Understanding Market Trends: A Close Look at Micron Technology, Inc.

New Traders Face Challenges

Trading can be quite tricky for newcomers. They often struggle with where to place buy and sell orders, leading them to make guesses. This approach can result in significant financial losses.

Recognizing Patterns in Stock Prices

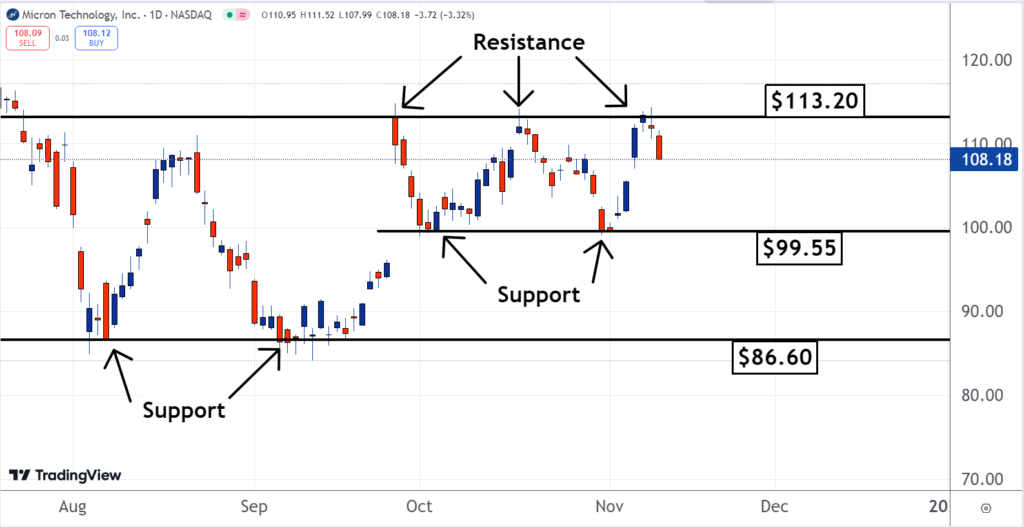

Experienced traders utilize market data to inform their decisions. They understand that when a stock like Micron Technology, Inc. MU reaches a prior resistance or support level, it is likely to experience a reversal in trend. This insight is why Micron is our Stock of the Day.

For instance, at the $113.20 mark, Micron encountered resistance and changed direction, demonstrating that past price levels influence future market movement.

The Impact of Sell Orders

Several traders who purchased shares near $113.20 during September and October regretted their choices when the stock’s value declined. Many resolved to offload their shares at breakeven if the price returned to that level.

Historical Price Behavior

When Micron’s price eventually approached $113.20 again, a flood of sell orders emerged, reinforcing that same resistance level.

Furthermore, the chart reveals that $99.55 served as a significant support level for Micron at the end of October. This occurrence also points to the idea that established support levels often hold sway over future stock performance.

Traders who sold shares around $99.55 in early October likely felt their decision was a mistake after observing a price rebound. Consequently, many of these traders opted to buy back their shares when the price fell back to $99.55, creating a wave of buy orders that established support at this price point.

Conclusion

Making random guesses in trading can lead to financial setbacks. In contrast, knowledgeable traders allow the market’s behavior to guide their actions, knowing that previously established support and resistance levels are likely to influence future price movements.

Read Next:

Tesla Rival Rivian Reports Steep Loss Of About $40K Per EV In Q3 As Deliveries Hit Lowest Since Q1 2023

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs