“`html

Market Overview

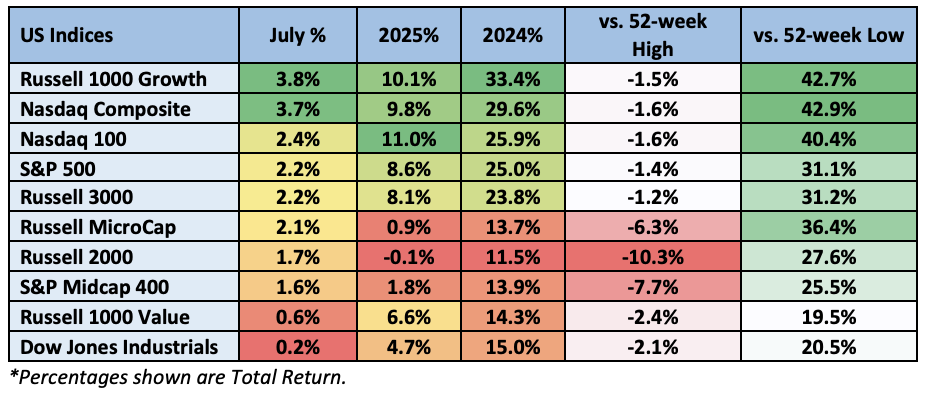

In July, the S&P 500 and Nasdaq reached new record highs, buoyed by easing trade tensions, a strong earnings season, and positive macroeconomic conditions. The S&P 500 was up for three consecutive months, while the Nasdaq experienced a four-month uptrend. June payrolls exceeded predictions, with a decrease in the unemployment rate to 4.1%, but job growth is expected to slow in July. Despite concerns about rising interest rates, the market remained optimistic.

Digital Asset Legislation

During “Crypto Week” from July 14-18, key digital asset legislation was signed into law. The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act) was passed by the House with a 308-122 vote and signed on July 18. It establishes a regulatory framework for stablecoins, requiring them to be fully backed and mandating disclosures. Additionally, the Digital Asset Market Clarity (CLARITY Act) passed with a vote of 294-134, aiming to resolve jurisdictional issues between the SEC and CFTC.

Earnings Performance

About 60% of S&P 500 companies reported Q2 earnings, with 83% exceeding EPS estimates, above the 10-year average of 75%. The aggregate earnings surprise stands at +7.3%, while positive EPS surprises have been led by the Energy sector at +12.7%. Overall earnings growth is at 9.5%, with notable lagging sectors including Consumer Discretionary and Health Care. The earnings season underscored solid sales growth, averaging 6.6% across sectors.

“`