Microsoft vs. Oracle: A Comparative Analysis of Cloud Leaders

In the fiercely competitive cloud computing landscape, Microsoft (MSFT) and Oracle (ORCL) have emerged as strong contenders vying for market dominance. Both have rich histories in enterprise software: Microsoft transitioned from its Windows operating system roots to become a cloud giant, while Oracle established itself through database technologies.

As businesses worldwide accelerate their digital transformation, these companies continue to position themselves as crucial partners in this evolution. With artificial intelligence (AI) as the driving force behind the next wave of cloud innovation, a close comparison between these two technology powerhouses offers essential insights for investors looking to enter this high-growth sector.

Let’s explore and compare the fundamentals of both stocks to determine which may present a better investment opportunity at this time.

Why Consider MSFT Stock

Microsoft’s cloud success is noteworthy, as its Microsoft Cloud surpassed $40 billion in quarterly revenue for the first time during the second quarter of fiscal 2025, marking a robust 21% year-over-year growth. This performance reflects the company’s effective transition from traditional software to cloud services. The tech giant from Redmond has positioned itself as a frontrunner in the AI movement, boasting an AI business with an annual revenue run rate of $13 billion—a staggering 175% growth year over year.

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenue stands at $275.39 billion, indicating a projected 12.35% increase from the previous year. Additionally, the earnings estimate is set at $13.04 per share, suggesting a year-over-year rise of 10.51%. However, this figure has slightly decreased by 0.2% over the past month.

Microsoft’s strength is rooted in its extensive cloud ecosystem, which includes infrastructure (Azure), platform services, and software-as-a-service offerings. Azure, the company’s cloud infrastructure division, is a primary growth driver, and data from IT market research firm Synergy reveals that Microsoft Azure, along with Amazon Web Services and Google Cloud, accounted for 68% of the global cloud market in the fourth quarter of 2024.

Strategic partnerships, such as those with OpenAI, running exclusively on Azure, provide Microsoft customers access to top-tier AI models, contributing to its share gain.

Microsoft has consistently led innovation, introducing several breakthroughs. In March 2025, it unveiled significant innovations like Azure AI Foundry’s Responses API and the Microsoft Dragon Copilot for healthcare. Its commitment to data sovereignty, demonstrated by the completion of the EU Data Boundary for Microsoft Cloud, enhances its attractiveness to European clients.

The company shows strong financial health, with operating income rising 17% in its latest quarter. The expansion of Copilot+ experiences across major silicon platforms marks a critical shift for increasing market penetration of its AI capabilities. Furthermore, MSFT’s Security Copilot now incorporates AI agents, tackling rising cybersecurity threats, with the company identifying over 30 billion phishing emails and 7,000 password attacks every second in 2024.

Image Source: Zacks Investment Research

Examining ORCL Stock

Oracle has made significant advancements in its cloud infrastructure with Oracle Cloud Infrastructure (“OCI”), recently reporting a 51% revenue increase. The company has celebrated the activation of its 101st cloud region, which may position it to outpace competitors in the number of regions offered. Its Gen 2 cloud architecture provides customers with flexibility, which Oracle considers a competitive edge.

However, Oracle’s overall performance raises some red flags. In its third-quarter fiscal 2025 earnings report, the company fell short of both earnings and revenue targets, reporting earnings per share (EPS) of $1.47, missing analyst estimates by $0.02, and total revenue of $14.13 billion, which was $259 million below expectations. While Oracle boasts impressive cloud revenue growth, its overall revenue growth of just 6.4% year over year is notably slower compared to Microsoft’s double-digit advances.

The earnings consensus for fiscal 2025 is now set at $6.04 per share, down slightly over the past month.

More concerning are the recent security issues that could severely affect Oracle’s market standing and investor confidence. Following two confirmed security breaches within a month, doubts have emerged about the company’s ability to safeguard sensitive client information. After initially denying that its cloud storage had been compromised, Oracle later admitted to customers that their data had been accessed in what it referred to as a legacy environment. This acknowledgment followed another incident in which hackers infiltrated Oracle servers and copied patient data in an alleged attempt to extort several U.S. healthcare providers.

