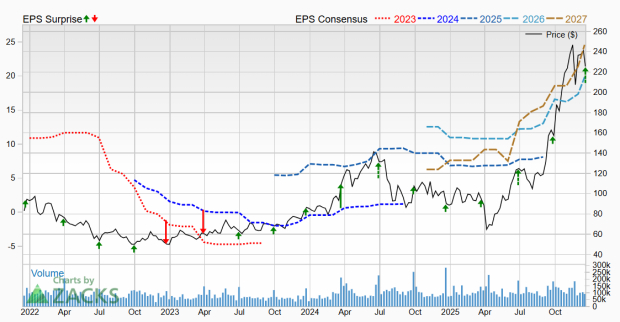

Micron Technology (MU) shares surged over 11% following the company’s recent earnings report on October 25, 2025, which exceeded analyst expectations with revenue guidance raised to $18.7 billion from $14.2 billion and earnings nearly doubling from $4.78 per share to $8.42. The firm also reaffirmed a strong demand for high-bandwidth memory, forecasting a total market reach of $100 billion by 2028, indicating a projected compound annual growth rate of around 40%.

In the past 60 days, current year earnings expectations for Micron have risen by 22.38%, while next year’s estimates increased by 32.42%. Despite the stock’s impressive rise, concerns remain regarding the cyclical nature of the memory industry, particularly with previous earnings peaks correlating with peak pricing and potential profit margin declines.

Industry giants like Nvidia (NVDA) and Broadcom (AVGO) have seen less favorable trading trends, raising questions about Micron’s sustained momentum and whether its high-bandwidth memory supply constraints will continue to strengthen its stock position.