Three Momentum Stocks Capturing Investor Attention in 2023

What is a Momentum Stock?

Momentum stocks are those that are rising at a pace significantly faster than the broader market. Unlike traditional stocks, these speculative investments are fueled by expectations for the future, innovation, psychology, market momentum, and strong industry trends. While seasoned investors may be cautious, retail traders with a short-to-medium-term focus can capitalize on these opportunities through careful chart analysis and risk management. Below, we delve into three momentum stocks from thriving sectors that are on the rise.

Rigetti: A Leader in Quantum Computing

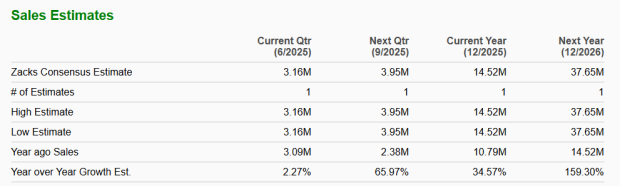

Quantum computing is still in its nascent stages of profitability, yet many investors are keen to enter. Zacks Rank #3 (Hold) Rigetti Computing (RGTI) aims to create the world’s most powerful quantum computers to tackle critical global challenges. Currently, Rigetti has just over $1 million in revenue, but it’s projected to surge to $37.65 million next year, according to Zacks Consensus Estimates.

Image Source: Zacks Investment Research

Recently, RGTI secured several government contracts, including one with the Defense Advanced Research Projects Agency (DARPA). It is currently breaking out of a long consolidation phase after a correction to its 200-day moving average.

Image Source: TradingView

Additionally, Rigetti is part of the growing quantum computing industry group alongside strong contenders like Quantum Computing (QUBT) and D-Wave Quantum (QBTS).

SoundHoundAI: A Rising Star in AI

While many big-cap tech companies like Microsoft (MSFT) dominate the AI landscape, they often lack the rapid growth potential that smaller firms offer. SoundHoundAI (SOUN), a global leader in AI voice technology, stands out in this competitive arena. Similar to RGTI, SOUN has established a significant partnership with AI powerhouse Nvidia (NVDA).

Image Source: TradingView

Carvana: A Remarkable Turnaround

In late 2022, e-commerce vehicle retailer Carvana (CVNA) faced potential bankruptcy, with shares trading in single digits. However, the company managed to secure financing and subsequently reversed its fortunes.

Image Source: Zacks Investment Research

Since then, CVNA shares have skyrocketed to over $300. The stock is once again breaking out on its price chart and holds a strong Zacks Rank #2 (Buy).

Bottom Line

Momentum stocks present exciting opportunities for agile traders. Currently, quantum computing and AI sectors offer the most promising avenues for investment.