“`html

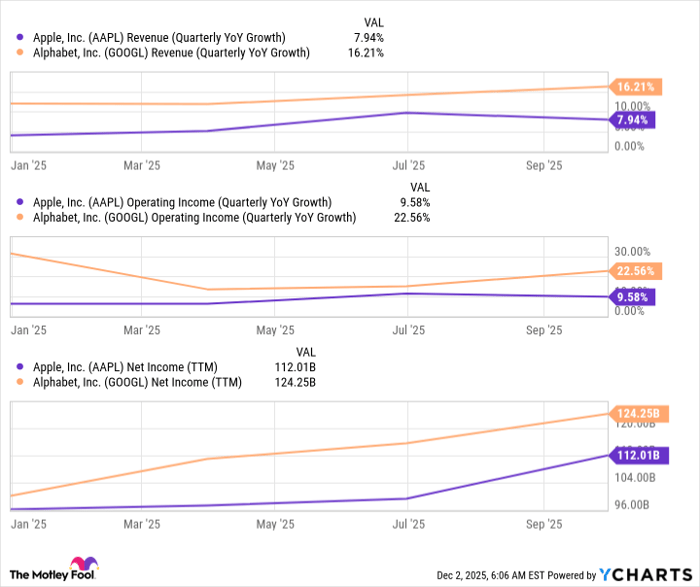

Image source: The Motley Fool.

MicroStrategy (NASDAQ: MSTR)

Q3 2024 Earnings Call

Oct 30, 2024, 5:00 p.m. ET

MicroStrategy’s Q3 2024 Earnings Call: Bitcoin Strategy Takes Center Stage

Agenda Overview

- Prepared Remarks

- Questions and Answers

- Call Participants

Introduction by Shirish Jajodia

Shirish Jajodia — MicroStrategy Incorporated

Hello, everyone, and good evening. I’m Shirish Jajodia, the vice president of investor relations and treasury at MicroStrategy. I’ll be moderating the earnings webinar for the third quarter of 2024.

Before we begin, I will share the safe harbor statement. Some statements during this call may predict future expectations and may differ from actual results. These differences could arise from important factors, including those mentioned in our latest SEC filings. We do not plan to update these forward-looking statements, which are valid only as of today. Additionally, we will discuss certain non-GAAP financial measures.

Strategic Opportunities Ahead

Ever think you missed out on investing in successful stocks? Our expert analysts have occasionally issued a “Double Down” stock recommendation for companies they believe will soon rise significantly. Historically, these recommendations have paid off:

- Amazon: Investing $1,000 in 2010 would now yield $21,492!*

- Apple: Investing $1,000 in 2008 would now be worth $44,204!*

- Netflix: Investing $1,000 in 2004 would have grown to $409,559!*

We currently have “Double Down” alerts for three promising companies, and this opportunity could be fleeting.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 28, 2024

Reconciliations between GAAP and non-GAAP results are available in our earnings release and presentation, which were released today on our website, microstrategy.com. As we begin, questions can be submitted using the Q&A feature at the bottom of your screen. Please include your name and company when asking questions.

Now, let me outline our agenda for this call. First, we will discuss our business operations for Q3 2024. Next, Andrew Kang will go over our financial results for this quarter. Finally, Michael Saylor will share insights on our strategy and the latest trends in the bitcoin market.

I will now turn the floor over to Phong Le, our president and CEO of MicroStrategy.

Insights from Phong Q. Le

Phong Q. Le — President and Chief Executive Officer

Thank you, Shirish. Welcome everyone to today’s webinar. Let’s start with key bitcoin highlights for Q3 2024.

MicroStrategy continues to be the largest corporate holder of bitcoin globally, currently possessing 252,220 bitcoins valued at $18 billion as of yesterday. Since June 30, 2024, we acquired an additional 25,889 bitcoin at a total cost of $1.6 billion, averaging $60,839 each. This year, bitcoin’s price has grown significantly, especially following the approval of bitcoin exchange-traded products (ETPs), which attracted more institutional investment. This trend signifies bitcoin’s maturation as a recognized asset class.

On the capital markets side, we’ve made strides in supporting our bitcoin strategy. In September, we netted $1.1 billion through our equity offering program, and raised $1.01 billion from issuing our 2028 convertible notes. We used part of that to fully redeem our $500 million senior secured notes due in 2028, which means our bitcoin assets are now entirely unencumbered.

Andrew will delve deeper into our financial and bitcoin acquisition activities this quarter. Our goal is to acquire more bitcoin through capital markets, a strategy that positions us primarily as a bitcoin treasury company. We uniquely refer to ourselves as BTC — the world’s first and largest bitcoin treasury company.

This means we are a publicly traded company holding bitcoin as our primary reserve asset. We strategically accumulate bitcoin using proceeds from equity and debt financing as well as operational cash flows, advocating for its role as digital capital. Our treasury strategy allows investors different levels of exposure to bitcoin through various securities, while offering innovative AI-powered enterprise analytics software.

