Micron’s High-Flying Journey to the Clouds

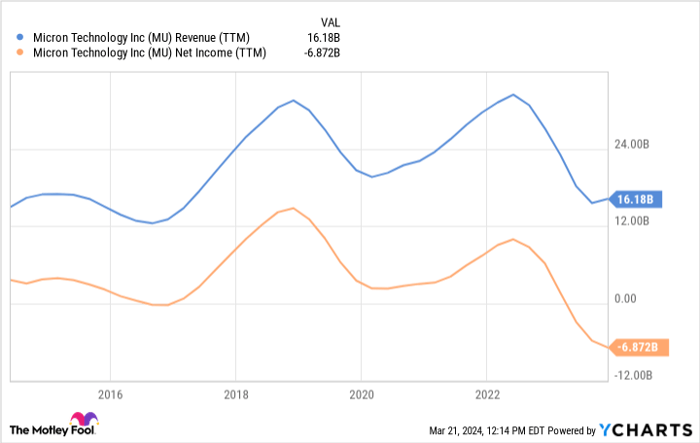

Emerging from the depths of the semiconductor industry downturn, Micron Technology (NASDAQ: MU) has orchestrated a remarkable recovery. The return to profitability witnessed in Q2 fiscal 2024, fueled by resurging demand in PCs and smartphones, marks a pivotal moment for the U.S. memory chip giant. However, the real game-changer lies in Micron’s production of HBM3e, the cutting-edge high-bandwidth memory coveted in the flourishing world of artificial intelligence and accelerated computing.

The HBM Revolution: Micron’s Moment in the Sun

With Micron’s HBM3e manufacturing capacity fully booked and supplies sold out till 2025, the company finds itself in an enviable position. CEO Sanjay Mehrotra’s optimistic projections of substantial HBM revenues in fiscal 2024 signal a lucrative period ahead. The market uproar over Micron’s profitability resurgence and robust growth projections unveils a narrative of redemption for the once-struggling memory chip maker.

Nvidia’s Ascent to the Summit: A Stock Market Phenomenon?

Nvidia’s (NASDAQ: NVDA) stock has surged over 500% since 2023, capturing the attention of investors globally. The relentless climb in share price, trading at 37 times the analysts’ EPS estimates, underscores the market’s bullish outlook on Nvidia’s future. As Micron’s HBM chips remain in high demand, Nvidia’s position in the generative AI realm seems secure for the foreseeable future.

Into the Unknown: Nvidia’s Trajectory Amidst Uncertainty

While Nvidia’s remarkable journey shows no signs of decelerating, uncertainties about sustained demand linger. The symbiotic relationship between Micron and Nvidia unveils a collaborative industry landscape where success hinges on the mutual prosperity of key players in the semiconductor ecosystem. As Micron gears up for a prosperous period, Nvidia stands to benefit from the ripple effects of the HBM revolution.

Should you invest $1,000 in Micron Technology right now?

Before you make any investment decisions, delve into the Motley Fool Stock Advisor recommendations to uncover potential market gems. Micron Technology’s current trajectory, intertwined with Nvidia’s ambitions, paints a promising picture for investors seeking strategic opportunities in the ever-evolving semiconductor space.