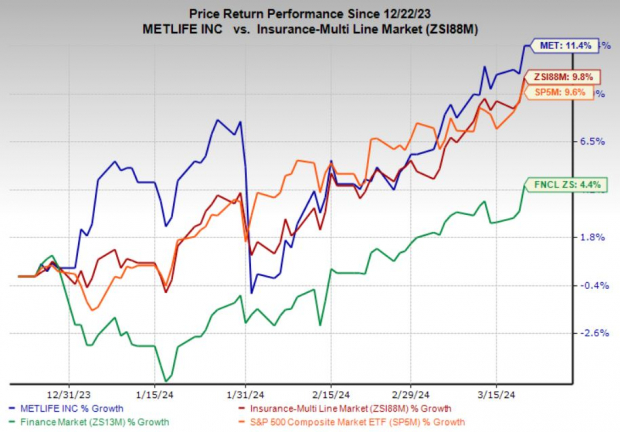

MetLife, Inc. MET, the insurance-based financial behemoth from the heart of New York, has been on a wild ride, soaring 11.4% in the past three months. This surge has left its industry peers in the dust, with an impressive 9.8% growth to boast. The company’s growth trajectory is fueled by robust performance in its Group Benefits and RIS business segments. As it stands, MetLife lays claim to a market cap of $53 billion.

Over the same period, MET’s stocks have outshone the Finance sector’s 4.4% and the S&P 500 Index’s 9.6% growth, indicating a formidable presence in the market. The company’s strategic prowess, ranging from surging premiums to an active inorganic growth strategy, cost-containment initiatives, and strong partnerships, are all working in unison to bolster its performance. It’s no wonder that investors are taking note of this Zacks Rank #3 (Hold) company’s remarkable price rise.

Image Source: Zacks Investment Research

The Momentum Continues…

Everything seems to be falling into place for MetLife, but let’s dig deeper into the numbers and forecast what lies ahead.

Market analysts predict a robust growth trajectory for MetLife, with a Zacks Consensus Estimate pegging the company’s 2024 full-year earnings at $8.81 per share, signifying a substantial 20.2% year-over-year surge. This projection is supported by two recent upward estimates for the company’s earnings. While not perfect, MetLife has beaten earnings expectations in one of the last four quarters.

Looking ahead, revenue estimates for MetLife in 2024 come in at a substantial $73.8 billion, indicating a healthy 3% rise from the previous year’s numbers. Notable growth is anticipated in the Latin America, Group Benefits, and Asia segments, promising a bright future for the company.

Strategic Moves and Financial Prowess

MetLife’s strategic maneuvers, expanding into new domains like vision care and pet insurance, along with forging key partnerships like the one with Fidelity Investments, are positioning it for future success. The company’s focus on cost-efficiency is paying off, with a decline in its direct expense ratio to 12.2% in 2023, below the company’s guided level.

Furthermore, MetLife boasts of a strong cash position, closing 2023 with $20.6 billion in cash and equivalents, outstripping its long-term debts. Its healthy liquidity has allowed for shareholder value enhancements, including significant share repurchases and consistent dividend growth.

Challenges Ahead

While the path seems promising, it’s not all smooth sailing for MetLife. Challenges loom on the horizon, such as a drop in variable investment income and potential impact from fluctuations in the real estate equity market. Additionally, projected increases in the group life mortality ratio pose a concern. Yet, with a calculated and strategic course of action, MetLife is well-poised for sustainable long-term growth.

Promising Contenders in Finance

Among the top growth prospects in the broader financial landscape are names like Ryan Specialty Holdings, Inc. RYAN, Root, Inc. ROOT, and Brown & Brown, Inc. BRO, all holding a Zacks Rank #2 (Buy). These companies exhibit significant potential for growth and make for compelling investment options in the market.

5 Stocks Set to Double

At Zacks, each stock selection is akin to choosing a potential home run, with possibilities of gains exceeding +100% or more in the year 2024. Past recommendations have seen staggering leaps of +143.0%, +175.9%, +498.3%, and +673.0%, proving the prowess of Zacks’ expert curation.

Discover These 5 Potential Home Runs Today >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.