We believe our operational excellence, bitcoin reserve strategy, and focus on technological innovation place us as leaders in both the digital asset and enterprise analytics sectors, creating distinct long-term value opportunities. Michael will further detail our vision as a bitcoin treasury company. Since launching our strategy, we’ve employed three main ways to acquire more bitcoin: through debt financing, equity issuances, and cash flow from operations.

Our total principal amount of convertible debt stands at $4.3 billion with an attractive annual rate of 0.8%. We have issued $4.3 billion in equity, aiming to add value for our shareholders and utilized $836 million of cash from our balance sheet since August 2020. These capital strategies allow us to leverage intelligently and grow our bitcoin holdings, which we think benefits our shareholders.

Looking ahead, those familiar with The Hitchhiker’s Guide to the Galaxy by Douglas Adams will recall that the answer to the ultimate question of life requires patience and exploration. In that spirit, we will continue to strive for clarity and progress in our financial journey.

“““html

MicroStrategy Unveils $42 Billion Capital Market Strategy Focused on Bitcoin Acquisition

MicroStrategy’s latest initiative highlights a plan to raise significant capital over the next three years, targeting bitcoin investments as their primary goal.

Capital Raising Goals and Innovative Financial Strategy

MicroStrategy has firmly positioned itself in the bitcoin market, currently owning approximately 1.2% of the maximum 21 million bitcoins that can ever exist. This announcement marks a pivotal moment for the company as it reveals plans to raise $42 billion through its capital market strategy, comprising $21 billion in equity capital and $21 billion in fixed income capital primarily for bitcoin acquisitions.

The firm is launching a historic $21 billion ATM equity program, which represents the largest such program ever recorded in capital markets. The fixed income capital could encompass various financial instruments, including convertible debt and preferred equity. Detailed targets for capital-raising include:

- 2025: $10 billion total, including $5 billion each in equity and fixed income

- 2026: $14 billion, anticipating $7 billion from both equity and fixed income

- 2027: $18 billion, with projected contributions of $9 billion each

This strategic approach aims to balance equity and debt management, supporting the company’s ambitious bitcoin investment plans.

Optimizing Revenue Streams Through Cloud Offering

Aside from its bitcoin ambitions, MicroStrategy is already a prominent player in the business intelligence sector, recognized as the largest independent, publicly traded company in this field. In Q3 2024, the company shifted its focus towards cloud-based offerings, with non-GAAP subscription billings soaring by 93% year over year to $32.4 million, marking its fourth consecutive quarter of double-digit growth.

The rise in cloud revenues has resulted from both existing customers transitioning to the cloud and attracting new clients. The company noted strong renewal rates and high demand for its cloud platform, launching MicroStrategy 1 on platforms such as Azure, AWS, and Google Cloud. This expansion into cloud services is vital as MicroStrategy adapts to the evolving technological landscape, despite facing expectations of decreasing product license revenues.

Financial Performance Overview and Strategic Insights

Turning to financial performance, MicroStrategy reported $116 million in software business revenues for Q3, representing a 10% decline compared to the prior year due to the ongoing transition from on-premise to cloud solutions. Although product license revenues fell, subscription service revenues increased by 32% year over year, now comprising approximately 24% of total revenues. With this growth, subscription services revenues have exceeded product license revenues, indicating a shift in the company’s revenue model.

Operating costs reflected a manufacturing shift, as the cost of revenues rose to $34 million, driven primarily by increased cloud hosting expenses. Furthermore, software operating expenses climbed by 7%, owed partially to higher stock-based compensation and custodial fees related to bitcoin holdings. These evolving dynamics showcase MicroStrategy’s dual focus on expansive cloud services while continuing to enhance its bitcoin strategy.

As MicroStrategy prepares for the upcoming quarters, investors and stakeholders are closely watching how these financial strategies and innovations will unfold in the competitive landscape.

Now, I will hand over the conversation to Andrew to discuss our financials for the first quarter in further detail.

Andrew Kang — Senior Executive Vice President, Chief Financial Officer

Thank you, Phong. First, I’ll take a few minutes to expand upon the software business results.

“““html

MicroStrategy’s Strategic Financial Moves Propel Bitcoin Holdings and Reduce Costs

During the quarter, we incurred nearly $14 million in severance costs linked to workforce optimization. This decision aims to save around $30 million in salary expenses next year. The company’s strategy, applied across all departments, focuses on adjusting staffing levels and enhancing organizational structures to foster a disciplined performance culture. Consequently, we anticipate a 13% reduction in annual staffing costs for the upcoming year, which will positively influence our profit margins in 2025. In terms of financial returns, the non-GAAP operating income from our software business stood at $0.9 million.

Additionally, corporate and other operating expenses for this quarter reached $414 million, primarily attributable to bitcoin impairments in Q3. Now, let’s delve into our bitcoin strategy. We experienced another productive quarter, growing our Bitcoin reserves by acquiring 25,889 bitcoins for approximately $1.6 billion, averaging $60,839 per bitcoin. By the end of September, our total bitcoin holdings reached 252,200 coins, purchased for a cumulative cost of $9.9 billion, averaging $39,000 per bitcoin.

