Micron Technology, Inc. (MU) reported fiscal first-quarter 2026 revenues of $13.64 billion, marking a 56.8% year-over-year increase, surpassing analyst expectations of $12.88 billion. The company’s profitability saw a significant boost, with non-GAAP net income reaching $5.48 billion, or $4.78 per diluted share, exceeding forecasts of $3.94.

Micron’s core cloud memory business reported revenue of $5.28 billion, up 99.5%, driven by soaring demand for high-bandwidth memory (HBM) chips amid an AI infrastructure boom. Looking ahead, Micron expects fiscal second-quarter 2026 revenues between $18.3 billion and $19.1 billion, with diluted earnings per share projected between $8.22 and $8.62.

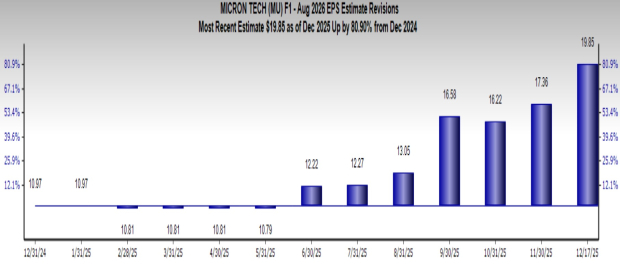

The demand for Micron’s HBM products, which are crucial for high-performance applications, positions the company strongly within the AI market. Micron is expected to achieve a 23.9% annual earnings growth rate, with a Zacks Consensus Estimate for EPS at $19.85, reflecting an 80.9% year-over-year increase.