Micron’s Stock Drop: Short-Term Pain or Long-Term Gain?

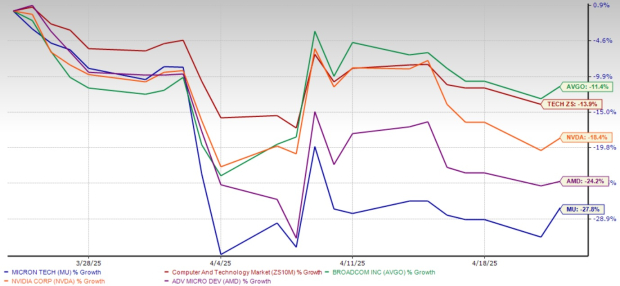

Micron Technology, Inc. (MU) shares have seen a significant decrease of 27.8% over the last month, lagging behind the Zacks Computer and Technology sector, which has dropped 13.9%. Additionally, MU has underperformed compared to major semiconductor players like Broadcom (AVGO), NVIDIA (NVDA), and Advanced Micro Devices (AMD).

Recent Performance Trends of MU

Image Source: Zacks Investment Research

This dramatic decline prompts the question: Should investors consider cutting their losses, or does the Stock still hold value? While short-term obstacles are evident, MU’s long-term growth potential remains robust, making a strong case for holding the Stock.

Factors Behind Micron’s Recent Struggles

Micron’s recent challenges are part of a larger tech sector pullback, driven by growing fears over an escalating tariff war and slowing economic growth. This situation is further complicated by concerns regarding the company’s declining gross margins.

In its latest fiscal report for Q2 2025, Micron’s non-GAAP gross margin fell to 37.9% from 39.5% in the previous quarter, indicating a significant decline. This decrease primarily results from lower NAND flash pricing and ongoing startup costs at its new DRAM production facility in Idaho.

More alarming for investors is the company’s guidance for Q3, forecasting a gross margin of 36.5% at the midpoint. This outlook suggests that margin pressures may continue in the short term.

Despite these immediate hurdles, Micron’s strong market position and encouraging long-term outlook suggest that the Stock is still worth holding.

Long-Term Prospects for Micron

Though the near-term profitability forecast is disappointing, Micron’s long-term growth prospects look encouraging. If the company meets its Q3 targets, it would reflect a notable year-over-year revenue increase of 29% and a 153% rise in earnings per share (EPS).

The Zacks Consensus Estimate indicates revenue growth of 41% for fiscal 2025 and 30% for 2026. EPS projections show a remarkable 427% increase for fiscal 2025 and 58% for fiscal 2026.

Moreover, Micron has a solid track record of beating earnings estimates. The Stock has exceeded the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 10.7%.

Micron’s Price, Consensus, and EPS Surprise Trends

Micron Technology, Inc. price-consensus-eps-surprise-chart | Micron Technology, Inc. Quote

With its strategic role in the memory and storage chip market, Micron is well-positioned to benefit from a predicted increase in AI-related capital expenditures in the coming years.

Positive Trends in the Semiconductor Market

Micron’s involvement in high-demand areas such as AI, data centers, automotive, and industrial IoT places it on the cutting edge of the semiconductor industry’s transformation. The rapid rise of AI applications has led to heightened demand for advanced memory solutions like DRAM and NAND. Through investment in state-of-the-art DRAM and 3D NAND technologies, Micron is actively enhancing its competitiveness in this evolving landscape.

Furthermore, Micron’s diversification strategy reduces its dependence on the more volatile consumer electronics market. By focusing on stable sectors such as automotive and data centers, Micron aims to diminish revenue fluctuations, enhancing its resilience in an industry often subject to economic cycles.

The growing requirement for high-bandwidth memory (HBM) products adds potential to Micron’s growth platform, especially as AI workloads multiply. The company has made notable advances in AI-optimized memory solutions, with its HBM3E products distinguished for their efficiency and bandwidth.

This January, NVIDIA announced Micron as a vital supplier for its GeForce RTX 50 Blackwell graphics processing units (GPUs), further reinforcing Micron’s standing in the HBM sector. Earlier in the year, Micron shared plans for a new advanced packaging facility for HBM in Singapore, scheduled to start operations in 2026, with further expansions projected by 2027. This indicates a strategic alignment with Micron’s growth strategies focused on AI, positioning the company for future success in high-performance memory chips.

Valuation Insights: Micron Appears Undervalued

In terms of valuation, Micron is currently undervalued, supported by a Zacks Value Score of B.

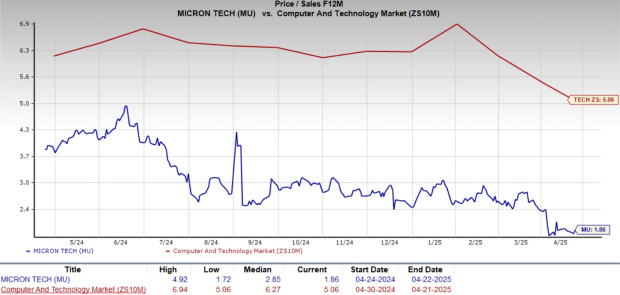

When looking at the forward 12-month Price/Sales (P/S) ratio, MU shares are trading at 1.86X, well below the sector average of 5.06X.

Image Source: Zacks Investment Research

Micron’s P/S multiple is also lower compared to major semiconductor competitors, including Broadcom, NVIDIA, and Advanced Micro Devices, which have forward 12-month P/S multiples of 11.88X, 11.79X, and 4.17X, respectively.

Conclusion: Hold Micron Stock for the Long Haul

The recent decline in Micron’s stock price can be attributed to short-term challenges; however, the long-term growth narrative remains compelling. Given its strong positioning in AI and data center markets, along with an appealing valuation, maintaining a position in Micron Stock is advisable for investors willing to weather near-term fluctuations.

Micron currently holds a Zacks Rank #3 (Hold). For more insights, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Best Stocks for the Next 30 Days

Just released: Experts have distilled 7 elite stocks from a current list of 220 Zacks Rank #1 Strong Buys. These stocks are deemed “Most Likely for Early Price Pops.”

Since 1988, this complete list has outperformed the market more than twice, averaging a gain of +23.9% per year. Be sure to check out these hand-picked 7 stocks promptly.

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days today, free of charge.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

Micron Technology, Inc. (MU): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Broadcom Inc. (AVGO): Free Stock Analysis report

This article originally appeared on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.