I’ll expand on our treasury operations shortly, but a major outcome of redeeming our 2028 senior secured notes in Q3 was the liberation of all bitcoin held by MicroStrategy. Now, all of our bitcoin assets are unencumbered, including those at both the MacroStrategy and MicroStrategy entities. Since August 2020, we have consistently added bitcoin to our treasury balance sheet every quarter. Encouragingly, numerous public and private companies are beginning to adopt bitcoin as a strategic asset to enhance shareholder value.

As of September 30, 2024, the market value of our bitcoin holdings stood at $16 billion, against an acquisition cost of $9.9 billion, giving an average price of $39,000 per coin. In stark contrast, the carrying value of our bitcoin was recorded at $6.9 billion at the end of the quarter. Beginning in Q1 2025, we will implement the new FASB Fair Accounting Rule, which mandates fair value treatment for bitcoin holdings. Consequently, on January 1, 2025, we will report a cumulative adjustment to retained earnings, reflecting the considerable gap between the market and carrying values of our bitcoin assets.

Regarding our treasury operations, we achieved significant milestones in capital markets execution this quarter. In September, we successfully completed a new convertible note financing, building on previous financings from March and June. We issued $1.01 billion in convertible senior notes, due September 2028, with an annual interest rate of 0.625%. The conversion premium is set at 40%, translating to a conversion price of about $183 per share. The net proceeds from this new issuance were directed towards redeeming our 2028 senior secured notes and acquiring more bitcoin.

We fully redeemed the $500 million 2028 senior secured notes at a redemption price of 103.063% of the principal, plus accrued interest. Early redemption provided several advantages, including the removal of restrictive covenants, complete unencumbering of our bitcoin holdings, and an annual interest expense saving of $24 million over the next four years, totaling around $100 million in future savings.

In Q3, we also issued $1.1 billion in common equity through our at-the-market (ATM) program, with about $891 million remaining available for issuance. As part of our new 21-21 three-year strategic capital plan, we submitted a prospectus for a $21 billion ATM program, which is set to become the largest ATM program in U.S. history across all sectors.

Our current capital structure includes $4.3 billion in unsecured convertible debt with a blended interest rate of 0.81%. This debt is staggered over several years, maturing between February 2027 and June 2032, with all currently trading above par. In 2024, we have become the top issuer of convertible notes in the U.S. by total principal raised.

Intelligent leverage is pivotal to our strategic capital allocation. When applied thoughtfully, it allows us to enhance our bitcoin treasury at a favorable cost and achieve Bitcoin yield. I’ll elaborate on these concepts in the upcoming slides. The nearest debt maturity is more than two years away, with our overall debt spread through 2032 and an average maturity of approximately five years. We continuously monitor the capital markets and explore liability management opportunities, aiming to optimize our debt and interest expenses while considering future financing options.

This year, our total bitcoin holdings increased by 33.3%, while our diluted shares outstanding rose by only 13.2%. To clarify, assumed diluted shares outstanding means we account for all convertible notes, stock options, and performance stocks, regardless of their conversion or vesting conditions. As a bitcoin treasury company, we plan to continue accessing equity markets and exploring various financing options to manage our leverage effectively.

Our proactive approach in utilizing equity, debt, and excess cash to acquire bitcoin has consistently generated value for our shareholders, creating a foundation to execute our 21-21 capital plan. We aim to increase our bitcoin holdings at a faster rate than our share issuance, a strategy we have consistently implemented successfully. To measure our progress, we have introduced a new key performance indicator (KPI) called BTC yield, which reflects changes in the ratio of total Bitcoin holdings to diluted shares outstanding over time.

The BTC yield helps us evaluate our performance in achieving our strategic goals and making sound capital allocation decisions. Achieving a positive BTC yield means increasing our Bitcoin holdings faster than the growth of diluted shares outstanding. Although BTC yield is not a traditional financial yield, it offers a metric for assessing our strategic accomplishments.

Moreover, we anticipate refinancing all indebtedness, including convertible notes into common stock at respective conversion prices, without factoring in other liabilities. This model allows us to maintain an informed approach as we continue our journey in asset acquisition and financial stewardship.

“`

MicroStrategy’s Bitcoin Yield Strategy: A Game Changer in Financial Metrics

MicroStrategy has vastly improved its approach to Bitcoin investment, defining its capital efficiency through BTC yield metrics. This focus on capital utilization helps shareholders gauge Bitcoin accumulation over time. Below, we illustrate the historical performance of this key performance indicator (KPI).

Tracking BTC Yield Over Recent Years

The company recorded an annual BTC yield of 43.3% in 2021, which decreased to 1.8% in 2022. However, there was a rebound in 2023 with a yield of 7.3%, including quarterly yields of 8.1% in Q1, 3.7% in Q2, and 5.1% in Q3. Management leverages these BTC yields to guide investment decisions, differentiating itself from spot Bitcoin exchange-traded products (ETPs) and other investment vehicles that typically incur management fees, resulting in a negative yield.

Future BTC Yield Goals and Strategies

In line with the company’s 21-21 plan, MicroStrategy has a solid strategy to boost Bitcoin holdings and maintain a positive annual BTC yield. So far in 2024, the year-to-date BTC yield stands at 17.8%, outperforming the previous year’s yield. The company has set new yearly yield targets for 2024–2027, revising them upward from 4%-8% to a more ambitious 6%-10% annually.

