Microchip Technology MCHP’s expansion into the embedded systems universe with the unveiling of the AVR DU family of microcontrollers (MCUs) has made waves in the industry. This recent addition showcases a plethora of upgrades, notably in the domains of USB connectivity, security attributes, and power delivery capabilities.

The widespread acclaim for USB connectivity endures due to its adaptability in embedded designs, facilitating device compatibility, streamlined communication protocols, and power distribution functionalities. The AVR DU family pushes the bounds of USB connectivity further by integrating robust security features and enhanced power delivery, heralding a new era for USB microcontrollers.

A standout feature of the AVR DU MCUs is their capacity to support power delivery of up to 15W through the USB interface. This unique capability, a rarity among comparable microcontrollers, presents exciting opportunities for applications like USB-C charging with currents of up to 3A at 5V, making these MCUs a prime choice for devices such as portable power banks and rechargeable toys.

In conjunction with augmented power delivery, the AVR DU family incorporates Microchip’s Program and Debug Interface Disable functionalities to fortify security measures. This feature locks access to the programming/debugging interface, thwarting unauthorized attempts to manipulate firmware.

Furthermore, the integration of Read-While-Write Flash and a secure bootloader assures secure firmware updates, enabling seamless in-field updates without disrupting product functionality.

Efficiency Gains and Cost Reductions Through Innovative Design

The AVR DU family streamlines design efforts and reduces costs through features such as USB clock recovery, eliminating the need for expensive external crystals. The Core Independent Peripherals feature consolidates key device functions onto a single-chip solution, optimizing board space and mitigating design intricacies.

The versatility of the AVR DU MCUs spans various applications, encompassing domains from fitness wearables to industrial machinery. Empowered by comprehensive development tools like MPLAB Code Configurator and MPLAB X Integrated Development Environment, Microchip equips developers to actualize their visions with precision and efficiency.

Challenges Amidst Macro Conditions Impede Growth

Despite its robust portfolio expansion, Microchip has faced headwinds due to persistent inflation and high interest rates, contributing to a challenging macroeconomic backdrop that has impeded MCHP’s progress.

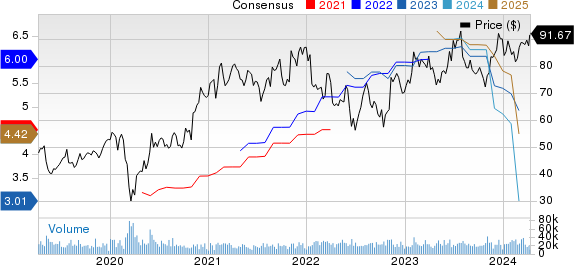

Year to date, the company has witnessed a modest 1.7% gain, trailing behind the broader Zacks Computer and Technology sector’s return of 11.4%.

Microchip has encountered requests to delay or cancel backlog orders as customers seek to rebalance their inventory amidst weaker business conditions. The company has halted internal capacity expansion, projecting decreased capital expenditure spending in fiscal 2024 and 2025 due to weakening demand and macroeconomic challenges.

In response to these adversities, Microchip has aimed to reduce lead times as a strategy to assist customers amid macro weakness and escalating uncertainty. However, shorter lead times have translated to reduced bookings and diminished short-term visibility.

Microchip anticipates net sales in the range of $1.225 to $1.425 billion for the fourth quarter of fiscal 2024. Non-GAAP earnings are expected to fall between 46 cents and 68 cents per share.

Market Positioning and Contenders

Microchip currently holds a Zacks Rank #5 (Sell).

Noteworthy alternatives in the broader sector include NVIDIA NVDA, Veeva Systems VEEV, and Synopsys SNPS, each bearing a Zacks Rank #1 (Strong Buy) currently. These companies have recorded year-to-date share gains of 71.8%, 11.4%, and 10.4%, respectively.

The long-term earnings growth rates for NVIDIA, Veeva, and Synopsys are presently situated at 30.93%, 24.09%, and 17.51%, respectively.

The Road Ahead for Microchip

Zacks Investment Research has compiled a Special Report exploring the potential for significant profits from Bitcoin, the world’s largest decentralized form of currency. With historical returns like +272.4% in 2012, +161.1% in 2016, and +302.8% in 2020, Zacks foresees another substantial surge.

For investors looking for the latest market recommendations from Zacks, a comprehensive report detailing the 7 best stocks for the next 30 days is available for download.

As the landscape of embedded systems continues to evolve, Microchip’s AVR DU family of MCUs stands as a beacon of innovation, offering a potent blend of cutting-edge features and enhanced functionalities. While navigating the currents of a challenging macroeconomic environment, Microchip remains at the cusp of technological advancement, poised to redefine the benchmarks of embedded design.

Investors keen on capitalizing on the burgeoning realm of embedded systems should keep a watchful eye on Microchip’s trajectory, as the company navigates through the complexities of the market to unveil groundbreaking solutions that resonate with the needs of developers and consumers alike.

Click here to read this article on Zacks.com

For more insights from Zacks Investment Research, visit their website

The viewpoints expressed in this article are reflective of the author’s perspective and do not necessarily mirror those of Nasdaq, Inc.