“`html

Microsoft Corporation (NASDAQ: MSFT) is currently down nearly 9% from its 52-week high of $365.00, reached on October 29, despite a strong earnings report indicating growth across all sectors, including its Azure cloud services business. CEO Satya Nadella noted the company faces margin pressures due to significant capital expenditures (CapEx) for AI infrastructure, prompting a need to “rapidly rethink the new economics of AI.”

In a competitive landscape, major players like Microsoft and Meta Platforms Inc. (NASDAQ: META) are investing billions to develop AI infrastructure. Concerns have arisen regarding whether the projected demand for AI solutions will materialize and be profitable. Analysts are weighing the risk of an AI bubble, with investors currently reassessing the value of Microsoft shares in light of potential delayed returns from AI spending.

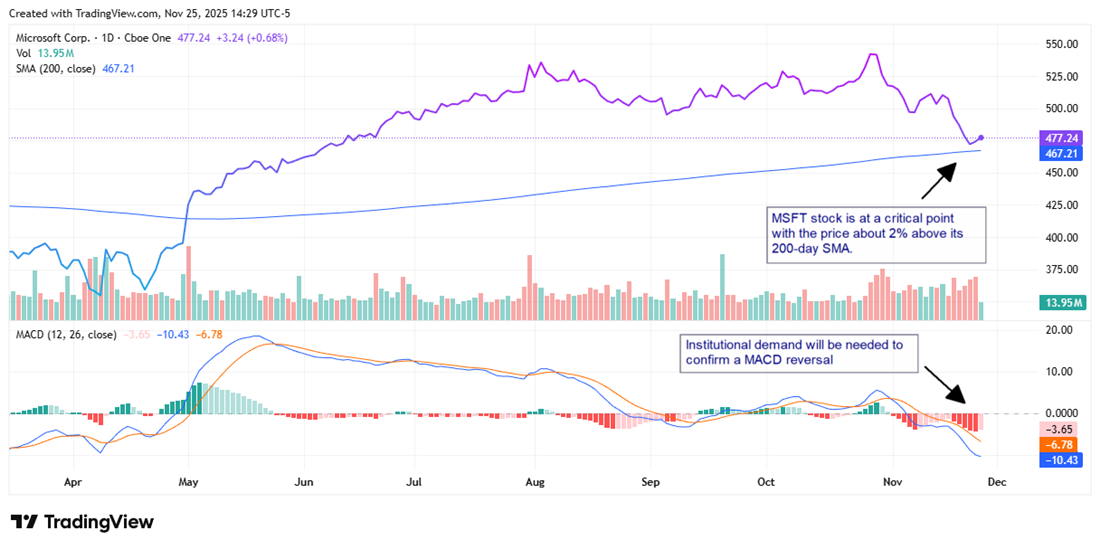

Microsoft is exploring innovative models for AI integration, including creating an “AI factory” and pay-as-you-go options for AI agents in its Microsoft 365 platform. The stock is nearing a critical support level, approximately 2% from its 200-day simple moving average, as institutional investors may look to capitalize on potential value in the tech sector as year-end approaches.

“`