Investing Insights: Why Meta Platforms and Alphabet Present Strong Value

The Nasdaq-100 includes 100 of the largest non-financial companies on the Nasdaq Stock exchange. Over the past decade, it has delivered a remarkable 343% return, significantly surpassing the S&P 500 due to its heavy concentration of top tech stocks.

However, the Nasdaq-100 has also shown greater volatility in uncertain times. Currently, it is in correction territory after a 13% drop from its recent peak. The decline has been primarily led by the “Magnificent Seven”—a group of seven companies known for consistently outperforming the broader market despite facing occasional downturns. Here’s a look at the recent market caps of these giants:

- Apple: $3.1 trillion.

- Microsoft: $2.8 trillion.

- Nvidia: $2.8 trillion.

- Amazon : $2.1 trillion.

- Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG): $2 trillion.

- Meta Platforms (NASDAQ: META): $1.5 trillion.

- Tesla: $770 billion.

In this article, we’ll explore two companies from this elite group due to their appealing valuations and potential to leverage emerging trends like artificial intelligence (AI). Both Meta Platforms and Alphabet have seen their stocks fall by 19% and 21%, respectively, from record highs. Here’s why investors might consider seizing the opportunity to buy on the dip.

1. The Case for Meta Platforms

Meta Platforms operates popular social networks such as Facebook, Instagram, and WhatsApp, connecting over 3.3 billion users daily. The company earns revenue through ad sales, which means increased engagement directly benefits its bottom line.

Attracting new users has become more challenging since nearly half of the global population uses its platforms. Thus, Meta is shifting its focus to enhancing user engagement. By utilizing AI in its recommendation algorithms, the company aims to better understand user preferences and keep them online longer.

According to CEO Mark Zuckerberg, this strategy resulted in an 8% year-over-year increase in the time users spent on Facebook and a 6% increase for Instagram by late 2024.

Furthermore, engaging users through new products is another strategy. Last year, Meta introduced an AI chatbot named Meta AI, available across all its platforms. Users can interact with it on various topics or include it in group chats to settle discussions and explore activities. By the end of the last year, Meta AI boasted over 700 million monthly active users, making it one of the world’s most utilized chatbots.

This chatbot is backed by the Llama family of large language models (LLMs), which are open-source and have seen over 600 million downloads. This ecosystem enables a collaborative developer community to address issues and enhance model capabilities quickly. Zuckerberg anticipates that the forthcoming Llama 4 version could outperform leading closed-source models, potentially establishing Meta AI as one of the industry’s top performers.

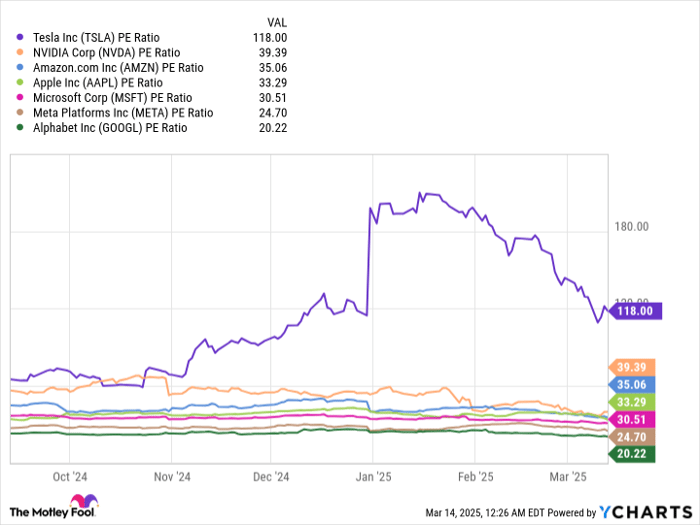

In the past year, Meta reported record revenue of $164.5 billion, a 22% increase compared to 2023. Its earnings per share (EPS) surged by 60% to $23.86, positioning its stock at a price-to-earnings (P/E) ratio of 24.7, making it the second-cheapest among the Magnificent Seven, after Alphabet.

PE Ratio data by YCharts.

Given Meta’s robust financial performance and its innovative AI initiatives, the recent 19% decline in its stock price creates an appealing long-term buying opportunity.

Image source: Alphabet.

2. The Case for Alphabet

Alphabet, the parent company of Google, YouTube, and Waymo, generates over half of its revenue through Google, primarily its search engine advertising. However, AI chatbots have emerged as competitors, challenging Google’s dominance in search by offering users convenient access to information.

To combat this threat, Alphabet is heavily investing in AI to maintain Google’s 90% market share. They launched AI Overviews last year, enhancing search results by providing AI-generated responses that blend text, images, and links to third-party content. This format saves users time by reducing the need to sift through multiple web pages.

Alphabet asserts that Overviews monetize effectively, similar to traditional search formats. The company reports that users are engaging with searches more frequently due to Overviews, allowing them to refine their inquiries for better results.

Powered by Alphabet’s Gemini family of LLMs, Overviews aim to enhance both Google Search and a standalone chatbot, also named Gemini. Additionally, Gemini serves as an AI assistant embedded in Google Workspace applications like Gmail, Docs, and Sheets.

Google Cloud also stands out as the fastest-growing segment of Alphabet’s business, rapidly becoming an essential platform for businesses. With these developments, Alphabet is positioned to leverage its robust market presence and technological innovations.

Google Cloud’s AI Growth Contrasts with Alphabet’s Stock Decline

Businesses and developers are increasingly turning to state-of-the-art data center computing capacity to support their AI initiatives. Google Cloud’s AI developer platform, Vertex AI, has driven significant growth, with customers utilizing eight times more computing capacity for AI training and inference in the final quarter of 2024 compared to 18 months prior. Last year, Vertex AI saw a fivefold increase in its customer base.

Despite this momentum in Google’s AI ventures, Alphabet’s stock has recently dropped by 21%. Typically, when a company’s fundamentals are improving, a declining stock price may indicate a potential buying opportunity for investors.

Financial Performance and Stock Valuation

In 2024, Alphabet reported a 38% increase in earnings per share (EPS), reaching a record $8.04. This performance results in a price-to-earnings (P/E) ratio of 20.2. Alphabet stands out as the most affordable among the Magnificent Seven stocks and is notably 32% cheaper than the Nasdaq-100 index, which trades at a P/E of 29.8. Although the company faces regulatory challenges, the recent decline in its stock price could present a promising long-term investment opportunity.

Investment Considerations for Meta Platforms

If you’re contemplating an investment in Meta Platforms, it’s worth noting the recommendations from the Motley Fool Stock Advisor analyst team. They recently identified their top ten stock picks, and Meta did not make the list. Investing in these selected stocks could yield significant returns in the years to come.

For perspective, consider that if you had invested $1,000 in Nvidia when it was first recommended on April 15, 2005, you would have seen that grow to $745,726 today.

Stock Advisor offers a straightforward approach for investors, including portfolio-building advice, regular analyst updates, and two new stock picks each month. Since 2002, Stock Advisor has generated returns more than four times that of the S&P 500.

*Stock Advisor returns as of March 14, 2025

Randi Zuckerberg, former Facebook market development director and sister to CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. John Mackey, ex-CEO of Whole Foods Market, is also a board member. Additionally, Suzanne Frey, an executive at Alphabet, sits on the board. Anthony Di Pizio holds no positions in any of the referenced stocks. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. They also recommend the following options: long January 2026 $395 calls and short January 2026 $405 calls on Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.