Technology Sector Struggles as Market Experiences Afternoon Decline

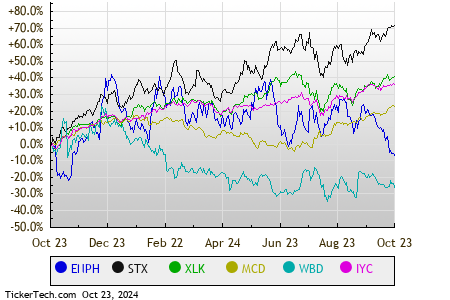

On Wednesday afternoon, the Technology & Communications sector is lagging behind, showing a decline of 1.3%. Within this sector, Enphase Energy Inc. (Symbol: ENPH) and Seagate Technology Holdings PLC (Symbol: STX) are notably underperforming, with losses of 15.2% and 7.0%, respectively. The Technology Select Sector SPDR ETF (Symbol: XLK), which tracks this sector, has dipped 2.0% today but remains up 18.55% year-to-date. It’s worth noting that Enphase is down 40.82% year-to-date, while Seagate has gained 25.15% in the same period. Together, ENPH and STX represent about 0.4% of XLK’s holdings.

Services Sector Joins the Downturn

Following Technology, the Services sector also faces losses, down 0.9%. Among the significant players in this sector, McDonald’s Corp (Symbol: MCD) and Warner Bros Discovery Inc (Symbol: WBD) have recorded losses of 5.0% and 3.2%, respectively. The iShares U.S. Consumer Services ETF (IYC), which closely tracks Services stocks, is down 1.3% today but up 14.72% year-to-date. While McDonald’s is up 2.50% year-to-date, Warner Bros has seen a significant drop of 35.98% in the same time frame. Collectively, MCD and WBD constitute approximately 1125.3% of IYC’s underlying holdings.

For a clearer picture, here’s a relative stock price performance chart comparing these stocks and ETFs over the last twelve months. Each symbol is displayed in a distinct color, as indicated in the legend below:

S&P 500 Sector Performance Overview

Below is a snapshot of how the various sectors in the S&P 500 are performing during afternoon trading today. Notably, only one sector is showing an increase, while seven sectors are experiencing declines.

| Sector | % Change |

|---|---|

| Utilities | +0.7% |

| Financial | -0.0% |

| Consumer Products | -0.4% |

| Materials | -0.4% |

| Healthcare | -0.6% |

| Industrial | -0.8% |

| Energy | -0.8% |

| Services | -0.9% |

| Technology & Communications | -1.3% |

![]() 25 Dividend Giants Widely Held By ETFs »

25 Dividend Giants Widely Held By ETFs »

Also see:

• Funds Holding RINF

• JPM Technical Analysis

• LFLY market cap history

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.