Spike in Options Trading Volumes for Steel Dynamics, Liquidity Services, and Lyft

Key Highlights from Today’s Market Activity

Today, notable options trading activity was observed in three companies listed on the Russell 3000 index. Steel Dynamics Inc. (Symbol: STLD) experienced a total of 5,991 contracts traded, equating to approximately 599,100 underlying shares. This figure represents around 44.3% of STLD’s average daily trading volume of 1.4 million shares over the past month. A particularly high volume was noted for the $145 strike call option set to expire on January 17, 2025, with 2,190 contracts trading today, corresponding to about 219,000 underlying shares of STLD. The chart below illustrates STLD’s trailing twelve-month trading history, with the $145 strike option highlighted in orange:

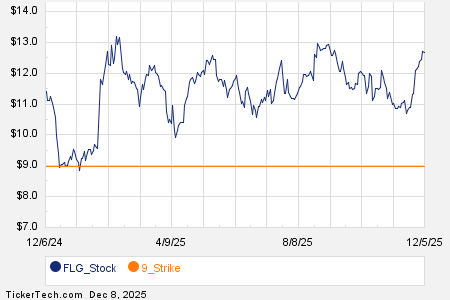

Liquidity Services Inc. (Symbol: LQDT) is also showing noteworthy options trading, with a total of 602 contracts traded, representing about 60,200 underlying shares. This accounts for approximately 42.9% of LQDT’s average daily trading volume over the last month, which was 140,430 shares. The $35 strike call option expiring on December 20, 2024, led the activity with 308 contracts trading today, equivalent to roughly 30,800 underlying shares. Below is a chart displaying LQDT’s trailing twelve-month trading history, with the $35 strike highlighted.

Meanwhile, Lyft Inc. (Symbol: LYFT) reported significantly higher options activity today, with 58,490 contracts traded, equating to approximately 5.8 million underlying shares. This figure amounts to about 42.6% of LYFT’s average daily trading volume of 13.7 million over the past month. A peak in volume was noted for the $16 strike put option expiring on February 21, 2025, with 7,008 contracts trading today, representing around 700,800 underlying shares of LYFT. The chart below displays LYFT’s trading history for the past twelve months, with the $16 strike highlighted in orange:

For more information on available option expirations for STLD, LQDT, or LYFT, visit StockOptionsChannel.com.

![]() Today’s Most Active Call & Put Options of the S&P 500 »

Today’s Most Active Call & Put Options of the S&P 500 »

Additional Resources:

- ITHX Historical Stock Prices

- SVC Options Chain

- CTS Average Annual Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.