Strategizing Capital Growth

To achieve these goals, MicroStrategy intends to responsibly utilize leverage while managing risks. This approach will include generating capital through equity and reallocating surplus cash from the software business. The firm plans to explore various financing options, including creative capital market transactions, to implement this strategy prudently. The commitment to maintaining disciplined capital-raising practices aligns with the goal of achieving BTC yield targets consistently over three years.

Pioneering Bitcoin Adoption

MicroStrategy takes pride in leading institutional Bitcoin adoption. The firm anticipates that consistent BTC yield will serve as a vital benchmark for investors in the future. With a robust track record, the company has navigated through the volatile Bitcoin market, establishing credibility to add value for shareholders. Michael J. Saylor will now share insights on the company’s direction.

Michael J. Saylor — Chair, President, and Chief Executive Officer

“Thank you, Andrew. I appreciate everyone joining the call today. We’re eager to define our strategy and vision for the next three years in greater detail. Let’s acknowledge that we are still in the early adoption phase of Bitcoin as a digital asset.

Recent Milestones in Bitcoin Adoption

The year 2024 marks notable accomplishments, including the launch of Bitcoin ETFs and increasing political endorsement for Bitcoin. These milestones signal a shift towards the normalization of Bitcoin in the financial markets. The anticipation surrounding options trading for ETFs indicates a positive trend, with banks beginning to engage in Bitcoin custody. Furthermore, a growing number of companies are adopting fair value accounting, reflecting Bitcoin’s relevance today.

Comparative Performance Insights

Bitcoin’s current status as a $1.4 trillion asset class indicates its potential to draw capital from various sectors, including equities, real estate, and gold. Since MicroStrategy implemented its Bitcoin strategy in August 2020, traditional bonds have declined by 5% per year. The S&P 500, conversely, has risen by 14%, marking the traditional benchmark for asset performance.

In evaluating asset performance, it’s crucial to note that Bitcoin has consistently outperformed other significant assets, including traditional stocks. MicroStrategy’s investment strategy has allowed it to achieve an impressive 1,989% increase in equity value, far surpassing the performance of comparable companies.

Final Thoughts on Digital Capital

As we continue to navigate the growing landscape of digital assets, it is clear that Bitcoin represents a compelling investment class. MicroStrategy has established itself as a strong contender in this investment space by demonstrating prudent capital management and a deep understanding of Bitcoin’s potential.

We appreciate your continued support as we move forward with our vision for the future. Thank you.

MicroStrategy’s Strategy: Embracing Volatility with Bitcoin

Understanding the Approach to Capital and Performance

MicroStrategy holds a unique position in the financial landscape, effectively diversifying its portfolio with assets like bonds and bitcoin. In the search for a strong treasury reserve asset, MicroStrategy argues that there aren’t many viable options, and the data supports this assertion. With all eyes on big tech stocks, MicroStrategy’s results stand out, especially in its integration of digital capital.

Nvidia’s Digital Edge and MicroStrategy’s Playbook

Nvidia has excelled by adopting digital intelligence, which sets it apart from other tech giants. The challenge, however, is replicating Nvidia’s success. MicroStrategy, on the other hand, has made its approach accessible and can serve as a model for others. The company emphasizes a significant shift in capital markets, identifying bitcoin as a revolutionary form of digital capital poised to gain traction among businesses.

The Performance Gap in the S&P 500

A staggering 1% of companies within the S&P 500 account for most gains, leaving the remaining 99% struggling to keep up. This disparity is underscored by the performance of bitcoin, which consistently outperforms the high-flying Magnificent Seven—a group of seven major tech companies. MicroStrategy firmly believes that a well-structured bitcoin strategy can help firms enhance their standing in this competitive environment.

Volatility: A Double-Edged Sword

Interestingly, MicroStrategy not only ranks as the top performer in the S&P 500 but also boasts the highest volatility. Traditional finance views volatility as negative, recommending stability over risk. However, the company’s approach challenges this perspective. Investing predominantly in U.S. Treasuries results in minimal volatility, yielding lower returns than the S&P index—about 10% less. In contrast, embracing bitcoin’s volatility—markedly higher—can lead to superior performance and a healthier capital base.

The Implications for Public Companies

Conventional strategies often diminish a company’s viability by dialling down risk. As companies shy away from volatility, they inadvertently put their appeal to potential investors at risk. They become ‘sick’ companies without realizing it. The goal for any public firm should hinge on engaging the capital markets effectively, offering an interest-worthy security for trading and speculation.

MicroStrategy’s Standing Among Peers

When analyzing trading volume and options open interest, MicroStrategy frequently appears among the top 10 stocks in the S&P 500. Despite its relatively small size compared to retail giants like Walmart and Coca-Cola, high volatility boosts its trading activity, fostering interest in its options.

The Case for Embracing Volatility

Volatility essentially serves as an engine’s revolutions per minute (RPM)—higher volatility equates to more power. By leveraging significant capital, MicroStrategy aims to transform that volatility into growth rather than letting it remain stagnant, which is often the case in traditional approaches to financial resources. Instead of viewing capital as toxic, the company’s method positions it to attract and amass more resources, enriching shareholders in the process.

