the holiday-quarter results, scheduled for release on January 29.

The stock is still considered reasonably priced, trading at a P/E ratio of 29, suggesting potential for further appreciation. While it may not experience the same margins as in 2024, analysts expect another year of growth for investors.

Opportunity Awaits for Investors

For those concerned they might have missed the top-performing stocks, opportunities may still be on the horizon.

Our analysis team identifies “Double Down” stocks, recommending companies that are predicted to see significant growth. Some success stories include:

- Nvidia: A $1,000 investment made in 2009 would now be worth $363,307!

- Apple: A $1,000 investment from 2008 would have grown to $45,963!

- Netflix: A $1,000 investment made in 2004 would have skyrocketed to $471,880!

We are currently issuing “Double Down” alerts for three promising companies. Don’t miss out on this potential opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 6, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.