Micron Technology (NASDAQ: MU) is experiencing a rebound in mid-August, driven by the increasing demand for memory due to artificial intelligence (AI), expected to grow exponentially by 2026. Analysts predict a potential increase in the stock price by nearly 100% within two years, with current valuations at 8x earnings and an expectation of strong growth across its DRAM and HBM markets.

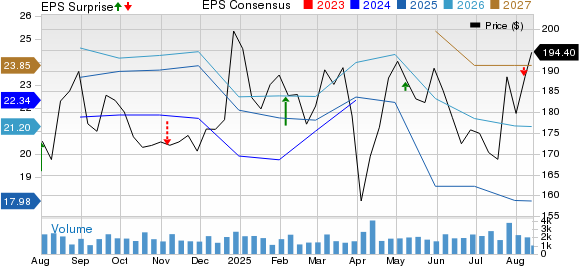

In Q3, Micron reported over 50% sequential growth in HBM sales, contributing significantly to its data center business, which accounted for more than 50% of revenue. The company forecasts a growth rate in the high 30s percent range, driven by robust analyst upgrades and positive market sentiment. The consensus among 21 of 23 analysts indicates a bullish outlook, pushing the stock price potentially to the $150 to $190 range in the near term.

Overall, Micron’s stock is positioned for continuous growth, supported by favorable demand conditions and a solid recovery in legacy markets, alongside an anticipated strong performance in the upcoming fiscal quarter.