Price Target Revision

Analysts have boosted Microsoft’s (NasdaqGS:MSFT) one-year price target to an impressive 465.38 / share, marking a robust increase of 9.54% from the earlier projection dated January 16, 2024.

The range of latest targets spans from a modest 301.08 to an ambitious 573.76 / share. The average price target shows a substantial surge of 13.05% from the most recent closing price of 411.65 / share.

Dividend Declaration

Microsoft declared a healthy regular quarterly dividend of $0.75 per share ($3.00 annualized) on November 28, 2023. Shareholders of record as of February 15, 2024, will enjoy the payout on March 14, 2024.

At the current share price of $411.65 / share, the stock’s dividend yield stands at a commendable 0.73%. Reflecting on a five-year span with weekly samplings, the dividend yield has ranged from a low of 0.72% to a high of 1.65%, with an average of 1.04%. Notably, the current yield is 1.31 standard deviations below the historical average.

Fund Sentiment and Shareholder Actions

An impressive 7442 funds or institutions have reported positions in Microsoft, representing a 4.10% increase in the last quarter. The average portfolio weight dedicated to MSFT across all funds stands at 3.77%, marking a substantial rise of 3.13%.

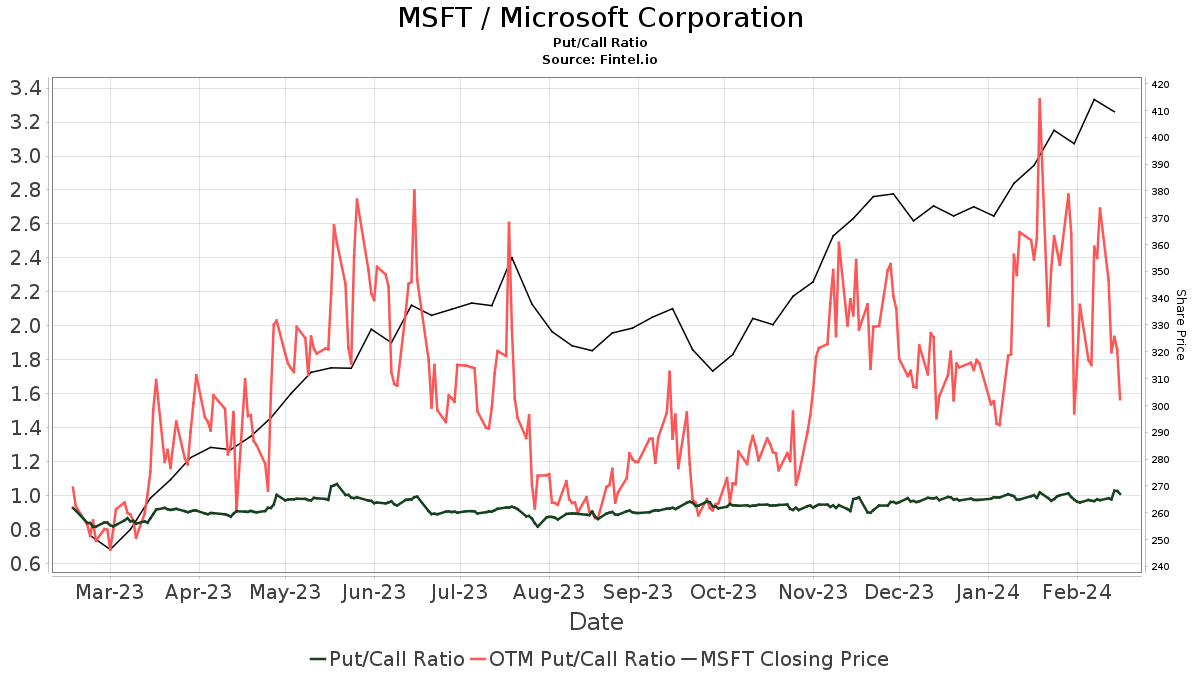

The total shares owned by institutions have escalated by 1.10% in the last three months, reaching 6,027,228K shares. The put/call ratio of MSFT stands at 0.95, signaling a bullish outlook.

Shareholder Movements

Vanguard Total Stock Market Index Fund Investor Shares holding 231,355K shares decreased its portfolio allocation in MSFT by 3.98% in the last quarter.

Vanguard 500 Index Fund Investor Shares, with 178,542K shares, increased its ownership by 0.84% over the same period.

Geode Capital Management, with 154,271K shares, heightened its portfolio allocation by 6.66% recently.

Price T Rowe Associates cut its stake by 5.20% but raised its portfolio allocation by 3.80% over the last quarter.

Jpmorgan Chase, having 124,051K shares, increased its ownership by 10.34% in recent months.

Microsoft’s Vision

Microsoft is on a mission to enable digital transformation in the era of an intelligent cloud and an intelligent edge. Their goal is to empower every individual and organization worldwide to achieve more.

About Fintel

Fintel stands as a comprehensive investment research platform catering to a wide audience, ranging from individual investors and traders to financial advisors and small hedge funds.

Their extensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and more. Furthermore, their exclusive stock picks are backed by advanced, backtested quantitative models for enhanced profitability.

For more information, you can visit Fintel’s website here.

This article was originally published on Fintel.

Please note that the views and opinions expressed in this article belong to the author and do not necessarily align with those of Nasdaq, Inc.