Meta Platforms: Analyzing Investment Potential as We Approach 2025

While examining past performance may not guarantee future success, it can provide valuable insights, especially for cyclical companies. Recently, a deep dive into Meta Platforms (NASDAQ: META) has yielded noteworthy indications for investors as we look toward 2025.

Where to invest $1,000 right now? Our analyst team has unveiled their picks for the 10 best stocks to buy at this moment. See the 10 stocks »

Meta Platforms: Balancing Growth and Value

Though Meta, the parent of Facebook and Instagram, may not immediately strike one as a cyclical company, its revenue largely depends on advertising, which fluctuates with economic sentiment. When businesses anticipate consumer spending will rise, they tend to increase their advertising efforts. Conversely, in times of recession, ad budgets often shrink.

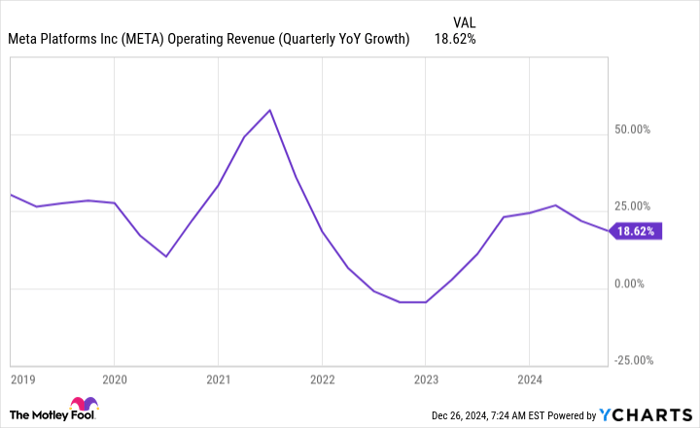

Meta’s recent revenue growth suggests that advertisers are optimistic about consumer spending. This trend mirrors what was observed between 2019 and 2021, with only a slight dip due to the impacts of COVID-19.

META Operating Revenue (Quarterly YoY Growth) data by YCharts. YoY = year over year.

Although growth was slightly faster in previous years, the current growth sentiment resembles that of 2019-2021. Additionally, Meta’s price-to-earnings (P/E) ratio aligns closely with levels seen during that period.

META PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Given that Meta is maintaining growth and valuation levels similar to 2019-2021, past performance indicates a positive outlook. Meta’s stock experienced substantial appreciation during those years, suggesting potential for strong returns in 2025.

Understanding Meta’s Valuation as We Enter 2025

Meta’s strong historical performance gives investors reasons to be optimistic about 2025. However, there are critical considerations to keep in mind.

Wall Street analysts forecast a revenue growth of about 15% for Meta in 2025. While this is slower compared to the growth seen from 2019 to 2021, it still denotes solid performance given Meta’s size.

As a mature tech company, Meta attracts investor interest focused on profit growth more than just revenue. However, there are concerns about profit margins, given management’s forecast of significant increases in infrastructure expenses next year, primarily driven by investments in artificial intelligence (AI).

Despite these anticipated costs, analysts project a 12% growth in earnings per share (EPS) for 2025, indicating that the elevated spending won’t severely hinder earnings potential.

Even with growth expectations tapering and increased expenses looming, Meta remains one of the more attractively priced large tech companies. In comparison to other “Magnificent Seven” stocks, which include Nvidia, Microsoft, Apple, Amazon, Alphabet, and Tesla, Meta ranks as the second-cheapest based on trailing or forward earnings.

Importantly, despite these factors, Meta’s Q3 revenue growth was the second fastest among these peers, underscoring its potential for growth at a fair price.

The context may not be identical to what was observed in 2019-2021, yet the similarities are striking. With an appealing valuation relative to its competitors, Meta stands out as a stock with the potential for notable returns in 2025.

Should You Invest $1,000 in Meta Platforms Today?

Before committing funds to Meta Platforms, it’s wise to consider the following:

The Motley Fool Stock Advisor team has identified what they believe are the 10 best stocks to buy now, and notably, Meta Platforms is not included in this selection. The stocks chosen by the analysis could yield impressive returns in upcoming years.

Reflecting on past recommendations, Nvidia was included on this list back on April 15, 2005. If you had invested $1,000 at that time, it would be worth $857,565!*

Stock Advisor offers a straightforward approach for investors, combining guidance on portfolio management with consistent analyst updates and two new stock picks each month. The Stock Advisor service has delivered results more than quadrupling the S&P 500 returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, is also a board member. Randi Zuckerberg, former director of market development for Facebook and sister to CEO Mark Zuckerberg, holds a position on the board. Keithen Drury has investments in Alphabet, Amazon, Nvidia, and Tesla. The Motley Fool recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool suggests the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. A full disclosure policy is maintained by The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.