While Oracle has formed partnerships with hyperscalers like Microsoft—especially through the Oracle Database@Azure service—execution challenges persist as it seeks to close the gap in the competitive cloud sector. Although Oracle reports that its remaining performance obligations have reached $130 billion, a 63% rise year over year, the company struggles with capacity constraints as demand continues to significantly exceed supply.

Image Source: Zacks Investment Research

Valuation and Price Performance Comparison

From a valuation standpoint, MSFT commands a premium over Oracle, trading at a forward 12-month price-to-sales (P/S) ratio of 9.43 compared to Oracle’s 5.83. This premium reflects investor confidence in Microsoft’s superior growth prospects and established market position.

P/S Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

Both companies have experienced fluctuations in their stock prices as they navigate this rapidly changing environment…

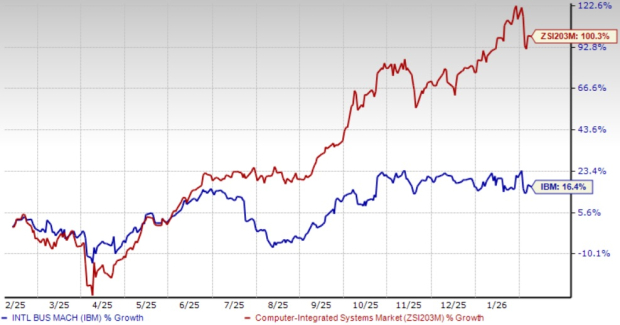

Microsoft Outperforms Oracle Amid Market Challenges in Cloud Sector

Despite a projected sector decline in 2025, Microsoft has demonstrated notable resilience. Its shares have decreased by 8.6% year to date, a performance markedly better than Oracle’s 19.6% drop and the Zacks Computer & Technology sector’s average decline of 13.9% during the same period.

Year-to-Date Stock Performance

Image Source: Zacks Investment Research

The tech sector is encountering challenges fueled by concerns over AI spending and tariff measures from the previous administration. Microsoft has recently stated it is “slowing or pausing” certain AI data center initiatives, yet it remains firmly committed to its long-term investments in AI. On the other hand, Oracle is grappling with more severe obstacles due to component delays, which have hampered its cloud capacity expansion. These issues could restrict Oracle’s ability to capture market share during this critical growth period.

Conclusion

Both Microsoft and Oracle provide access to the expanding cloud computing and AI sectors, yet Microsoft appears to be the more appealing investment choice. With higher growth rates, a more extensive cloud ecosystem, and robust financial performance, Microsoft is positioned to better leverage these technological advancements. Additionally, Oracle faces setbacks from recent security breaches, capacity limitations, and weaker financial metrics, raising concerns about its competitiveness in the fast-changing cloud landscape. Investors interested in long-term growth in cloud computing may find Microsoft, holding a Zacks Rank #3 (Hold), to be a more attractive option compared to Oracle’s Zacks Rank #4 (Sell), highlighting a stronger upside potential in this AI-driven market.

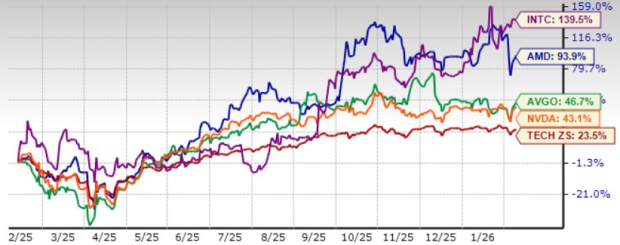

Zacks Identifies #1 Semiconductor Stock

Although only 1/9,000th of NVIDIA in size, which has surged more than +800% since our recommendation, this new leading chip stock holds significant growth potential. While NVIDIA continues to thrive, this emerging stock displays promising prospects.

With solid earnings growth and a growing customer base, it is well-positioned to meet the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is forecasted to leap from $452 billion in 2021 to $803 billion by 2028.

Get the latest insights from Zacks Investment Research by downloading the 7 Best Stocks for the Next 30 Days. Click here for your free report.

Discover Microsoft Corporation (MSFT): Free Stock Analysis report

Explore Oracle Corporation (ORCL): Free Stock Analysis report

This article was originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.