Achieving Capital Attraction Through Strategy

MicroStrategy’s philosophy hinges on two main conditions for positive capital polarization: investing in initiatives that consistently outperform the S&P 500 and ensuring quick execution of those investments. By integrating bitcoin as a treasury reserve asset, the firm is setting a precedent—balancing capital markets with progressive investment strategies, ultimately creating a sustainable model for engaging capital efficiently.

MicroStrategy’s approach highlights a significant shift in how companies can utilize innovative assets like bitcoin to enhance their operational and market performance, creating a framework for future financial strategies.

MicroStrategy Leads the Charge in Bitcoin-Backed Bonds

How MSTR Stock Outshines the S&P 500 and What Investors Should Know

MicroStrategy is capitalizing on market volatility by strategically investing in Bitcoin and offering enticing returns to shareholders. This unique approach sets them apart from traditional investment vehicles, allowing for a combination of protection and performance.

Now, let’s dive into some key points you may not be aware of regarding MicroStrategy’s stock, MSTR. Investors often note that MSTR has outperformed the S&P 500 index. Additionally, options for MSTR are now more actively traded compared to other stocks within the S&P 500, a testament to its appeal and liquidity in the market.

MicroStrategy has successfully issued six convertible bonds, leading to significant returns for investors. If you had purchased any of these bonds, your returns would have been 224%, 86%, 67%, 90%, 41%, or 54% respectively. This remarkable performance highlights their influence in the convertible bond market.

One of the key advantages of MicroStrategy’s approach is the way it blends Bitcoin investment with downside protection. While traditional investments like ETFs offer straightforward risk and reward scenarios—100% upside and 100% downside—MicroStrategy’s bonds present a compelling alternative. They enable investors to capture Bitcoin’s upside while safeguarding against price declines.

Looking at performance, since the issuance of the bonds, Bitcoin has achieved a 47% return. In contrast, MicroStrategy’s bonds have clocked a staggering 90%. This illustrates the greater allure of the company’s investment strategy over just buying Bitcoin directly.

Investors often question MicroStrategy’s unique position in the market. The company stands out as one of the principal issuers of Bitcoin-backed bonds globally, supported by a robust $18 billion in permanent Bitcoin reserves, which bolsters their credibility when issuing these financial instruments. The combination of a vast equity market capitalization and permanent capital allows for a secure investment framework that is hard to replicate.

To understand the challenges competitors would face in mimicking this success, consider the scenario of selling $300 billion in cash or treasury bills to issue convertible bonds. While buyers would be assured of their investment return, it’s unlikely they could achieve Bitcoin’s performance, let alone outperform traditional Treasury yields.

MicroStrategy is not merely a holding company; it operates much like a treasury for Bitcoin, tapping into a global economy that is increasingly influenced by technology and inflation. This connection allows them to navigate the highly volatile crypto market while offering considerable liquidity to investors.

Fundamentally, MicroStrategy acquires and holds Bitcoin, managing custody for many investors who may lack the capability or desire to do so themselves. They routinely adjust their leverage and manage various securities to optimize returns for both themselves and their shareholders.

At present, MicroStrategy holds 252,220 Bitcoin, a significant asset that serves as permanent capital. This stability underpins the company’s creditworthiness, allowing them to confidently explore new securities opportunities.

Market demand remains high for securities tied to Bitcoin, notably spot Bitcoin ETFs, which could expand worldwide compliance and custody frameworks. As such, MicroStrategy aims to continue blending both equity and fixed-income strategies to leverage its Bitcoin reserves effectively.

In conclusion, MicroStrategy’s strategic position and innovative financial products present a unique opportunity in the fluctuating landscape of cryptocurrency investment. Their bonds not only offer returns that surpass traditional Bitcoin investment but also provide a layer of security that many investors desire.

MicroStrategy’s Unique Financial Strategy: Leveraging Bitcoin for Growth

In the evolving world of finance, MicroStrategy has carved out a distinctive path. Their strategy combines exposure to Bitcoin with traditional financial instruments, aiming to leverage this cryptocurrency’s potential while managing risk.

The Structure of Their Investment Funds

MicroStrategy operates somewhat like institutional banks, taking overnight deposits and limiting their activities. For example, if a client deposits $1 million, the fund may invest it in Bitcoin. However, when the client requests their capital back, they simply return the original amount. This structure means that investors can access a Bitcoin-like experience without the long-term commitment usually required in traditional markets.

Bitcoin-Like Volatility

The performance of MicroStrategy’s offerings closely parallels the volatility of Bitcoin itself. If Bitcoin experiences a 50% volatility (vol), so too does MicroStrategy’s investment product. This approach provides a straightforward opportunity for investors interested in gaining exposure to the digital currency within a more conventional security wrapper.

MicroStrategy’s Convertible Bonds

MicroStrategy also provides another investment vehicle via convertible bonds, which are less risky than holding Bitcoin directly. For instance, if Bitcoin trades at $70,000 when they issue these bonds, their convertible bonds offer a way for investors to gain long exposure to Bitcoin’s potential price increases while retaining the option to convert their bonds into MicroStrategy’s stock. If Bitcoin were to drop by 50%, bondholders still have the ability to redeem their bonds at par.

