Want to start the week ahead of the pack? Check out Momentum Mondays, where I cover the leading breakout stocks in the market, summarize the major events of the week ahead, and prepare investors for profitable trading.

Today, we will be taking a look at the broad stock market indexes to summarize the action of the last few weeks, then we will look at theeconomic calendarand earnings releases to address any market moving data coming our way. And finally, I will share four compelling technical trade setups in stocks with top Zacks Ranks.

Challenging First Quarter Ahead

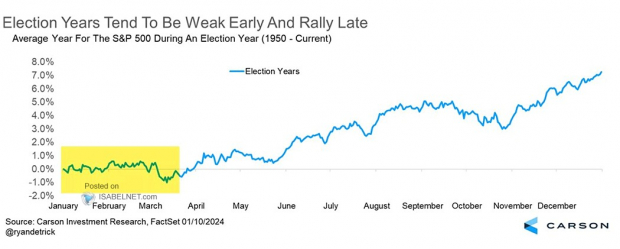

In addition to a rapidly shifting economic environment due to the transitioning interest rate policy from the Fed, US presidential elections lead to a potentially more uncertain 2024. The first quarter has shown seasonal tendencies to choppy action during election years.

Image Source: Carson Group

Furthermore, US equity indexes broke down from an ascending channel on the first day of the year.

Image Source: TradingView

Economic Calendar

Theeconomic calendaris lighter this week, with initial jobless claims on Thursday as the main data catalyst this week.

We will also see earnings season begin in earnest this week. Companies including Goldman Sachs, Morgan Stanley, Alcoa, and Schlumberger report this week. However, next week is when it really get interesting, with Microsoft, Tesla, Netflix and other major players reporting.

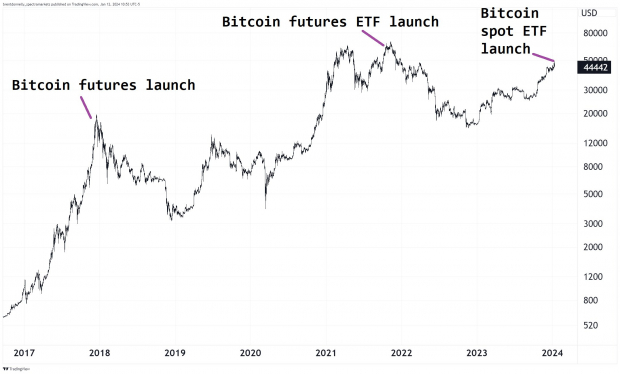

Bitcoin

Bitcoin ETFs finally began trading last week, but events like this have lead to near-term tops in the past.

Image Source: Brent Donnelly

Technical Setups

I am favoring more defensive stocks in this week’s edition of Momentum Monday, but still include one leading technology stock that has been showing relative strength.

Image Source: TradingView

Bottom Line

Even the best trading setups fail, so it is always important for traders to prioritize making a trading plane, following the plan, and utilizing strict risk management protocols.

Good luck this week traders!

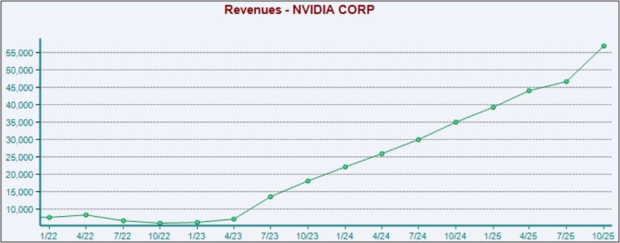

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.