“`html

Molson Coors Reports Mixed Q3 Results Amid Market Challenges

Molson Coors Beverage Company (TAP) released its third-quarter 2024 results, showing both positive and negative trends. While the company topped Zacks Consensus Estimates for earnings and sales, figures decreased compared to the previous year. The decline primarily reflects the tough U.S. economic climate, shipment timing issues, and the ending of a contract brewing agreement. Notably, U.S. financial volume plummeted by 17.9% year over year, though strong performances in the EMEA&APAC and Canada segments helped mitigate some losses.

The adjusted earnings came in at $1.80 per share, down 6.2% from last year but ahead of the Zacks Consensus Estimate of $1.65.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Net sales dropped by 7.8% year-over-year, reaching $3.04 billion, but still managed to surpass the Zacks Consensus Estimate of $3.14 billion. This decline was attributed to lower financial volume, although an improved pricing and sales mix provided some offset.

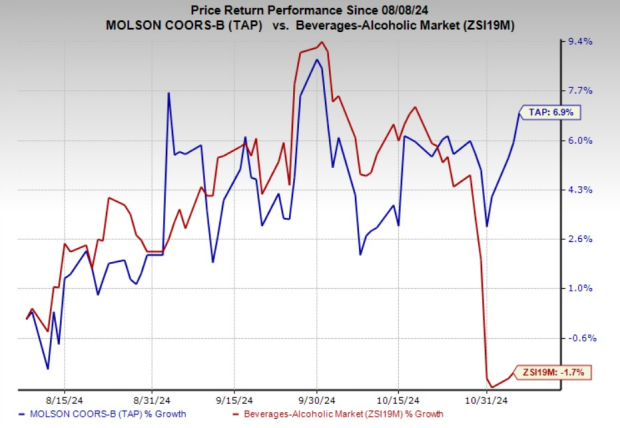

Following this news, shares of Molson Coors fell 1% in pre-market trading on November 7, 2024. The declines in sales and EPS, combined with a lowered sales forecast for 2024, contributed to investor concerns. Nevertheless, the stock has increased by 6.9% over the past three months, compared to the industry’s 1.7% decline.

Image Source: Zacks Investment Research

Insights into Q3 Performance

Molson Coors experienced a 12.3% decline in financial volumes compared to last year, largely due to reduced shipments from contract brewing in the Americas. Brand volumes also dipped 4.4% overall, with the Americas down 5.4% and EMEA&APAC 1.8% lower.

Despite these challenges, net sales benefited from a 4.5% increase in the price and sales mix, reflecting improvements in pricing and product mix across both regions, even as contract brewing volumes fell in the U.S.

Gross profit decreased by 10.7% year over year to $1.2 billion, with the gross margin contracting 130 basis points to 39.5% during this period.

Marketing, general and administrative (MG&A) expenses fell by 8.3% year over year to $684.7 million, reflecting lower incentive compensation and marketing expenditures as compared to last year. Underlying MG&A expenses also declined by 8.4% in constant currency terms.

Underlying earnings before taxes (EBT) dropped a significant 39.1% year-over-year to $331.4 million, with constant-currency figures showing an 8.7% decline due to lower financial volume and material cost inflation. However, higher pricing, reduced MG&A costs, and a better sales mix partially alleviated these pressures.

Molson Coors Beverage Company Price, Consensus and EPS Surprise

Molson Coors Beverage Company price-consensus-eps-surprise-chart | Molson Coors Beverage Company Quote

Segment Performance Breakdown

Americas: Net sales in this segment fell by 11% year over year to $2.3 billion, reflecting a 10.7% decline in constant currency. Lower financial volume and negative currency effects drove the decrease, though a favorable price and sales mix offered some relief.

Financial volumes in the Americas dropped 15.6%, impacted by the timing of shipments and reduced demand in a struggling market. Brand volumes fell by 5.4%, primarily due to a 6.2% decrease in the U.S., along with challenges in sustaining previous year’s growth rates. However, an additional trading day and favorable holiday timing partially offset these losses, while brand volumes in Canada grew by 3.9% due to the success of the above-premium portfolio. Pricing and sales mix improved, up 4.9% due to higher net pricing.

Underlying EBT was down 14.7% in constant currency, reaching $419.8 million reported, influenced by lower financial volumes and cost pressures. Positive aspects included net pricing increases and effective cost-saving measures.

EMEA&APAC: This segment experienced a 5.1% increase in net sales to $704.4 million (up 3.8% in constant currency), benefiting from improved pricing and a better sales mix, even as financial volumes declined. Enhanced pricing strategies and a favorable mix contributed to a 6.8% increase in the sales mix.

Both financial and brand volumes in this segment fell, impacted mainly by low demand in Western Europe and aggressive competitor promotions. Nonetheless, the underlying EBT surged by 41.8% year over year to $98 million on a reported basis and 40.5% in constant currency, driven by better net pricing and sales mix despite a drop in volume.

Financial Position Overview

At the end of Q3, Molson Coors had cash and cash equivalents totaling $1.02 billion. The company reported a total debt of $6.2 billion as of September 30, 2024, giving a net debt of $5.22 billion.

For the first nine months of 2024, net cash from operating activities was $1.4 billion, while underlying free cash flow reached $856 million. Share repurchases totaled $437.4 million as part of the program initiated on September 29, 2023, with dividends amounting to $279.4 million during this timeframe.

For 2024, capital expenditures are projected at $750 million (with a 5% margin), while the underlying free cash flow expectation is $1.2 billion, plus or minus 10%.

Future Outlook for Molson Coors

In response to ongoing macroeconomic challenges affecting the U.S. beer industry, Molson Coors has revised its 2024 sales forecast to a 1% decline in constant-currency terms. This is a shift from their previous expectation of low-single-digit growth. Despite this adjustment, the company maintains its underlying EBT outlook, thanks to better packaging material and transportation cost expectations.

Molson Coors is targeting mid-single-digit growth for its underlying EPS, which it now expects to reach the higher end of this range, aided by an accelerated share repurchase initiative.

Final projections for underlying depreciation and amortization will continue to be updated as the year progresses.

“`

Consumer Staples Show Strong Potential: Key Stocks to Watch

Company Insights and Predictions

Recent estimates suggest that a company’s sales might reach around $700 million for the upcoming year, with a possible variation of 5%. For 2024, the effective tax rate is expected to fall between 23% and 25%. Additionally, net interest expenses for the company are estimated to be approximately $210 million, with a variation of 5%.

Top Stock Picks in Consumer Staples

Several stocks within the Consumer Staples sector stand out due to their strong rankings. These include Ingredion (INGR), Vital Farms (VITL), and Vita Coco Company (COCO).

Ingredion is recognized for its work in nature-based sweeteners, starches, and nutrition ingredients. It currently holds a Zacks Rank #1 (Strong Buy). The company has reported an average earnings surprise of 9.5% over the past four quarters. The Zacks Consensus Estimate indicates that Ingredion’s earnings per share (EPS) is projected to grow by 6.7% compared to last year, with a slight increase of 1% in the EPS estimate over the last month.

Vital Farms specializes in pasture-raised foods and holds a Zacks Rank #2 (Buy). It boasts an impressive average earnings surprise of 82.5% over the last four quarters. The Zacks Consensus Estimate shows anticipated growth of 27% in sales and 88.1% in EPS compared to the previous year, with stable EPS estimates over the past month.

Vita Coco is known for its coconut water products sold in various regions including the U.S., Canada, and Europe. It also holds a Zacks Rank of 2. Vita Coco has seen an average earnings surprise of 17.6% across four quarters. Current estimates predict growth of 3.5% in sales and 29.7% in earnings compared to last year, with a recent 9.1% increase in the EPS estimate over the past week.

Urgent Opportunities in Nuclear Energy

The demand for electricity is on the rise, initiating a shift away from fossil fuels like oil and natural gas towards nuclear energy as a cleaner alternative.

Recently, leaders from the U.S. and 21 other nations pledged to triple global nuclear energy capacity. This bold move could lead to significant profits for investors in nuclear stocks who act quickly.

Our report, Atomic Opportunity: Nuclear Energy’s Comeback, dives into the major players and technologies driving this shift, including three stocks poised for potential gains.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Want more insights from Zacks Investment Research? Download 5 Stocks Set to Double for free.

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.