Mikron Holding (SWX:MIKN) has seen a notable surge in its stock price target, which now stands at 19.89 per share. This uptick marks an 8.33% increase from the previous estimate of 18.36 on January 16, 2024.

Analysts have revised this average one-year price target based on a composite of several individual targets. Recent assessments span from a low of 17.17 to a high of 23.10 per share. The average price target reflects an 18.04% rise from the latest closing price of 16.85 per share.

Mikron Holding Boasts a Steady 2.37% Dividend Yield

Currently, Mikron Holding offers a consistent dividend yield of 2.37% at its current stock price.

Furthermore, the company maintains a dividend payout ratio of 0.24. This ratio indicates the proportion of a company’s earnings paid out as dividends. A payout ratio of 1.0 signifies 100% of the earnings distributed as dividends. Ratios exceeding 1.0 suggest the company is tapping into reserves to support dividends, which can be concerning. Typically, firms with limited growth opportunities distribute most of their earnings as dividends, leading to payout ratios between 0.5 and 1.0. Conversely, companies with growth potential tend to reinvest earnings, resulting in ratios from zero to 0.5.

Insights into Fund Sentiments and Shareholder Activities

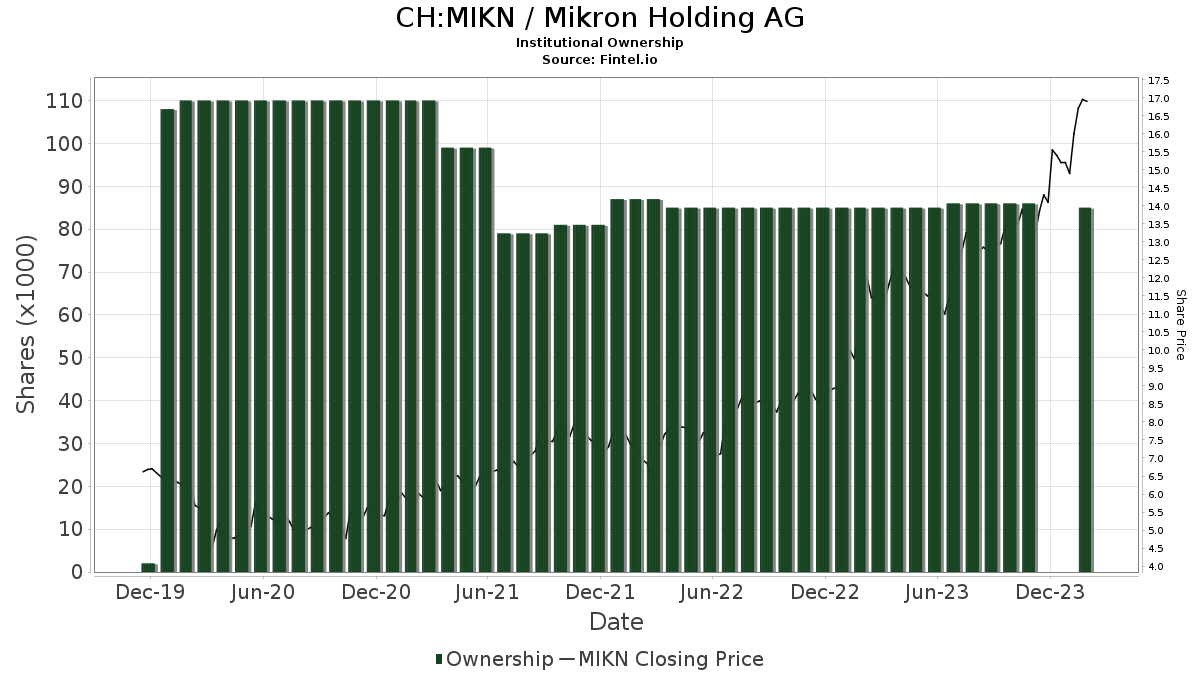

Institutional data reveals that 14 funds or institutions hold positions in Mikron Holding, a figure unchanged from the last quarter. The collective portfolio weight for MIKN across all funds has risen by 24.65% to 0.00%. Institutional ownership saw a decrease of 1.00% over the past three months, with total institutional shares numbering 85K.

Delving deeper, DFIEX – International Core Equity Portfolio – Institutional Class holds 53K shares, representing a 0.32% stake in the company. In their previous filing, the institution disclosed ownership of 56K shares, indicating a 4.47% reduction. They boosted their allocation to MIKN by 11.06% during the last quarter.

Additionally, Dfa Investment Trust Co – The Continental Small Company Series owns 9K shares, equal to a 0.05% stake, with no changes reported in the recent quarter.

Other significant shareholders include DFA INVESTMENT DIMENSIONS GROUP INC, which holds various shares representing ownership ranging from 0.02% to 0.03%, with no changes recorded in the previous quarter for any of these holdings.

Fintel serves as a comprehensive investment research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Their data encompasses a global scope, including fundamental insights, analyst perspectives, ownership particulars, fund sentiments, options sentiment, insider trading, options flow, unusual trades, among other critical details. Moreover, their exclusive stock recommendations rely on sophisticated, backtested quantitative models to boost investment returns.

Curious to know more?

This story was first featured on Fintel.

Disclaimer: The opinions expressed in this article are those of the author and may not necessarily align with those of Nasdaq, Inc.