Revolutionizing IoT Security Landscape

Microchip Technology MCHP unveiled a game-changing addition to its Trust Platform lineup, aiming to fortify cybersecurity in the expanding realm of Internet of Things (IoT) devices.

The latest ECC608 TrustMANAGER, in conjunction with Kudelski IoT keySTREAM, provides a dynamic solution to meet the increasing demand for robust security measures in interconnected IoT systems.

Traditionally, IoT security has been stagnant, relying on fixed certificate chains established during manufacturing. However, with the ECC608 TrustMANAGER and keySTREAM, Microchip is rewriting the rules. This innovative duo allows for on-the-fly management and updates of security credentials, breaking free from the confines of static security implementations.

Central to this technology is the ECC608 TrustMANAGER, employing a secure authentication IC to protect cryptographic keys and certificates. These credentials are supervised by the keySTREAM Software as a Service, ensuring end-to-end security throughout an IoT product’s life cycle. This dynamic strategy enables the creation of a self-serve root Certificate Authority (root CA) and a public key infrastructure reinforced by Kudelski IoT, simplifying the provisioning and management of devices in the field.

One of the standout features of the ECC608 TrustMANAGER with keySTREAM is its capacity to enable in-field provisioning and certificate management, smoothing the process of overseeing IoT ecosystems. This becomes crucial as security standards and regulations evolve, demanding the adaptability of security infrastructure for IoT devices.

Setting a New Standard for IoT Security

The ECC608 TrustMANAGER with keySTREAM presents a significant leap in IoT security, establishing a fresh benchmark for smart device security. By harnessing Microchip’s cutting-edge semiconductor technologies alongside Kudelski IoT’s security services, this partnership delivers unparalleled protection and ease of provisioning for IoT device manufacturers.

Priced starting at 75 cents each in 10,000-unit quantities and applying an activation fee solely after the device’s initial connection, the ECC608 TrustMANAGER offers a cost-effective solution for enhancing IoT security. Manufacturers can leverage Microchip’s Trust Platform Design Suite to explore the keySTREAM use case and integrate this state-of-the-art technology into their IoT products.

Challenges Amid Macro Weakness

Despite a strong and expanding portfolio, lingering inflation and high interest rates have added to the strain of a weak macro environment. These factors have cast a shadow on MCHP’s outlook.

The company faces requests to defer or cancel backlog as customers seek to rebalance their inventory due to challenging business conditions. With the market undergoing challenging times, Microchip has paused internal capacity expansions, anticipating reduced capital expenditure spending in fiscal 2024 and 2025.

Implementing shorter lead times, Microchip aims to support customers through a period of macro weakness and mounting uncertainties. However, these shorter lead times are leading to decreased bookings and diminished short-term visibility.

Microchip’s outlook for the fourth quarter of fiscal 2024 predicts net sales between $1.225 billion and $1.425 billion. Non-GAAP earnings are expected to range from 46 cents per share to 68 cents per share.

Persistent Challenges Amid New Innovations

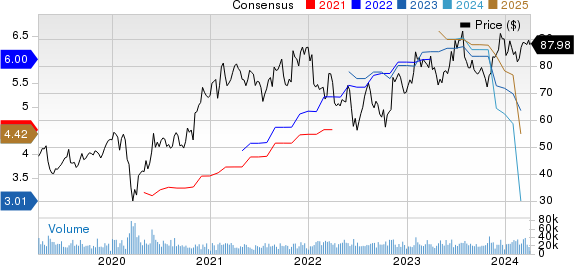

The Zacks Consensus Estimate for revenues stands at $1.33 billion, implying a 40.57% year-over-year decline. Earnings are forecasted to be 57 cents per share, reflecting a 65.24% year-over-year decrease.

With a Zacks Rank #5 (Sell), Microchip has seen a 2.4% decline in its year-to-date shares, underperforming the broader Zacks Computer and Technology sector’s return of 13.6%.

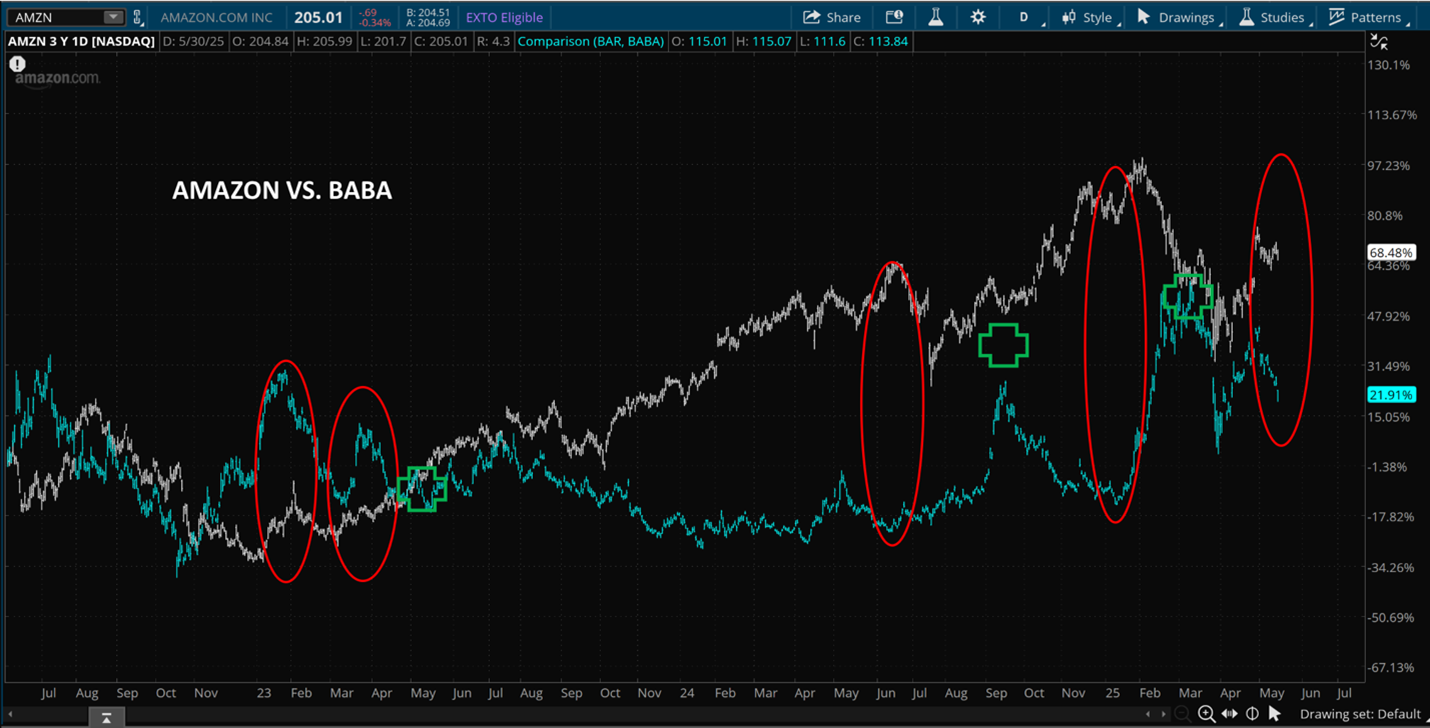

On a brighter note, NVIDIA NVDA, BILL Holdings BILL, and Synopsys SNPS are favorably positioned in the sector with a Zacks Rank #1 (Strong Buy) at present. Shares of NVDA and SNPS have gained 80.6% and 10.7% year to date, respectively. In contrast, BILL shares have declined 21.8%.

Long-term earnings growth rates for NVIDIA, BILL Holdings, and Synopsys are presently estimated at 30.93%, 23.64%, and 17.51%, respectively.