The Balancing Act of Risk and Reward

While they do not have a definitive track record for predicting future performance against Bitcoin, history shows that MicroStrategy’s convertible bonds have, at times, outperformed Bitcoin. Selling the bonds at a premium allows bondholders to benefit from Bitcoin’s price fluctuations while managing risk more effectively. Over time, this strategy has seen MicroStrategy shares outperform Bitcoin significantly, with historical leverage reaching nearly two times the equity.

Liquidity and Trading Opportunities

MicroStrategy’s offerings, such as MSTX and MSTU, have rapidly attracted over $1 billion in capital due to their high volatility and potential for returns. As Bitcoin investors seek trading leverage, options based on MicroStrategy’s equity provide attractive opportunities. The company has maintained a clear strategy of holding Bitcoin long-term, affirming its commitment to this digital asset and establishing trust among traders.

Future Plans: Fixed Income Products

Looking ahead, MicroStrategy aims to raise $21 billion through its fixed income strategy. This may include convertible bonds or preferred stocks designed to offer more stability and downside protection while still providing partial exposure to Bitcoin’s performance. Many investors may prefer a more conservative approach, perhaps desiring a fixed coupon with a clearer sense of creditworthiness.

Understanding Market Demand

In a world where income and appreciation are primary objectives for investors, MicroStrategy’s treasury operations play a vital role in assessing market needs. By evaluating which financial instruments could appeal to their stakeholders, they strive to create valuable offerings based on digital commodities like Bitcoin. The battle for market share may resemble historical precedents in other industries, such as the oil industry, where companies learned to refine and manage their resources effectively to maximize value.

In summary, MicroStrategy’s approach effectively combines Bitcoin’s potential with financial instruments that can satisfy varying risk appetites, showcasing a model that could shape future investment strategies in the digital currency space.

The Transformative Role of Oil Refining and Bitcoin in Financial Markets

The oil industry represents a massive $10 trillion asset class, making it a significant player in the global financial landscape. This market relies heavily on commodities, particularly crude oil, which companies extract and refine into various products.

The Crucial Functions of Oil Companies

Oil companies operate by locating, extracting, and processing oil. They possess both proven and unproven reserves. However, valuing an oil company solely based on these reserves would be insufficient. Instead, understanding their refining operations is essential.

Refining oil transforms it into various consumer products, categorized by their level of refinement. Jet fuel is the most refined product, crucial for air travel. Next in line are gasoline, diesel, and liquefied petroleum gas (LPG), followed by heating oil and fuel oil. Finally, there is asphalt, used for paving roads. It’s clear that crude oil in its raw form cannot serve as a direct substitute for these products, underscoring the importance of refining processes.

The Value Added in Oil Refining

Oil companies create value by refining crude oil and managing its distribution. The worth of a company lies in its combined operations of extraction and refining. This mirrors how digital assets, like Bitcoin securities, are valued. Companies managing Bitcoin portfolios offer investors a refined format of this digital commodity, catering to those seeking exposure to Bitcoin without direct ownership of the asset itself.

In finance, a term called the “BTC spread” reflects the difference between the market value of a Bitcoin-backed security and the Bitcoin it contains. For example, if this spread is 50%, a company could sell $100 million of a security backed by $50 million worth of Bitcoin, resulting in a $50 million gain—a significant advantage for shareholders.

MicroStrategy’s Evolving Strategy

MicroStrategy began with a simple intent to hold Bitcoin to maintain capital. Over time, it became more strategic, recognizing the digital transformation occurring across global capital markets. The firm has positioned itself to issue securities that provide a balance of Bitcoin performance and volatility, appealing to a diverse range of investors.

Potential investors include those interested in the tech-savvy nature of digital assets as well as those looking for stability. For instance, options traders engage with the securities indirectly while still benefiting from related market activities. As a pioneer in the Bitcoin space, MicroStrategy stands to gain from offering innovative products like their convertible bonds.

Rising Interest in Digital Assets

The growing demand for MicroStrategy’s equity reflects broader market enthusiasm for securities backed by digital assets. Investors seeking diversification away from traditional risk assets are increasingly intrigued by the potential returns of Bitcoin-backed securities. Offering instruments with downside protection and potential for capital gains attracts many, including hedge funds and institutional investors.

Others may favor a mixed investment approach, seeking to combine equities with fixed income. MicroStrategy has developed this type of offering, capturing the interest of traditional investors who value security coupled with potential upside from Bitcoin investments.

Looking Ahead

In the conventional market, interest in products such as mortgage-backed securities and corporate debts remains steady. MicroStrategy recently issued a $500 million note with a 6.25% interest rate, demonstrating confidence in its financial standing. This offering was secured by a substantial array of assets, allowing the firm to avoid encumbering its Bitcoin reserves, consequently preserving liquidity and flexibility.

MicroStrategy is paving the way for innovation in financial markets and is becoming the leading issuer of convertible bonds, signaling a shift in how digital assets can reinvigorate both traditional and emerging investment avenues. By broadening the markets accessible to investors and enhancing liquidity in financial products, MicroStrategy aims to create innovative investment opportunities that benefit shareholders and the broader market alike.

