Maui Land & Pineapple Company Sees Revenue Growth Amid Wider Losses

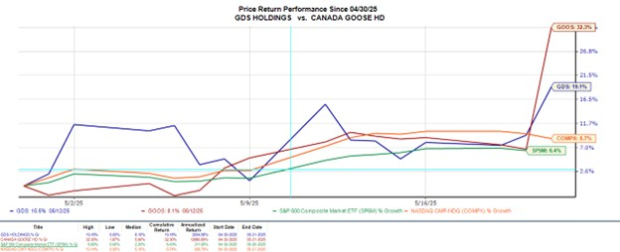

Shares of Maui Land & Pineapple Company, Inc. (MLP) have declined by 1.1% since the announcement of its 2024 financial results. This contrasts with the S&P 500 index, which has experienced a 0.4% gain during the same period. Over the past month, the stock has dropped 11%, in comparison to a 2.7% decline for the S&P 500.

Revenue Growth Despite Net Loss

For the year ending December 31, 2024, Maui Land & Pineapple reported operating revenues of $11.57 million, indicating a 25% increase from $9.29 million in 2023. This growth was primarily fueled by the company’s land development, sales, leasing, and resort amenities. Notably, land development and sales, which contributed no revenue in 2023, generated $520,000 in 2024 due to participation in a state-funded relief housing project. Lease revenues rose 14% year-over-year to $9.62 million, while resort amenities saw an impressive 72% increase, totaling $1.42 million.

Despite this revenue growth, Maui Land & Pineapple reported a GAAP net loss of $7.39 million, or 38 cents per share, for 2024, worsening from a loss of $3.08 million (15 cents per share) in 2023. The wider net loss was mainly due to increased non-cash stock compensation expenses and rising operating costs. However, adjusted EBITDA reported a positive shift, reaching $492,000 compared to a loss of $662,000 from the previous year.

Price Trends and Earnings Surprises

Maui Land & Pineapple Company, Inc. price-consensus-eps-surprise-chart | Maui Land & Pineapple Company, Inc. Quote

Performance of Business Segments

Land Development and Sales: Revenues from land development and sales amounted to $520,000, bolstered by $320,000 from the Honokeana Homes Relief Housing Project, along with $200,000 from selling a non-strategic parcel. This marks a significant change from 2023, when no revenue was recorded in this segment.

Leasing: Revenues in leasing grew to $9.62 million for 2024, increasing from $8.46 million in 2023. This rise was attributed to higher occupancy rates, updated lease agreements, and approximately 1,000 acres of previously dormant agricultural land being newly leased for farming purposes.

Resort Amenities: Revenues from resort amenities rose by $596,000, totaling $1.42 million in 2024, mainly due to the acquisition of new memberships and enhanced collection of dues.

Insights from Management

CEO Race Randle noted the company’s noteworthy progress in utilizing its land assets to meet community demands. He pointed out advancements in housing and agricultural projects, strengthened by an expanded leadership team with a mission-oriented approach. Randle highlighted the company’s solid cash position and the continued monetization of non-strategic land as crucial for creating long-term value.

Key Factors Affecting Financial Results

The company reported $6.31 million in one-time non-cash stock compensation costs, primarily linked to stock option grants given to its newly appointed board and CEO, significantly impacting the increased net loss. Other notable cost increases included $509,000 in expenses related to land development, mainly from the Honokeana project, and $586,000 in leasing-related costs, including insurance and management fees. Additionally, $631,000 was attributed to the accelerated vesting of canceled stock options.

Overall operating costs surged by 33% year-over-year, reaching $18.92 million, while non-operating income saw a modest increase of $217,000 to $924,000, which included a $561,000 gain from the sale of a ranch lot through a joint venture. Pension and post-retirement expenses also increased to $948,000 from $436,000.

Liquidity and Balance Sheet Overview

As of December 31, 2024, the company reported cash and investments convertible to cash totaling $9.52 million, an increase from $8.83 million in 2023. Total assets grew to $50.14 million from $42.22 million, although total liabilities more than doubled to $16.96 million, largely due to a $3-million draw on a line of credit and $3.18 million in contract overbillings.

Recent Developments

Maui Land & Pineapple has identified 12 non-strategic land parcels for sale, totaling 373.7 acres. By year-end, three parcels (16.4 acres) were actively listed with a combined asking price of $10.9 million. The company continues to leverage these asset sales to fund development initiatives without aiming for direct profits from its housing relief project.

Furthermore, in February 2025, a joint venture in land development sold a 25-acre agricultural lot for $2.4 million, equating to $150,000 per usable acre. This sale followed a previous joint venture transaction involving a 6-acre ranch lot in 2024 for $1.8 million, or $300,000 per usable acre. Such transactions reflect the company’s strategy to unlock land value through selective asset auctions and partnerships.

Investment Perspective

From a pool of thousands of stocks, five experts at Zacks have identified their preferred picks expected to rise by over 100% in the coming months. Among these, the Director of Research, Sheraz Mian, has highlighted one company with significant growth potential.

This selected company, catering to millennial and Gen Z consumers, generated nearly $1 billion in revenue last quarter. Given the recent market pullback, it may be an opportune moment for investment. Although not every expert pick yields success, this selection has the potential to outperform earlier Zacks investments like Nano-X Imaging, which surged by +129.6% within approximately nine months.

Free: See Our Top Stock And 4 Runners Up

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.