Micron Technology, Inc. MU shares climbed 2.7% on Tuesday after NVIDIA Corporation NVDA announced that Micron would serve as a key supplier for its innovative GeForce RTX 50 Blackwell graphics processing units (GPUs). This announcement, made during NVIDIA’s CES 2025 keynote, highlights Micron’s significant role in the high-bandwidth memory (HBM) market and its increasing importance in the fast-growing AI semiconductor sector.

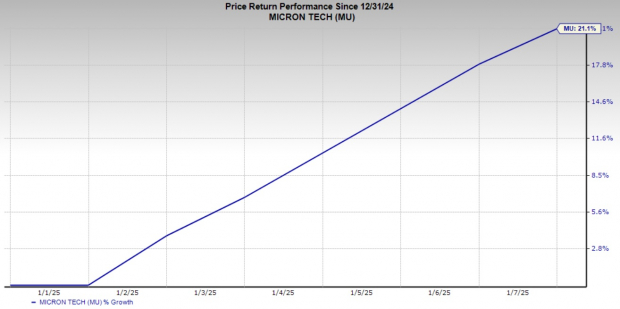

So far in 2025, Micron’s stock has surged 21%, leading investors to wonder if this upward trend can continue. For now, holding onto this stock seems wise due to its long-term growth potential and strategic position in the industry.

Image Source: Zacks Investment Research

NVIDIA’s Announcement Boosts Micron’s Profile

NVIDIA’s recent news highlighted Micron as the main memory supplier for its latest GeForce RTX 50 Blackwell GPUs, set to enhance AI capabilities in gaming and data processing. Micron’s HBM solutions will provide these chips with an impressive 1.8 terabytes per second of bandwidth — double that of the previous generation.

This partnership extends beyond a single project; Micron and NVIDIA have enjoyed a long-standing collaboration in AI and gaming hardware. By featuring Micron in its latest products aimed at consumers and gamers, NVIDIA reinforces Micron’s strength in delivering next-generation memory solutions. The surge in demand for high-performance computing fueled by AI is an opportunity for Micron’s HBM offerings to gain market share.

Long-Term Growth Potential for Micron

Despite facing short-term fluctuations, Micron’s long-term prospects remain bright. The company expects the HBM market to expand from $16 billion in 2024 to an astonishing $100 billion by 2030. This growth aligns with the rising demand for AI and advanced computing applications that utilize Micron’s DRAM and HBM technologies.

Although Micron provided cautious revenue guidance of $7.9 billion for the second quarter of fiscal 2025, falling short of the Zacks Consensus Estimate of $8.96 billion, its focus on AI-related memory products offers a strong growth trajectory. Achieving its second-quarter targets would still indicate a robust year-over-year revenue growth of 36% and a significant increase in earnings.

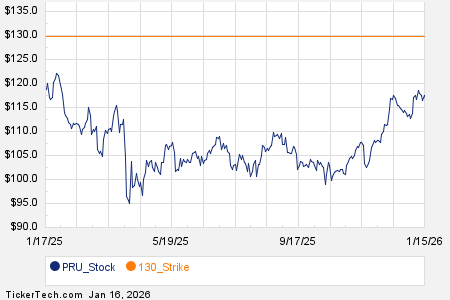

Image Source: Zacks Investment Research

Partnerships with key industry players such as NVIDIA, Advanced Micro Devices, Inc. AMD, and channel partners like Cadence Design Systems and Synopsys, Inc. SNPS further bolster Micron’s market presence. The collaboration with Advanced Micro Devices focuses on delivering memory and storage solutions, while partnerships with Cadence and Synopsys ensure effective memory verification processes.

Micron’s Valuation Shows Value

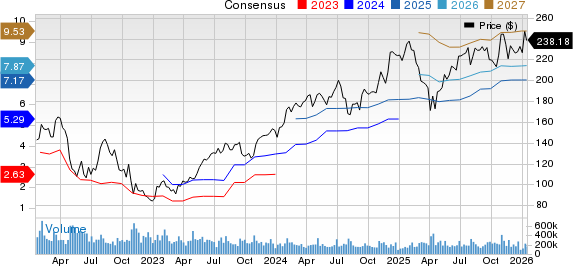

Micron’s current valuation enhances its attractiveness. With a forward 12-month price-to-earnings (P/E) ratio of 12.27 and a price-to-sales (P/S) ratio of 2.9, the stock trades at a discount relative to the Zacks Computer-Integrated Systems industry averages of 20.01 and 3.34. This valuation suggests an inviting entry point, particularly in light of its growth potential.

Image Source: Zacks Investment Research

Micron’s Short-Term Challenges

Despite promising long-term growth, Micron faces immediate obstacles. A decline in consumer spending has negatively affected demand for memory chips, particularly those used in personal computers (PCs) and smartphones, resulting in a 10% sequential revenue drop in its Embedded Business Unit during the first quarter of fiscal 2025.

Additionally, manufacturers of PCs and smartphones are adjusting their orders due to lackluster demand. Micron expects low-single-digit growth in smartphone unit sales and mid-single-digit growth in PC sales for 2025, which likely will impact DRAM sales.

Geopolitical tensions also pose challenges. The continuing U.S.-China trade conflict creates uncertainty, especially since China is a major market for Micron, exposing the company to potential regulatory or economic disruptions.

Conclusion: Position Your Portfolio Carefully

Micron’s partnership with NVIDIA highlights its long-term opportunities in AI and high-performance computing sectors. While facing short-term challenges like reduced consumer spending and geopolitical risks, the stock’s attractive valuation and growth outlook suggest that it is advisable to hold onto Micron shares for now.

For investors interested in the AI-driven semiconductor market, maintaining their investment in Micron could be wise as the company navigates these near-term hurdles. Currently, Micron carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Promising Stocks to Watch

Recently released: Experts have selected 7 promising stocks from a current list of 220 Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Increases.”

Since 1988, the full list has outperformed the market by more than double, boasting an average annual gain of +24.1%. So be sure to pay immediate attention to these selected stocks.

Discover them now >>

Want the latest stock recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.