MicroStrategy’s Bold BTC Strategy: A Closer Look

MicroStrategy plans to increase its bitcoin yield targets significantly while addressing investor concerns about its capital-raising capabilities.

The company is optimistic about the future after announcing a new three-year plan, even though CEO Michael Saylor noted, “I don’t have a crystal ball.” Key opportunities lie in exploring the combination of capital markets, bitcoin, and shareholder interests.

Excitement Around BTC Yield Increases

MicroStrategy has elevated its BTC yield targets, now aiming for a range from 6% to 10%, up from previous estimates between 4% and 8%. This shift highlights the company’s commitment to optimizing its investment strategy.

Addressing Misunderstandings and Concerns

Despite concerns about the company’s ability to secure more capital through equity and debt, Saylor reassured investors that worries are misplaced. The success of their 21-21 plan indicates that MicroStrategy can continue issuing fixed income instruments without any hindrances from EBITDA or cash flow covenants. Furthermore, the recent filing of a $21 billion At-the-Market (ATM) equity program dispels doubts about their expansion capabilities.

The Value of Bitcoin Growth

Central to MicroStrategy’s argument is its identity as a growth company driven by bitcoin, which is projected to increase in value at about 50% annually. In growth company valuations, a 50% growth rate can lead to multiples between 60 to 100 times earnings. With bitcoin’s historical performance in mind, Saylor anticipates continued growth for the cryptocurrency over the next several years.

Measuring BTC Operations’ Worth

The real metric to consider is the operation’s value rather than its balance sheet. If bitcoin maintains its growth at 30% to 50%, it could support a valuation based on those multiples. For example, achieving a 10% yield could equate to a 300% to 500% premium to net asset value, indicating an enterprise value growing potentially between $80 billion to $100 billion.

Understanding BTC Gains

MicroStrategy’s 5% BTC yield for the quarter translates to an acquisition of 12,500 bitcoin for shareholders. Annualized, this suggests a substantial $3.6 billion BTC gain. When applying a growth multiple for valuation, the total value could reach between $108 billion to $180 billion, further emphasizing the potential profitability of the bitcoin treasury operations.

Strategic Position in the Market

MicroStrategy is firmly positioned as a leader in bitcoin treasury operations, set apart by a robust $18 billion in permanent capital. The company views its strategy as akin to constructing a digital infrastructure rapidly, enabling unique investment opportunities.

A Unique ATM Equity Offering

Saylor highlighted that MicroStrategy’s ATM equity offering stands out in the market because the capital raised will directly fund bitcoin purchases rather than dilutive investments. Most other companies would struggle to justify such a capital increase without risking poor returns on less favorable assets.

This innovative approach underscores a major distinction between MicroStrategy and conventional firms. Essentially, they are creating value by turning their capital into bitcoin quickly, potentially setting a standard in the industry.

MicroStrategy Reinforces Commitment to Bitcoin: A Clear Path for Shareholders

MicroStrategy’s approach towards Bitcoin has been characterized by transparency, speed, and a focused strategy that aims to benefit shareholders significantly. The company is not merely observing the market; it actively engages with its investors to ensure everyone is aligned in their goals.

Shareholder Transparency and Efficiency

At MicroStrategy, shareholders are provided with complete transparency regarding credit and risks. The firm has implemented a straightforward metric that indicates whether their strategies are creating value or diluting stock. This focus on efficiency allows investors to assess if the Bitcoin spread is enhancing their interests. The balance sheet is designed to prioritize capital, enabling high-speed investment cycles that take only five days compared to typical five-year timelines.

Investor Concerns Addressed

According to company leadership, investors have expressed more concern about continuity rather than dilution. Their primary inquiry remains whether MicroStrategy will maintain its aggressive acquisition strategy, with many expressing a preference that the company does not pause its impressive progress. This dialogue signifies a positive relationship built on shared objectives and mutual benefits.

Core Principles Driving Bitcoin Strategy

MicroStrategy’s strategic direction is grounded in five key principles that prioritize long-term growth and shareholder partnerships:

- Commitment to Bitcoin: The firm plans to buy and hold Bitcoin indefinitely. Investors seeking diversification should look elsewhere, as the focus remains solely on Bitcoin.

- Priority for Shareholders: MicroStrategy pledges to prioritize MSTR common stock shareholders, fostering long-term value creation.

- Respect for All Investors: The management treats all investors with respect and aims to build trust through consistent and transparent communication.

- Outperforming Bitcoin: MicroStrategy strives for its stock to outperform Bitcoin, aiming for a performance of at least 1.5 times BTC’s returns.

- Continual Bitcoin Acquisition: The firm is committed to acquiring Bitcoin while pursuing positive BTC yield, ensuring every investment decision is assessed for its potential benefit to shareholders.

Emphasizing Transparency in Decision-Making

MicroStrategy’s leadership takes pride in its transparent methodologies, revealing calculations and decision processes tied to Bitcoin yields. This principle reinforces accountability, letting shareholders see how strategies align with promised outcomes. The focus on clear communication ensures investors understand the rationale behind choices made regarding Bitcoin acquisitions and other investments.

