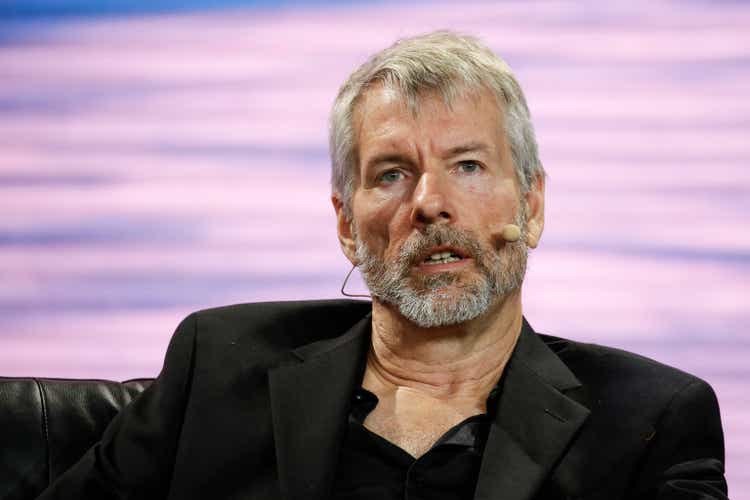

Image: Marco Bello/Getty Images News

MicroStrategy, listed on NASDAQ as MSTR, astounded analysts with its Q4 earnings report released on Tuesday. The business intelligence company, co-founded by Michael Saylor, reaped the benefits of a substantial surge in the price of bitcoin (BTC-USD) during the quarter.

President and CEO Phong Le emphasized, “We achieved double-digit subscription services revenue growth for both the fourth quarter and full year, demonstrating our ongoing commitment to transition our business to the cloud.”

During Q4, the company recorded adjusted earnings per share (EPS) of $5.62, significantly exceeding the average analyst estimate of $0.21. This marked a noteworthy turnaround from the negative figures of -$8.98 in Q3 and -$20.51 in the year-ago quarter.

Despite missing the consensus revenue estimate of $132.2 million, MicroStrategy still generated a substantial $124.5 million in revenue for the quarter. This figure, although lower than the $129.5 million in Q3, showed relatively resilient performance in a challenging market environment.

In after-hours trading, MSTR experienced a slight decline of 1.2%, reflecting the mixed market reaction to the earnings report.

Operating expenses totaled $139.0 million, indicating an increase from the previous quarter but a decrease from $299.5 million in Q4 2022. The company also reported narrower digital asset impairment losses, reflecting a positive trend in its management of Bitcoin-related holdings.

As of December 31, 2023, the carrying value of MicroStrategy’s bitcoin stash, amounting to approximately 189,150 BTC, stood at $3.626 billion. This value reflected cumulative impairment losses of $2.269 billion since acquisition and an average carrying amount per bitcoin of approximately $19,172.

The earnings report was accompanied by an announcement of a conference call scheduled for 5:00 p.m. ET to provide additional insights and context to investors.

In addition, the company’s non-GAAP EPS of $5.62 and revenue of $124.5 million missed analyst expectations by $7.68 million, revealing some variances from the consensus estimates.