Embracing cutting-edge memory and storage solutions, Micron Technology’s MU stock shattered records following its robust performance in the fiscal second quarter presented on Wednesday.

A Spectacular Start

An optimistic revenue outlook driven by the escalating demand for its artificial intelligence memory cells rocketed Micron’s stock up by 18% during this morning’s trading.

Potential investors may be contemplating whether to ride this wave, especially with the intriguing fact that Micron’s Zacks Semiconductor Memory Industry currently ranks in the top 1% among the 250+ Zacks industries.

Image Source: Zacks Investment Research

A Revolutionary Leap

Micron has boldly embraced the AI transformation with its HBM3E memory cells that outshine traditional dynamic random-access memory (DRAM) cells used in computers. Unlike ordinary DRAMs, the HBM3E is tailored for specialized applications like graphics processing, high-performance computing, and servers.

Crafted to deliver superior bandwidth and lower power consumption, the HBM3E is employed in the production of Nvidia’s NVDA H200 AI GPU, critical for the advancement of large language models (LLMs) and other AI duties.

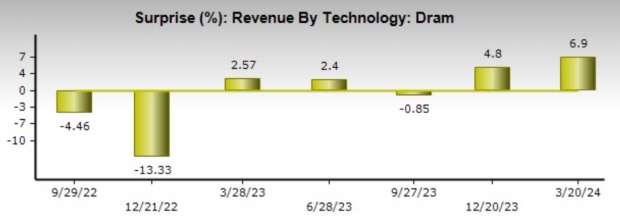

Eager Demand for HBM3E

Backed by its collaboration with Nvidia and the soaring demand for HBM3E, Micron’s Dram segment revenues surged by a striking 52% year over year to $4.15 billion from $2.72 billion in Q2 2023, surpassing Zacks’ estimates by 7%.

Image Source: Zacks Investment Research

Total quarterly sales of $5.82 billion surged by 58% YoY, surpassing estimates by 9%. Notably, Micron achieved an unexpected profit of $0.42 per share compared to the expected adjusted loss of -$0.27 per share. Despite the prevailing high inflation, Micron’s Q2 EPS climbed from an adjusted loss of -$1.91 per share in the previous year. Impressively, Micron has exceeded earnings projections in all of its past four quarterly reports.

Image Source: Zacks Investment Research

Astounding Revenue Projections

In the upcoming fiscal third quarter, Micron anticipates sales of $6.6 billion, surpassing the current Zacks Consensus of $5.89 billion for the current quarter. According to Zacks’ estimates, Micron’s total sales are predicted to soar by 46% in fiscal 2024 to $22.67 billion, compared to $15.54 billion in the past year. Even more remarkable, FY25 sales are forecasted to skyrocket by an additional 48% to reach $33.57 billion.

Image Source: Zacks Investment Research

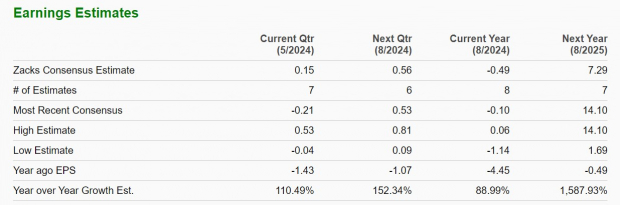

Earnings Projections

Micron is anticipated to report an adjusted loss of -$0.49 per share in FY24, a significant improvement from the -$4.45 per share in 2023. With a promising outlook, Micron’s yearly earnings are expected to surge to $7.29 per share in FY25, positioning the company well on its path to profitable returns.

Image Source: Zacks Investment Research

Moreover, over the last month, earnings estimates for FY24 have remained stable, but forecasts for FY25 EPS have risen by 4%.

Image Source: Zacks Investment Research

Key Insights

Micron’s pivotal role in driving artificial intelligence forward has been somewhat overlooked, with the company currently sporting a Zacks Rank #2 (Buy). As earning projections continue to rise for Micron’s FY24 and FY25, many analysts are beginning to adjust their price targets following the impressive Q2 performance of this memory chip titan.

5 Stocks Set to Double

Handpicked by a Zacks expert as the top stock poised to double or more in 2024, each recommendation has seen remarkable growth in the past: +143.0%, +175.9%, +498.3%, and +673.0%.

This report shines a light on stocks flying under Wall Street’s radar, offering a unique opportunity to get in early on potential successes.

Today, Discover These 5 Potential Winners >>

Seeking the latest insights from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days today. Click to access this free report

Micron Technology, Inc. (MU) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The viewpoints expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.