It’s this unwavering dedication to both Bitcoin and shareholders that highlights MicroStrategy’s unique position in the market, establishing a route of trust and clarity that many firms may aspire to mimic.

MicroStrategy’s Vision for Bitcoin Treasury and Financial Growth

MicroStrategy’s approach to expanding its Bitcoin operations includes various strategies to enhance BTC yield while navigating the complexities of the financial market. The company recognizes that certain deals may yield better returns than others, and their commitment to maximizing Bitcoin yield remains strong.

Rapid yet Responsible Growth in a Volatile Market

The company aims to grow quickly while ensuring responsibility in its strategies. Market conditions can fluctuate significantly, sometimes daily, and MicroStrategy is committed to remaining responsive to these changes. Their focus is on pursuing growth opportunities that make sense within the current market dynamics.

Innovative Fixed Income Securities for Bitcoin Investors

MicroStrategy plans to issue unique fixed income securities backed by Bitcoin, including convertible bonds. This approach allows investors to gain Bitcoin exposure with reduced volatility and risk, which could resonate with various investor groups, from crypto enthusiasts to traditional investors. The company’s primary focus remains on maintaining a robust Bitcoin treasury reserve as it seeks creative fixed income solutions.

Pursuing Leverage to Enhance Shareholder Value

Fixed income investments are critical for leveraging potential returns on MSTR common stock. When executed effectively, these investments can generate returns of 1.5 to 2 times that of Bitcoin, benefiting shareholders and the broader market alike.

A Commitment to Transparency and Pristine Balance Sheets

Maintaining a transparent and straightforward financial structure is essential for MicroStrategy. The company is mindful of the risks associated with investing in Bitcoin, particularly its volatility. Therefore, they aim to provide a clear understanding of their assets and liabilities to instill confidence in investors.

Streamlining Financial Operations

MicroStrategy is eager to simplify its balance sheet by eliminating unnecessary complications. The recent repayment of a $500 million senior bond aims to reduce complications that could hinder its operations. By removing restrictive elements from their financial structure, the company strives to enhance its ability to serve shareholders and engage effectively in capital markets.

Advocating for Bitcoin as a Treasury Reserve Asset

The final principle focuses on promoting Bitcoin’s adoption as a treasury reserve asset across various entities, including public and private companies. MicroStrategy believes that Bitcoin can address the common issue of unhealthy balance sheets faced by many organizations. The company advocates for the substantial benefits of adopting Bitcoin, highlighting its potential to revitalize stocks and options.

Questions from the Audience

Shirish Jajodia — MicroStrategy Incorporated

Following an engaging session, Jajodia shifted to audience questions, expressing appreciation for the participation of over 4,000 viewers.

Andrew Kang — Senior Executive Vice President, Chief Financial Officer

The first inquiry revolved around managing interest expenses with ongoing fixed income notes issuance. Kang explained the company’s recent redemption of high-cost debt, freeing up around $30 million annually. Looking forward, MicroStrategy intends to raise significant capital to aid in covering interest obligations.

Michael J. Saylor — Chair, President, and Chief Executive Officer

When asked about concerns surrounding control status due to capital raising efforts, Saylor addressed that he currently holds slightly over 50% of the voting stock. He expressed confidence in retaining the company’s partnership with shareholders and clarified that outcomes would align with shareholder interests.

MicroStrategy’s Leadership Discusses Future Strategies and Stakeholder Influence

Greater Stake for Shareholders

During a recent earnings call, leaders at MicroStrategy outlined plans for increased shareholder participation. Michael Saylor, the Chair and CEO, noted, “I don’t think there’s any reason our company can’t function effectively with me holding 48% of the voting shares instead of 52%.” This adjustment aligns with their principle of ensuring that stakeholders have a voice in the company’s direction.

Company’s Direction Maintained

Saylor expressed confidence in his ability to guide the company, stating that he will still maintain enough voting shares to keep MicroStrategy on course. He also mentioned, “I’m not at all concerned about issuing additional equity,” indicating a strategic openness to growth opportunities.

Optimism About Bitcoin’s Role

Phong Q. Le, the President and CEO, thanked the thousands of attendees for their participation in the lengthy call. He emphasized the company’s positive outlook on Bitcoin and the significant value it can create for shareholders. “We believe that our bitcoin treasury strategy combined with our enterprise software model will spur growth and value,” he explained, hinting at a dual approach to expanding the company’s influence in the market.

Looking Ahead

Le extended best wishes for the upcoming quarter and holidays, expressing hope to reconnect in 12 weeks. Both he and Saylor conveyed enthusiasm about MicroStrategy’s potential trajectory as they plan for future developments.

Call Participants:

Shirish Jajodia — MicroStrategy Incorporated

Phong Q. Le — President and Chief Executive Officer

Andrew Kang — Senior Executive Vice President, Chief Financial Officer

Michael J. Saylor — Chair, President, and Chief Executive Officer

Michael Saylor — Chair, President, and Chief Executive Officer

Phong Le — President and Chief Executive Officer

More MSTR analysis

All earnings call transcripts

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company’s SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.