In our prior evaluation of Micron (NASDAQ:MU), we foresaw potential challenges from new Chinese regulations, buoyed by the possibility of a revenue reduction of 5.6% to 25%, with our base case aligning at an 11.3% decline congruent to Micron’s forecast. Despite potential advantages for competitors like Samsung and SK Hynix, we forewarned that Chinese chipmakers, specifically YMTC in NAND, could capitalize on the ban, to Micron’s detriment. Nonetheless, we anticipated market pricing resurgence, as Micron was already implementing price hikes.

In this subsequent analysis, we honed in on Micron’s potential growth through High Bandwidth Memory (‘HBM’) in light of its recent earnings briefing, which underscored the prospects of HBM in the context of AI. First and foremost, we scrutinized Micron’s competitive stance in the HBM DRAM chip market. Moreover, we delved into how AI propels the demand for memory chips in data centers, particularly HBM DRAM. Finally, we scrutinized the company’s capital expenditure plans and refreshed our supply growth projection, to gauge its capacity to capitalize on increasing demand, concurrently assessing market pricing trends.

Micron’s Competitive Position in HBM

|

Micron FY2023 |

Actual |

Our Previous Forecast |

In FY2023, Micron reported a full-year contraction of 49.5%, substantially lower than our earlier prognosis of a 3% decline. This downturn emanated from both its DRAM and NAND revenues which plummeted by 61% and 46% respectively, primarily attributed to ASP decreases of 49% and 38%. In contrast, our prior anticipation had been for positive full-year ASP growth for DRAM and NAND, predicated on an anticipated equilibrium in the demand-supply dynamics, on the back of major chipmakers curtailing capex. However, actual unit shipment growth surpassed our projections for DRAM and NAND.

Furthermore, we delved into Micron’s competitive positioning within the arena of HBM memory – a variant of DRAM memory characterized by low power consumption and broad communication pathways – to ascertain its potential to capitalize on the burgeoning opportunity.

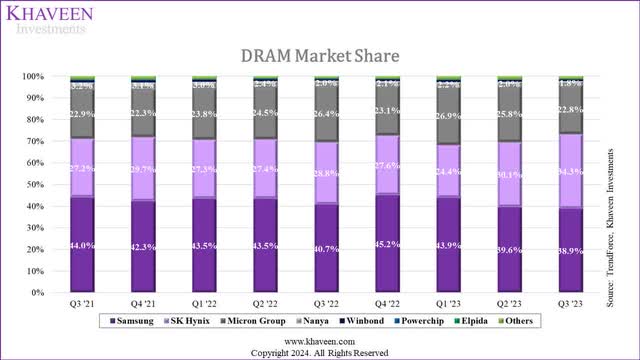

In the broader DRAM domain, Micron commands a 25% market share, trailing behind industry pacesetters Samsung (OTCPK:SSNLF) and SK Hynix.

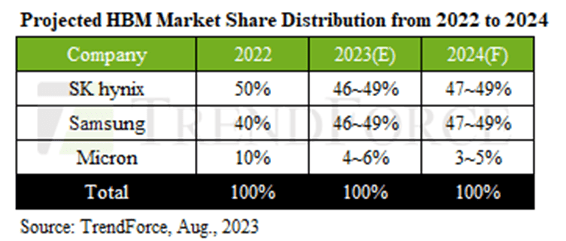

According to TrendForce, Micron’s stake in the HBM market stood at a mere 10% in 2022, with SK Hynix taking the lead, followed by Samsung. SK Hynix positioned itself as the primary purveyor of HBM3, leveraging its first-mover edge by initially supplying NVIDIA (NVDA) with its H100 chips. However, Micron swiftly followed suit, launching its HBM3 memory in July 2023. Impressively, the company has also recently unveiled its next-gen HBM3E memory, boasting enhanced memory performance.

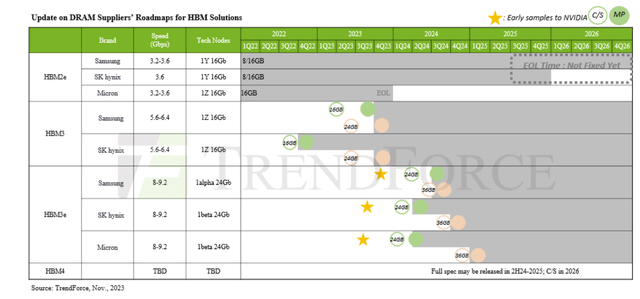

The above timeline illustrates diverse releases of HBM3 and HBM3e by Samsung, SK Hynix, and Micron. In Q1 2024, Micron is slated to debut its new HBM3e memory. Concurrently, SK Hynix and Samsung are projected to introduce their HBM3e memory shortly thereafter, with Samsung set to unveil the first 36GB HBM3e in 4Q24. A comparison of the timelines for each company’s launch of HBM3 and HBM3e reveals that SK Hynix requires over a year to roll out HBM3e, Samsung takes one year, while Micron achieves this feat in only about two quarters, underscoring its emphasis on HBM3e.

HBM3e Expected to Revolutionize Memory Market

Samsung’s HBM3e specs outperform Micron and SK Hynix overall with higher data rate and bandwidth per device, but Micron edges out SK Hynix. Therefore, in the near term, we expect Micron’s competitiveness in HBM3e to position it well to capture market share from current leader SK Hynix.

Data Center Boosted by HBM for AI Applications

Micron has secured a partnership with Nvidia, for the supply of HBM chips valued at $770 million. As covered previously, Nvidia is the market leader in server GPU with an estimated 95% market share.

|

Nvidia |

A100 |

H100 |

H200 |

|

Memory Bandwidth (GB) |

80 |

80 |

141 |

|

Growth % |

0% |

76% |

|

|

Type |

HBM2e |

HBM3e |

HBM3e |

|

Year |

2020 |

2023 |

2024 |

|

AMD |

MI200 |

MI250 |

MI300x |

|

Memory Bandwidth (GB) |

128 |

128 |

192 |

|

Growth % |

0% |

50% |

|

|

Type |

HBM2e |

HBM2e |

HBM3 |

|

Year |

Dec-21 |

Nov-21 |

Dec-23 |

Furthermore, based on the table above, the next-generation server GPUs from Nvidia and AMD have higher memory bandwidth, using next-gen HBM memory chips which we believe benefits demand growth for Micron.

|

DRAM |

2023E |

2024F |

2025F |

2026F |

|

Mobile Phones |

3.0% |

11.3% |

11.3% |

11.3% |

|

Total DRAM Demand Growth % |

4.4% |

12.8% |

11.3% |

10.5% |

|

Total DRAM Demand Growth % (With HBM) |

20.0% |

15.0% |

13.4% |

12.6% |

|

HBM Boost to DRAM Market Demand |

2.2% |

2.1% |

2.1% |

|

|

Micron HBM Market Share Increase |

5.9% |

5.9% |

5.9% |

|

|

Micron DRAM Demand Growth |

20.0% |

17.5% |

16.0% |

15.3% |

Source: Company Data, Khaveen Investments

Micron’s Prospective Financial Growth and Market Recovery Analysis

The memory chip industry is a volatile landscape, much like a rollercoaster with unexpected twists and turns. The recent analytical prognosis of Micron, a key player in the memory chip industry, delves into the multifaceted factors that contribute to Micron’s projected growth and market recovery. Taking a deep dive into market demand, supply projections, and pricing trends of both DRAM and NAND, the insightful prognosis presents a comprehensive perspective for investors eying the company’s future.

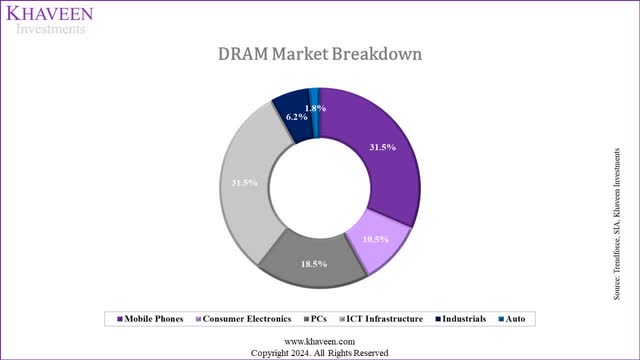

The Revival of DRAM Market Demand with HBM

The increasing demand for High Bandwidth Memory (HBM) in tandem with ICT infrastructure growth signals a positive trajectory for Micron. The projected 2.1% surge in total DRAM demand attributed to HBM underpins an opportunity for Micron to capitalize on this burgeoning market segment. With the company’s planned increase in capex spending directed towards HBM memory production, the stage is set for Micron to harness the potential growth stemming from the demand for HBM in the market.

Market Recovery & Pricing Trends

The pricing trends of DRAM and NAND, akin to a seesaw, illustrate the tempestuous nature of the memory chip market. While both segments experienced a rebound in Q4, the overall pricing growth for the year fell short of earlier projections due to the sluggish market recovery in the first half. However, the late surge in market pricing, particularly for DRAM, bodes well for Micron’s growth prospects, especially considering the higher cost of HBM compared to regular DRAM chips.

Analysis and Forecasts

Based on the revised pricing forecasts, Micron’s revenue is anticipated to skyrocket by 59% in the fiscal year 2024. The robust pricing growth for DRAM and NAND, estimated at 93.5% and 18.3% respectively, is positioned to be a catalyst for Micron’s revenue surge. This surge is expected to lay the foundation for substantial growth in the upcoming fiscal years, solidifying Micron’s position amidst the recovering market dynamics.

Source: Company Data, Khaveen Investments

The Future Outlook for Micron

Data from Khaveen Investments and insight from company reports provide mobile app users with detailed projections about Micron technology’s share prices.

Revenue Trends

Micron’s Total Revenue for the near future showed an upward growth trend: from 24.73 to 28.82. The average growth rate over the three years was 13.11%.

Market Share

Market projections suggest that Micron’s share in HBM market may rise from 5% in 2023 to 23% in 2026, a growth attributed to its competitiveness in HBM3e.

Supply and Demand

Supply projections, considering the latest capex guidance, foresee a robust pricing recovery in DRAM at 98.9% and in NAND at 18.3%. This is further boosted by market supply balancing efforts by top companies and the premium HBM commands over standard DRAM chips.

Analyst’s Verdict

Despite an increase in projected price targets, the company’s stock price has risen by 22% since the last coverage. Micron’s future growth may be considered conservative with an upside of 4.9%, according to the latest analysis. This reflects the 30% Molodovsky discount added to the price target.